The lack of any tick box approach will remain a key challenge for dealerships providing financing and insurance products as the impact of new consumer duty legislation starts making itself felt.

The Consumer Duty regulations which came into effect in July are aimed at creating more stringent standards for consumers and improving competition in the retail financial services market.

Speaking at the Financing & Leasing Association (FLA) Financing the Future conference on September 12, Roma Pearson, director of consumer finance supervision at the Financial Conduct Authority (FCA), told delegates: “We don't want a tick box approach to the consumer,” she said. “Real world outcomes are what really matter here, which means customers are given the information they need at the right time and presented in a way that they can understand.”

She said the FCA will be increasing its engagement with the industry, explaining that the government is planning a second stage consultation next year which will allow industry to provide feedback.

She added that the FCA believes the higher standards of the duty and the shift to focusing on customer outcomes will require a significant change in many firms’ cultures.

“Now that we're six weeks into the duty, I want to emphasise this is not a ‘once and done’ compliance exercise. There's been a huge amount of effort that's gone into meeting those deadlines in July and it's just important that those efforts continue beyond.

“We expect you to be proactive, reviewing what you're delivering over time to learn from what's working well and to act when you find problems. This includes carrying out regular reviews to ensure that your products and services continue to meet the needs of your customers.”

She added that appropriate data-driven action should be taken which could mean making product changes, providing additional or different information to the customer and providing appropriate mitigation where necessary.

“You can expect that at every stage of the regulatory cycle to be asked to demonstrate how your business model, the actions you've already taken or are taking and how your firm's culture operationally is focused on delivering good customer outcomes,” she said, warning that FCA enforcement, while proportionate, would prioritise the most serious breaches ‘acting swiftly and assertively when there's a need to do so’.

She added that in the longer term, the duty would offer an opportunity to move towards a less prescriptive and more flexible regulatory framework with fewer new rules.

Speaking to am-online at the conference, Alex Hughes, managing director, CA Auto Finance UK, expressed his concerns about the FCA's 'evolutionary' approach: “It’s almost as if they’re saying that the absence of tick boxes is a positive thing, and I'm sure that there's very good reason for that. But on the other hand, tick boxes help you to understand if you've done everything.”

“To offer an analogy, it is like the difference between being given a school textbook with the answers in the back. Now, the difference is that you’re being asked to answer an essay question which has to go away to be marked.”

He added that the industry could become frustrated if the regulator takes too long to evaluate implementation which could create ‘legacy risk’.

He cited as an example the fact that the new consumer duty requires co-manufacturers to enter into a written agreement outlining their respective roles and responsibilities in order to comply with the regulation’s requirements which could mean drawing up new commercial agreements.

“The FCA wrote to the industry back in March about co-manufacturers but failed to give any proper guidelines. As a result, the industry is taking a view on what constitutes a co-manufacturer. In four, five, six years’ time, the FCA could come back and say they were actually co-manufacturers all along, and that immediately creates a legacy risk.”

“If it's principles-based finance that makes sense but we'd rather have a quick answer to our homework than an answer in six years’ time telling us that our homework was wrong all along.”

Hughes said dealers and intermediaries had a significant role to play in supporting the customer’s decision-making process but that if selling finance became so unattractive due to the high burden of regulation, they would stop offering finance and that the car buying public would ultimately suffer.

He said continuing to offer car finance was especially important in view of new consumer insight research by Auto Trader which was presented at the conference that surveyed consumers who had bought a vehicle in the last six months.

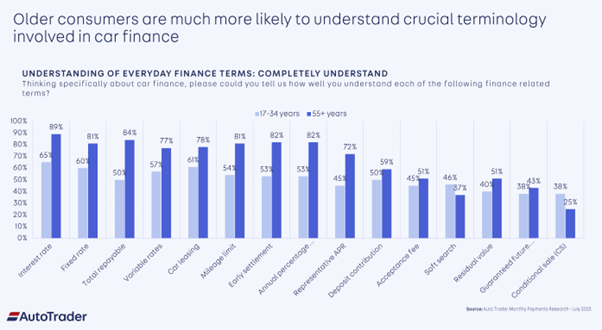

Rachael Jones, director of automotive finance at AutoTrader, said the research showed that younger car buyers especially had a worrying level of knowledge of key terms used in a typical conversation when finalising a contract.

The findings also revealed a significant male/female divide with women having less understanding of finance terms in addition to the marked difference of understanding of terminology between age cohorts.

“We expect consumers to understand 17 different terms and this is just the finance agreement. We're not talking about any other part of the car-buying process.

“Only 65% of that younger age cohort understood what an interest rate was, only 54% of them understood what a mileage limit. There was also generally a very low understanding of what things like representative APR, residual value and guaranteed future value were.

“And yet, they've just entered into a PCP contract which can really trip them up. That is very worrying. It's definitely something to be thinking about in terms of how we can help consumers understand better and give them clarity and reassurance.”

Commenting on the findings, Hughes said: “Imagine how much worse it would be if there was no salesman or business manager to actually help the customer understand and they've just got to find it for themselves on the internet or by asking the bloke down the pub.”

“I think consumer duty regulation is very challenging in terms of making sure that we've really properly understood and implemented it as the regulator intended, and making sure that the regulator hasn't got so far ahead of the customers that it's trying to protect in terms of where their understanding is.”

Login to comment

Comments

No comments have been made yet.