Compliance & risk management - Page 2

All articles

News

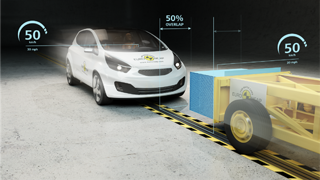

Euro NCAP sounds alarm over ‘car bloat’ and head-on crash compatibility

Independent car safety authority, Euro NCAP, has issued a warning over the growing trend of heavier, bulkier vehicles - highlighting the impact that so-called "car bloat" may have on road safety.

Manufacturer News

21 May 2025

Feature

Executive View: OEMs set to lose exclusive sight of vehicle data

From September, the EU Data Act will require manufacturers to give vehicle owners control over their data, allowing them to share it with third parties, writes Marcel Wendt, CTO and founder of Digidentity.

Executive Views

6 May 2025