Auto Trader’s latest data reveals that consumer demand remains robust, with all segments of the second-hand market recording growth on 2022 levels as the quietest trading period of the calendar kicks in.

Average used car prices contracted 1% in mid-November on a month-on-month basis, largely following typical pre-pandemic seasonal trends, according to the online marketplace.

Even so, on a year-on-year basis, the data shows strong price growth in a significant proportion of the used retail market. Cars aged above five years old increased 2.2% year-on-year (YoY) at the November mid-month point, whilst those aged over a decade are up 8.4%.

Highlighting the current nuance of the market, however, Auto Trader noted that the average price of cars aged below five years old are down 4.5% YoY, due, in part, to the increased supply of younger vehicles over recent months, as well as increasing pressure from new-car deals. As a result of the softening in younger vehicles, the overall total market figure is being pulled down, contracting -2.3% so far this month.

It said that contrary to some recent speculation, the used car market remains resilient, with current consumer demand on its online marketplace increasing YoY in all segments, including different age groups, and fuel types.

At a total market level, Auto Trader said demand is up 6.9% on November 2022, while supply is up just 3.2% and because of this slight imbalance, its Market Health metric - which determines the potential profitability of used cars based on real-time supply and demand dynamics - is up a robust 3.6% versus last year.

This imbalance in supply and demand is also at play at a more granular level, and in some cases, to a more significant degree. Indeed, whilst supply levels are down -6.9% YoY in cars aged 1-3 years old in mid-November, consumer demand is up 9.5% on the same period last year, which is resulting in a significant 17.5% YoY increase in Market Health.

For those nearly new cars, aged below 12 months, supply continues to grow, rising 29.9% YoY so far this month. However, it is being outpaced by the very strong consumer appetite for these young cars, with demand up 31.7%, causing Market Health to increase a respectable 1.4%.

It's a largely similar picture across fuel types, with demand growing in both ICE and alternatively fuelled vehicles. However, whilst demand for petrol and diesel cars are recording relatively conservative levels of growth at 2.7% YoY and 0.7% respectively, interest for low emission cars listed on Auto Trader has rocketed; by mid-month, demand for plug-in hybrid and full/mild hybrids were up 37.6% and 51.1% respectively.

Fuelled by the enticing combination of improved affordability and availability, consumer engagement for fully electric cars on Auto Trader is up a massive 69.1% on November last year.

And with the supply growth of EVs now easing to just 12.9% YoY (from the record high of 303% in January 2023), the imbalance is resulting in a huge 49.7% increase in Market Health – the highest recorded since March 2022.

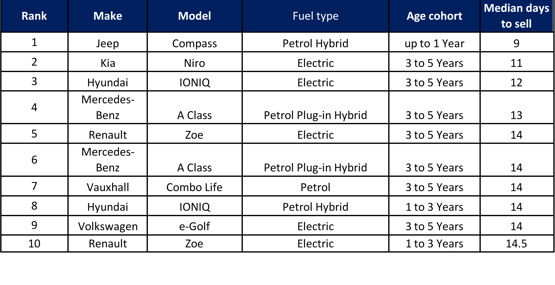

The overall demand of the retail market is also reflected in the current speed in which used cars are leaving retailers’ forecourts. On average, cars are taking just 31 days to sell in November, which is the same speed as the last three years but is faster than pre-pandemic November 2019 (33). Of all of the fuel types, electric cars are taking the least amount of time to sell, currently taking an average of just 25 days, compared to 31 for both petrol and diesel. What’s more, of the top 10 fastest selling models, five are electric, and four are hybrid.

Commenting, Auto Trader’s director of data and insights, Richard Walker, said: “Although the younger end of the market is being squeezed by increasing supply levels and renewed pressure from new car offers, it’s promising to see that consumer engagement from our 10 million monthly visitors remains robust across all segments of the market.

"Used car supply is increasing, but critically it remains behind demand, which makes any sudden or significant drop in retail prices unlikely. With a large proportion of the market still recording strong price growth, car buyers are clearly prepared to pay the retail market value, and so I would urge retailers not to risk profit potential or a self-fulfilling prophecy by making knee jerk reactions based on trends in trade values.

"Cars continue to sell, and importantly, quickly – by buying and selling fast, there’s little time for small changes in value to be felt. So, my advice remains unchanged; price to the market to sell quickly, and don’t give up your profits unnecessarily, follow the data.”

Top 10 fastest selling used cars up to 17th November

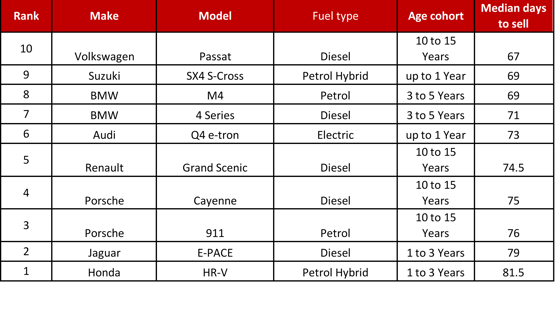

Top 10 slowest selling used cars up to 16th November 2023

Top 10 slowest selling used cars up to 16th November 2023

Login to comment

Comments

No comments have been made yet.