The FCA and managing car customers' data

For Richard Hallam, head of data for Experian’s automotive business, understanding a customer’s financial abilities first with a pre-qualification check, which also entails amassing a wealth of data on an individual, is imperative.

“This kind of understanding would help when it came to any kind of upselling,” he said. “The relationship killer is when the customer fails the credit check.”

Crucially, such a check, including credit history, should not leave a footprint on credit records, in keeping with Financial Conduct Authority regulations.

“This kind of insight allows dealers to ‘pre-qualify’ customers for suitable deals, engage with them far higher up the sales funnel and ensure the deal doesn’t collapse in the final stages. It also enables dealers to encourage applications from suitable customers and proactively offer alternative deals where appropriate based on their credit rating.”

Meanwhile, data collation and its application will only become even more sophisticated.

Capgemini’s work has included exploring the use of radio-frequency identification (RFID) tags, essentially a tracking device attached to objects which uploads a wide range of information.

By placing one in the car, data is amassed and transmitted and can therefore be acted upon with huge implications.

In one OEM pilot, 400 customer vehicles were fitted with a SIM card which linked directly to the DMS and a contact centre.

This service enables the driver to connect to a call centre adviser from the car to request practically anything such as the nearest hotel or ask for an explanation on why a light has activated on the dashboard.

Such innovation reflects the increasingly important position data will continue to occupy for the industry.

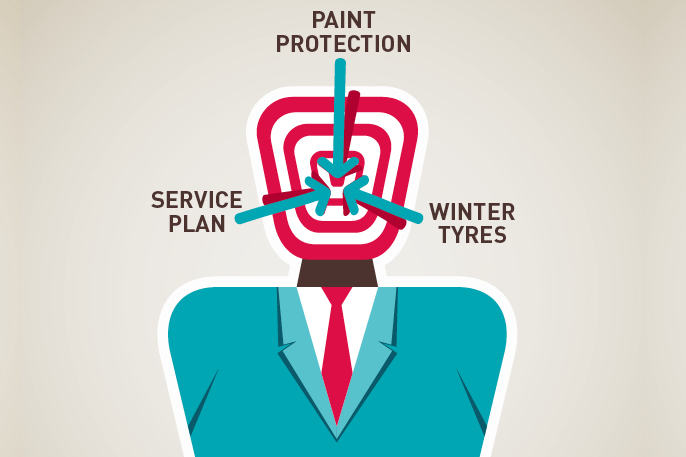

Upselling to car customers online

With customers interacting with dealers online, gathering digital information and using it intelligently is increasingly crucial. Customers expect 24/7 contact and franchised dealers must be geared up to manage these expectations.

ADP’s Neil Packham said: “If your DMS is sophisticated enough, it can carry out interactions with customers around the clock, responding to service bookings, dealing with test-drive enquiries and delivering personalised information based on data shared by the customer.”

Proactive dealers are also using late evening live chat or social media to engage with consumers during the period they’re doing their car-related research because they recognise this is an opportunity to win an appointment before the consumer heads to another website.

Where the consumer does not want human engagement but simply wants to book online, digital systems are now available that can enable the consumer to easily take an upsell. The service booking system from GForces lets users select additional services such as MoTs, brake fluid changes and air conditioning services, and its tyres system has been developed to enable franchised dealers to better compete with fast-fit centres and online tyre specialists while incorporating upsell opportunities when customers make their tyre selection online.

GForces’ NetDirector CitNoW provides a live video link to a workshop so technicians can talk through the work required with the customer via their internet browser.

Login to comment

Comments

No comments have been made yet.