Half of consumers think car finance is too complex and confusing, according to a new survey commissioned by Intelligent Environments.

The financial technology company is urging dealers to adopt digital solutions in order to stay ahead of their competition.

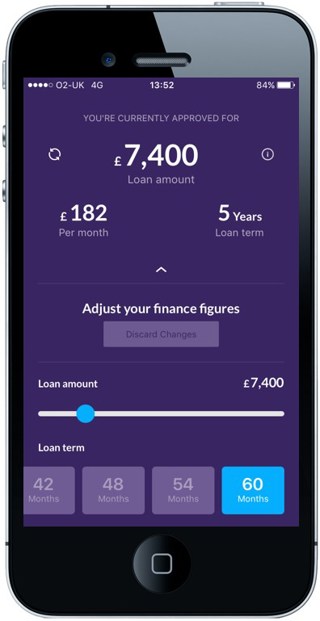

David Webber, managing director at Intelligent Environments, said: “The answer is clear: businesses must digitise. If half of consumers agree that the vehicle finance application process is too complex, then something must change. And once a change has been made, both the consumer and business benefits are obvious.

The survey also found that 32% of respondents would rather take out a personal loan than apply for motor finance and 29% thought it was harder to apply for finance than to buy insurance.

But two in five (39%) consumers declared they would look to upgrade their vehicle if they could get a good financing deal.

“Moving to a digital-first approach requires a significant shift in the way an organisation operates and can be a daunting experience. However, no one is expecting you to go alone; with the right partner alongside, investing in the digital tools and processes that today’s consumers are demanding is a much simpler prospect.

“Ultimately, as more and more vehicle financing companies begin to embrace change and digitise their processes, those who fail to invest will quickly find themselves being overtaken by more agile rivals. Right now, businesses have a choice: start their engine early and accelerate ahead of the competition, or wait and risk being left behind,” said Webber.

Login to comment

Comments

No comments have been made yet.