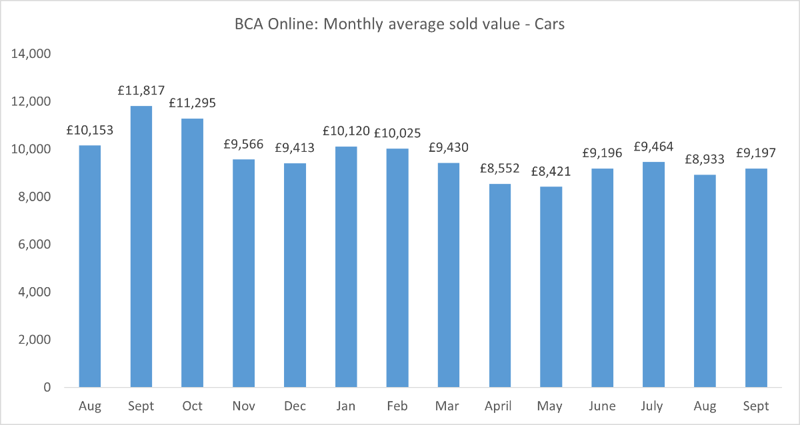

BCA has said that used vehicle process will “remain very robust for some time to come” after wholesale used car values rose 2.9% to £9,197 in September.

The remarketing giant said that vehicle volumes climbed “steadily” in a numberplate change month that usually signals in influx of part-exchange vehicles but added that new car supply challenges would continue to hold high prices firm, with supply and demand well balanced.

Last month’s average used car sale price at BCA’s auctions was the fifth lowest of the past 12 months but came back on a dip in values during August.

Commenting on the market’s movement, BCA chief operating officer Stuart Pearson said: “Despite the continuing concerns around the economy, the cost of living, inflation and interest rates, September trading was positive and there was a familiar seasonal feel to activity - demand is there, price performance remains healthy, and the marketplace is currently stable.

Commenting on the market’s movement, BCA chief operating officer Stuart Pearson said: “Despite the continuing concerns around the economy, the cost of living, inflation and interest rates, September trading was positive and there was a familiar seasonal feel to activity - demand is there, price performance remains healthy, and the marketplace is currently stable.

“With new car supply remaining challenging, the younger and best quality vehicles have been in high demand for most of the year, however during September we’ve seen a particular lift in activity around older and even poorer graded stock.

Pearson added: “There was positive news from the SMMT as new car sales improved for the second month running, with the caveat that volumes remain well behind what we would normally see at this time of year and also pre-pandemic levels.

Pearson added: “There was positive news from the SMMT as new car sales improved for the second month running, with the caveat that volumes remain well behind what we would normally see at this time of year and also pre-pandemic levels.

“With the ongoing shortage of ex-lease, rental and OEM stock in the used marketplace, there is every likelihood that prices on used vehicles will continue to remain very robust for some time to come.”

In conversation with AM, Cap HPI director of valuations Derren Martin said that used car values had declined 0.2%, at the three-year, 60,000-mile point in October’s retail market by the month’s mid-point.

This continued uplift followed a rise of 0.3% in August – 2022’s first value uplift.

But he suggested that retailers were exercising caution in their approach to stocking, just as was later recommended by Cox Automotive Europe.

Martin said: “There are few that have said they would be stocking up for January, as they normally would, however. Right now, retailers are continuing to simply attempt to replace the vehicles that they have sold.”

Martin said that Cap HPI were still seeing used car volumes down by around 25% on pre-COVID 2019, with “good, clean cars” in short supply.

Login to comment

Comments

No comments have been made yet.