A growing divide in the used car sector is seeing values decline among older vehicles in poorer condition as retailers remain ‘laser focussed’ on fast selling stock, BCA has said.

A monthly wholesale vehicle pricing report reflected observations made by Cap HPI today which highlighted the failing fortunes of more affordable cars in a sector which is starting to feel the impact of the cost-of-living crisis on less affluent customers.

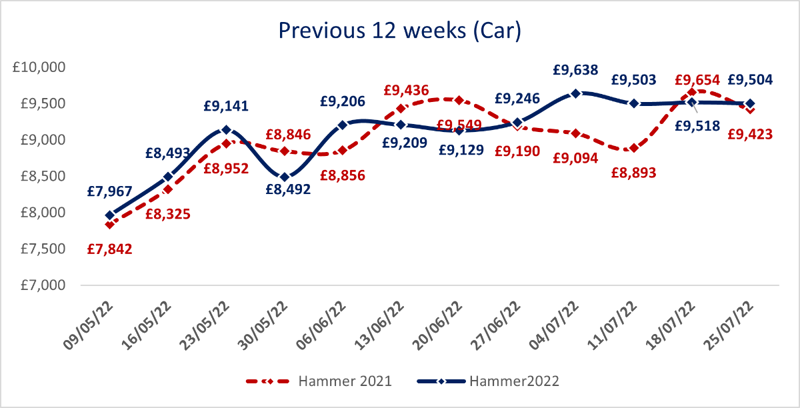

BCA’s data showed that wholesale values were 2.9% up on average, at £9,464, last month, however, as demand remained strong for the sector’s reduced supply of newer sports and prestige models – particularly retail ready examples.

Performance against guide values at its auctions rose to 97.7% in July, up marginally compared to June, it said.

BCA UK chief operating officer Stuart Pearson said: “July continued the emerging trends of previous months with strong levels of demand for younger, higher-grade vehicles, alongside sustained interest in sports and prestige models, with the particular focus on convertibles that you would expect to see at this time of year.

BCA UK chief operating officer Stuart Pearson said: “July continued the emerging trends of previous months with strong levels of demand for younger, higher-grade vehicles, alongside sustained interest in sports and prestige models, with the particular focus on convertibles that you would expect to see at this time of year.

“Data from BCA Valuations provided further evidence that dealers remain laser focussed on vehicles that can be sold quickly, often buying to order and generating good retail churn despite the challenging economic conditions.”

BCA said that vehicles in Grade 1 and Grade 2 condition attracting significantly more attention from professional buyers with cars presented via its Forecourt Ready sale programme outperforming the rest of the market.

Earlier this month survey results compiled by Startline Motor Finance revealed that older vehicles are creating problems with service history, preparation and breakdowns, with 86% of dealers expressing issues.

Pearson said: “There has been a divide forming in the market with the shortage of ex-lease, rental and OEM stock ensuring resilient prices for one to four-year-old vehicles, whilst at the lower end, some of the poorer condition part-exchange vehicles have seen prices drop more dramatically as dealers have concerns over potentially expensive preparation costs and delays in parts supply.”

Pearson said: “There has been a divide forming in the market with the shortage of ex-lease, rental and OEM stock ensuring resilient prices for one to four-year-old vehicles, whilst at the lower end, some of the poorer condition part-exchange vehicles have seen prices drop more dramatically as dealers have concerns over potentially expensive preparation costs and delays in parts supply.”

In its monthly used car market update Cap HPI said today that car retailers were having to “work harder” to maintain sales as consumer demand begins to falter.

It said that margins were being challenged as, on the retail side, franchise dealers, independents and supermarkets were “feeling the need to adjust advertised prices down, particularly for cars that have been with them for an unpalatable number of days”.

Login to comment

Comments

No comments have been made yet.