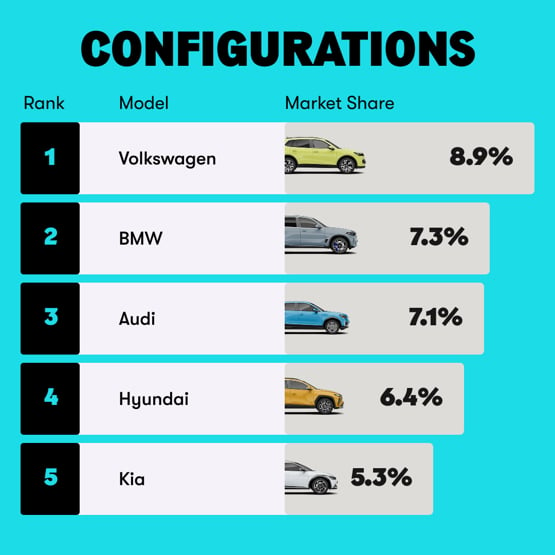

Volkswagen remains the most-configured brand on Carwow in 2025 to date, accounting for 8.9% of all vehicle configurations on the platform, ahead of BMW (7.3%) and Audi (7.1%).

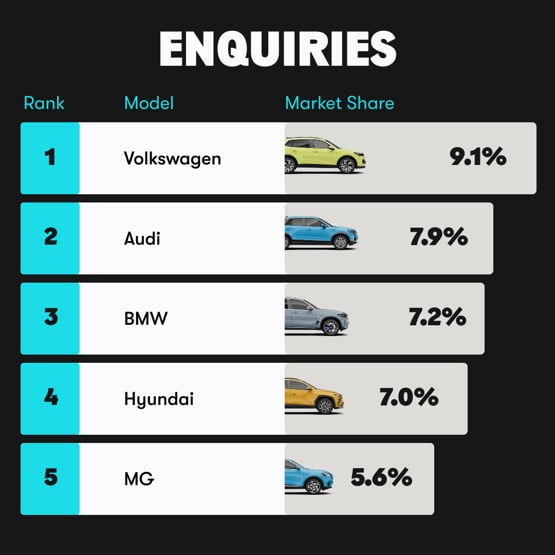

It also generated the highest volume of consumer enquiries among OEMs, with a 9.1% share of total enquiries delivered to Carwow’s retail network since January.

In April, Volkswagen vehicle enquiries rose 10% year-on-year. The uptick in interest is in line with SMMT new vehicle registration data, which shows Volkswagen’s UK market share increasing from 8.03% in 2024 to 9.08% in 2025.

Carwow data also highlights a regional shortfall in Volkswagen stock availability.

Two-thirds of UK locations currently show a supply gap from Volkswagen retailers. The most affected areas are Leeds, Nottingham, Derby, Leicester, and Newcastle upon Tyne.

These regions represent 8% of all Volkswagen configurations and enquiries on Carwow, while accounting for 10% of the brand’s UK sales.

The Tiguan is Volkswagen’s most-configured model on Carwow, with a 1.5% share across all marques, followed by the Golf and Polo at 0.9% each.

Battery electric vehicle (BEV) interest on Carwow continues to rise, with BEV configurations up 39% and enquiries up 79% year-on-year.

Volkswagen’s ID range ranked fifth in both BEV configurations and enquiries on the platform in April.

Volkswagen also saw strong activity in Carwow’s used car auctions.

In Q1, three models featured in the top 10 for resale margin potential: the 2020 Golf GTI (£3,386), the 2021 Golf R (£3,196), and the 2020 Tiguan (£2,702).

Despite holding the lead in overall configurations, Volkswagen models are seeing increased pressure from new entrants.

According to Carwow, the JAECOO 7 is currently the most-configured model so far in Q2, with Chinese brands also dominating the platform’s most-viewed car reviews.

Sepi Arani, managing director of media & commercial at Carwow, said: “Competition for market share among brands is continuing to ramp up as we approach the halfway point of the year.

"Volkswagen holds a strong position, but with new entrants increasingly securing favour with UK car buyers and new retail partners, we’re seeing a gradual shift in brand popularity.

"Despite Volkswagen retaining the top spot in the list of most-configured manufacturers, it has dropped in the rankings of most popular models on Carwow as a whole.

“Eight of the top 10 most-viewed car reviews on Carwow are for Chinese brands.

"That’s why now, more than ever, established OEMs wanting to protect their share in an increasingly competitive market need to address their gap in supply so they can continue to meet strong consumer demand.”

Login to comment

Comments

No comments have been made yet.