BYD has overtaken Tesla as Europe’s top-selling electric vehicle brand for the first time, marking a major shift in the region’s electric vehicle market, according to the latest data from JATO Dynamics.

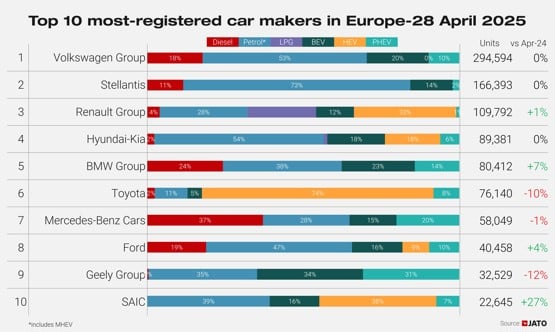

The data, which tracks new passenger car registrations across 28 European markets, revealed a stable overall market in April, with 1,078,521 new cars registered — just 0.1% higher than the same period last year.

While electrified vehicles remained a growth driver, Tesla's continued decline has signalled a potential shift in the region’s EV hierarchy.

BYD overtakes Tesla in BEV sales

In a significant milestone, BYD registered 7,231 BEVs in Europe last month, narrowly edging out Tesla, which registered 7,165 units.

While the margin may appear modest, the implications are far-reaching. BYD’s emergence as a serious contender comes just two years after its broader European market entry.

“Although the difference in volume is small, this marks a watershed moment for the European EV landscape,” said Felipe Munoz, global analyst at JATO Dynamics.

“Tesla has dominated BEV registrations in Europe for years, and BYD’s ascent is a sign of how quickly the competitive environment is changing.”

Tesla’s performance continues to trend downward, with April volumes down 49% year-on-year.

The US-based manufacturer has now posted several consecutive months of decline, as increased competition, reduced subsidies and fewer model launches weigh on its appeal.

Tesla chief executive Elon Musk preempted the European sales performance by describing the market as "quite weak" in an interview with Bloomberg.

Musk said: "Europe is Tesla's weakest market, but the brand is strong everywhere else.

"Sales have fallen in Europe, but that's true of all manufacturers. There's no exceptions.

"The European car market is quite weak."

Chinese brands accelerate, despite tariffs

Despite the introduction of EU tariffs on Chinese-made electric cars earlier this year, brands like BYD have demonstrated remarkable resilience.

Chinese manufacturers collectively saw BEV registrations increase by 59% year-on-year in April, driven by both model diversification and aggressive expansion strategies.

Plug-in hybrid (PHEV) volumes from China grew by an even more impressive 546%, highlighting the sector’s ability to pivot in response to evolving regulatory challenges.

"Chinese OEMs are not just BEV leaders — they're now global frontrunners in PHEVs too,” added Munoz. “In response to EU tariffs, many are pushing hybrid offerings to maintain momentum in Europe.”

Tesla's challenges mount

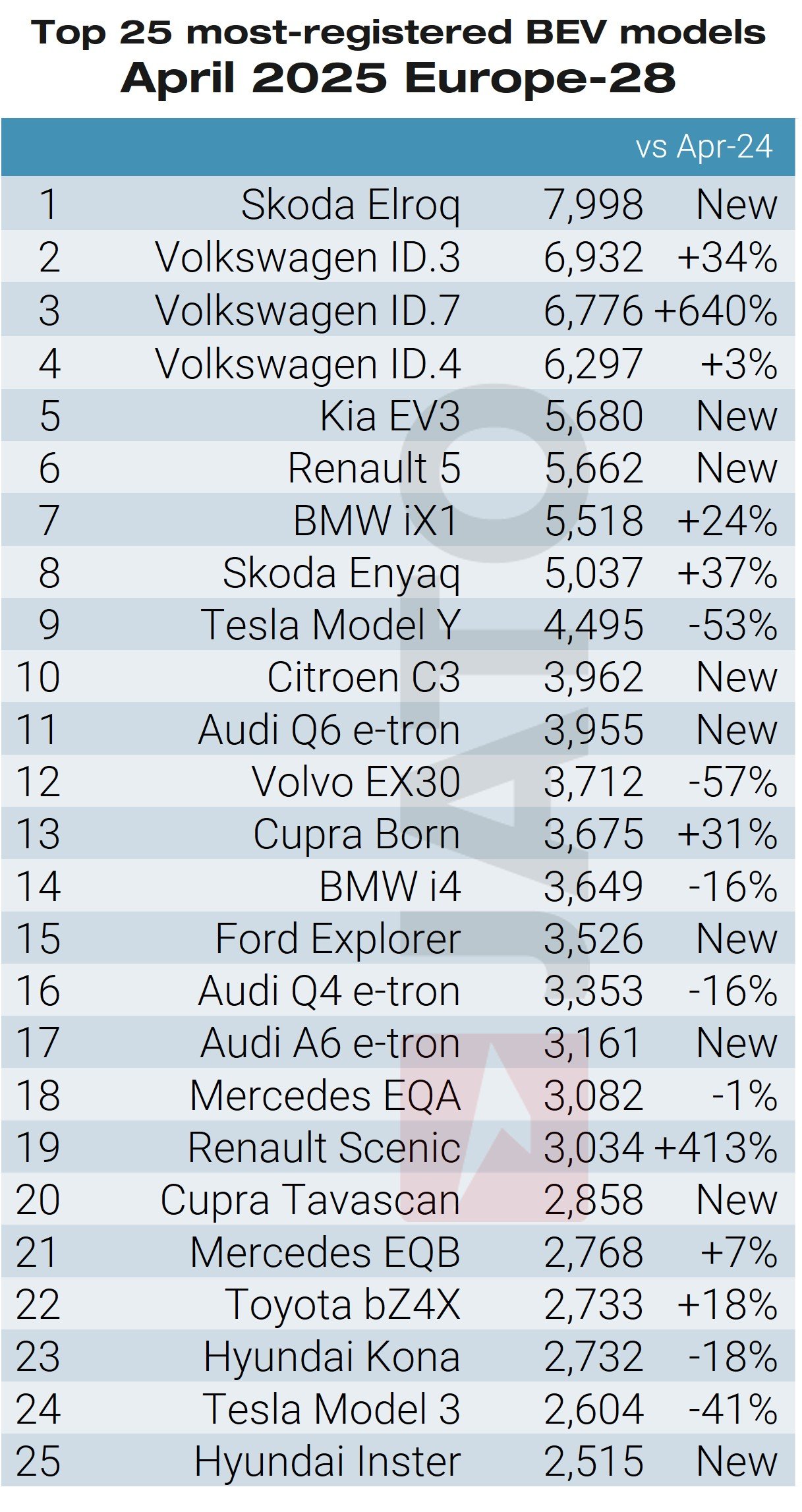

Tesla’s Model Y, once the undisputed bestseller in Europe’s BEV market, saw its registrations fall 53% year-on-year last month.

The company’s increasingly narrow product portfolio, lack of recent updates, and stiff pricing competition have all contributed to its softer performance. The drop comes as newer players introduce well-equipped, attractively priced alternatives across the continent.

Meanwhile, the Renault Clio led Europe’s overall model rankings for the first time since 2020, with 19,000 units registered. In the BEV space, Skoda's new Elroq SUV topped the charts, followed closely by multiple Volkswagen models, underscoring the growing strength of European incumbents in the electric segment.

Login to comment

Comments

No comments have been made yet.