Cazana has reported that demand for used cars during the COVID-19 lockdown may have outstripped the 20% of sales transactions which were completed during the period.

The result, according to its director of insights Rupert Pontin, was an upward pricing trend.

Here, Pontin shares his observations from “retail-driven, real-time” data gathered during the period from March 24:

The lockdown period has been a very difficult time for the UK automotive industry, and it is important to understand exactly what happened during the closure of retailer premises.

While sales levels dropped by around 80% there was still online sales activity and the retail consumer was still there to buy new and used vehicles.

This necessitated a new approach to customer interaction which has relied on digital communication, virtual showrooms and online sales processing.

With wholesale activity almost completely halted and auctions halls dormant

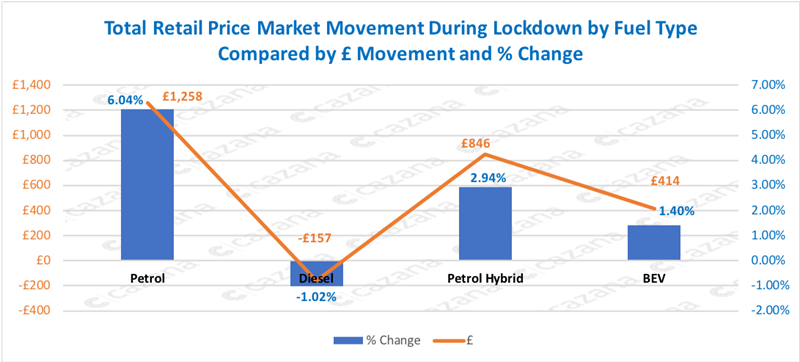

The only way to understand what happened is to look at retail driven real-time insight. The chart below looks at the retail price movements by percentage by fuel type from March 23 through until May 25:

This chart shows that at a high level for all but diesel-powered cars, retail pricing has increased over the lockdown period.

This chart shows that at a high level for all but diesel-powered cars, retail pricing has increased over the lockdown period.

Looking at the data more deeply, it is clear that the price decline for diesel product came in the high mileage ex-fleet vehicle profile.

When pricing moves upwards like this it can be an indication that there is good consumer demand and perhaps a shortage of stock.

Given that transactions have been taking place over the course of the lockdown period it would be wise to acknowledge that generally speaking stock levels have been dropping and on that basis, there will be encouraging wholesale demand as the auctions start to do business again.

The issue lies in the fact that the auction and logistics supply chain could take four- to six-weeks to get up to speed.

Transporters are out of place and cars are with dealers or customers and all need moving to the right place to be prepared for sale.

With so many vehicle movements required and the need for effective safety to be in place and enough personal protective equipment (PPE) to be available, there are many challenges.

There are only so many vehicles that can be moved in one day with a higher level of safety requirements in play.

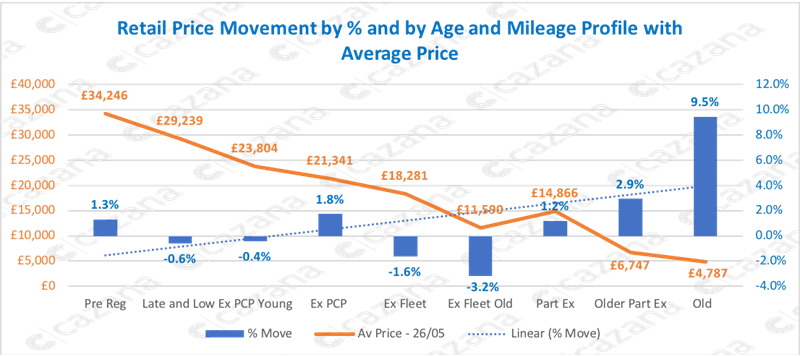

The next chart looks at the market from an age and profile perspective and gives more context to high level market movements over the same period:

This chart looks at data covering the lockdown period from a slightly different angle and it is immediately clear that five of the age and mileage profiles show a positive increase in prices, while four show a decline.

This chart looks at data covering the lockdown period from a slightly different angle and it is immediately clear that five of the age and mileage profiles show a positive increase in prices, while four show a decline.

The data requires deeper analysis to identify exactly where the problems lie and the two main areas of concern are the ex-fleet cars at three- and four-years-old which have dipped in price during the lockdown period to the tune of 1.6% and 3.2%.

The data shows that significant volatility in the low volume of insight for petrol hybrid models is the cause of the market move which originates from the change in classification of petrol hybrid vehicles to incorporate stop/start models.

Excluding that spurious data brings the pricing movement to a decline of 1% and 1.56% respectively which is a far more positive representation of market data and highlights the importance of granularity.

Confidence in the market

Given that the data highlights that overall there has been an upward pricing trend during the lockdown period both from a pure fuel type perspective and an age and mileage profile point of view, it demonstrates that there is confidence in the market and retail consumer demand.

Wholesale vendors and retailers using this insight and combining it with the understanding that stock will be more difficult to come by in the coming weeks, are therefore in the main reacting correctly to the effects of market demand and not letting stock go at low money as there is no need to.

With this level of retail data available it is hard to argue the factual accuracy of the pricing output.

In addition, it is hard to comprehend how other valuation data providers can justify downward pricing moves of up to 5%.

In conclusion, retail pricing is in good health and there is currently a positive trend across the market.

In these circumstances a positive and responsible attitude to remarketing, retailing and reporting is appropriate and the use of whole market retail driven insight essential to maximise on the opportunities currently available.

Login to comment

Comments

No comments have been made yet.