The squeeze on household incomes and continued new car supply constraints mean that the UK’s car finance sector is likely to be restricted to ‘single-digit growth’ in 2022, the FLA has said.

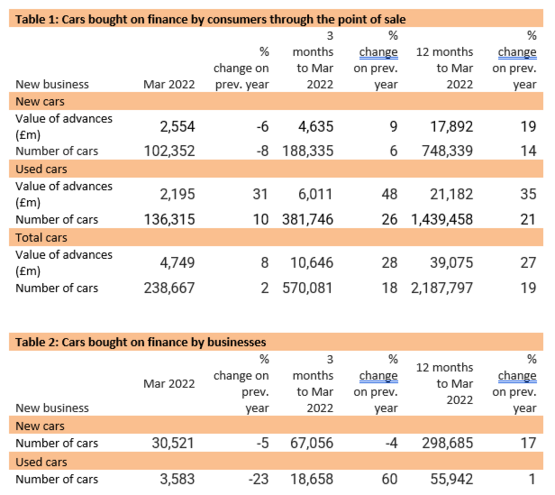

The Finance and Leasing Association’s March car finance sector data showed that business volumes rose by just 2% to £4.75 billion on a 2021 period hampered by ongoing COVID-19 trading restrictions in the sector, as the value of new business rose by 8% to 238,667 vehicles.

It marks a slowdown of the recovery at the end of a Q1 2022 period which, as a whole, delivered new business volumes up 18% on the same quarter in 2021, at 570,081 vehicles, as values rose by 28% to £10.65bn.

Geraldine Kilkelly, the FLA’s director of research and chief economist sought to highlight the impact of supply constraints on the automotive recovery, but also warned of the impact of the UK’s cost of living crisis.

She said: “The slowdown in growth reported by the consumer car finance market in March was primarily driven by the adverse impact of supply shortages in the new car market. The consumer used car finance market remained buoyant reaching new heights in March as monthly new business surpassed £2bn for the first time.

“The UK economic outlook has weakened significantly because of the squeeze on household incomes and business profit margins from higher inflation.

“Pressure on household incomes this year and the ongoing vehicle supply issues mean the consumer car finance market is likely to record single-digit growth in the value of new business in 2022 overall.”

“Pressure on household incomes this year and the ongoing vehicle supply issues mean the consumer car finance market is likely to record single-digit growth in the value of new business in 2022 overall.”

Kilkelly's comments come a month after the FLA said a “difficult” near-term economic outlook had caused it to reduce its value growth projection for the sector from 11% to 7%.

Kilkelly added: “As always, any customer worried about meeting payments should speak to their lender as soon as possible to find a solution.”

According to the FLA’s data, the consumer new car finance market reported a fall in new car business of 6% by value (to £4.64bn) and 8% by volume in March (to 188,335) compared with the same month in 2021.

In Q1 2022 overall - a period reported by the Society of Motor Manufacturers and Traders (SMMT) to be down 1.9% by volume in Q1 - new business volumes in this market were 6% higher than in the same quarter in 2021 at 748,339 as the value of business rose 9%, to £17.89bn, perhaps due to OEMs focussing on higher-priced vehicles and EVs.

Plugging the gap in March, the consumer used car finance market reported new business up 31% by value, to £2.2bn, and 10% by volume to 136,315 compared with the same month in 2021.

In Q1 2022 overall, new business volumes in this market were 26% higher than in the same quarter in 2021, at 381,746, as values rose 21% to £1.44bn.

Login to comment

Comments

No comments have been made yet.