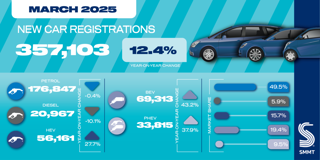

March new car registrations fell 15.7% year-on-year, with diesels suffering a 37.2% fall.

The result was described as not unexpected and the Society of Motor Manufacturers and Traders’, that published the figures this morning, stressed this was the fourth biggest March ever for the sector – and that March 2017 was the biggest month ever for the new car market.

The SMMT blamed last month’s performance on economic and political uncertainty and “confusion” over air quality plans. March saw the 12-month of successive falls in new car registrations.

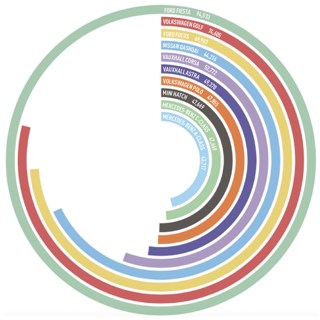

Overall the first quarter of this year is down 12.4%, with 718,489 registrations compared to 820,016 last year.

Mike Hawes, SMMT chief executive, said, “March’s decline is not unexpected given the huge surge in registrations in the same month last year.

“Despite this, the market itself is relatively high with the underlying factors in terms of consumer choice, finance availability and cost of ownership all highly competitive.

“Consumer and business confidence, however, has taken a knock in recent months and a thriving new car market is essential to the overall health of our economy.

“This means creating the right economic conditions for all types of consumers to have the confidence to buy new vehicles.

“All technologies, regardless of fuel type, have a role to play in helping improve air quality whilst meeting our climate change targets, so government must do more to encourage consumers to buy new vehicles rather than hang onto their older, more polluting vehicles.”

Demand from business, fleet and private buyers all fell in March, down -14.3%, -15.0% and -16.5% respectively.

Registrations of plug-in and hybrid vehicles continued to rise, up 5.7%, with demand for plug-in hybrids up 18.2% for the month.

Registrations of petrol cars were stable, up 0.5%.

The decline in demand for diesel cars continues to be of concern, the SMMT said, and the latest tax changes announced by the Government “do nothing to encourage consumers to exchange their older diesel vehicles for new lower emission models”.

The company car benefit-in-kind supplement was increased from 3% to 4% from this month for all diesels not certified to the RDE2 standard. VED also increased for diesels bought on or after April 1.

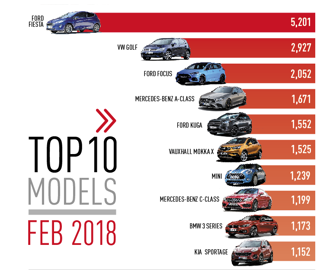

March and YTD new car registrations breakdown + model performance

MORE: Dealer new car sales per franchised outlet

MORE: Historic new car registration figures

Industry comment

Chris Bosworth, director of strategy at Close Brothers Motor Finance, said: “Today’s figures come as a disappointment. Traditionally March is a popular month to buy vehicles as the new number plates are out, and this month’s figures should have been boosted by a spike in demand before the new VED changes set in.

"That said, petrol and alternative fuels remain the heroes of the forecourts, with diesel suffering and seeing yet another month of decline.

“As we begin the one year countdown to Brexit we expect turbulence in the sector to continue, but dealers are not powerless to adapt. They need to be willing and able to offer the most appropriate finance and stock to their customers, whether that’s diesel, petrol, or electric. The strong pound should ease the way and allow them to buy better value stock, while also offering breathing space for the losses incurred by cars sat on the forecourt."

Sue Robinson, director of the National Franchised Dealers Association, said: "NFDA members are seeing extremely strong sales of used three-to-five-year-old vehicles, which continue to contribute to the health of their businesses.

“Despite the decline in new car sales, alongside a robust used car market, retailers also report strong aftersales demand with more motorists getting their cars serviced and repaired at franchised dealerships.

“NFDA estimates that a decline of 13% in the overall March 2018 market could be attributed to the changes in Vehicle Excise Duty rates introduced in April last year which prompted consumers to pull forward their purchases into March 2017. Yearly, the market is still expected to perform in line with initial predictions.

“We expect the market to start picking up from April and remain steady throughout the remainder of the year.”

Freddy Macnamara, chief executive and founder of Cuvva, said: “New car sales have fallen off a cliff in the last year and while Brexit has undoubtedly played a part, we can’t ignore the role of rising insurance costs. Annual premiums have soared and 80% of insurers believe they will continue to rise for the next two years. This is pushing car ownership beyond the level of affordability for millions of UK drivers and new car sales will keep falling as a result.

“Drivers worst affected by rising insurance costs are those who only use their car once in a while, yet find themselves paying through the roof for annual premiums. Anyone in this position should consider moving to a more flexible pay-as-as-you-go policy, so that that they’re only paying for the time they spend behind the wheel.”

Alex Buttle, director, car buying comparison website Motorway.co.uk, said: "Twelve months ago the car industry was celebrating record new car sales, today, it's facing something of a crisis with no clear plans to reverse its fortunes.

"The car industry has tried but failed to promote the benefits of Euro 6 diesel cars without government support and sales figures are telling. Consumers aren't buying the sales patter with new diesel proving a confusing area for potential buyers.

"Diesel car owners are choosing instead to keep their current vehicles running longer than commit right now to a big ticket purchase. And instead of moving towards cleaner, greener motoring, British roads will remain clogged up with older, more polluting cars until the tide meaningfully turns towards electric.

"However, while new diesel registration figures are weak, the more worrying statistic is slow growth in AFV sales.

"Although electric and hybrid sales are up in March, a 5.7% rise is nowhere near rapid enough to keep us on track for the 2040 electric-hybrid switch over.

"Will we see more action from the Government? It can't be blind to the poor state the UK car industry is in, and yet very little progress appears to have been made since the big 2040 announcement.

"Car owners are confused about what they should be doing and what their purchasing choices are across petrol, Euro 6 diesels and AFVs.

"The Government can do more, and it could start by putting its full financial backing behind electric and hybrid motoring, and offering attractive subsidies to those motorists who switch now.

"The accelerator pedal also needs to be pushed on the Government's electric car infrastructure rollout to be attractive for would-be electric car owners. There are simply not yet enough visible charging points on UK streets to convince people to switch.

"There's a lot of silence, and very little action out there at the moment, and consumers don't need much of a reason in the current economic climate to stick with the vehicle they already own.

"The new car market's loss is also the used car market's gain right now. This widespread confusion will continue to boost used car sales as people who want to upgrade their old motors are more likely to look for good value diesel or petrol cars in the second hand car market."

Simon Benson, of AA Cars, said: "This 12th consecutive monthly decline in new car registrations gives a fairly dismal view of confidence in the sector.

"While this downward trajectory has a ring of familiarity about it now, it’s important to note with such a hefty annual fall that March last year was a record high for new car sales as buyers rushed to beat the new VED rates.

"Despite this, it's hard to ignore the fact that instead of the usual March spike following the introduction of new plates, this is more of a whimper than a bang.

"On the face of it this may not present the rosiest of outlooks, but in other parts of the car market there are bright flashes of hope.

"Our own data shows that used car sales continue to beat dwindling consumer confidence and rise.

"This is, in part, being driven by a growing customer awareness of the availability and choice of car finance in the used market - something which has traditionally been associated solely with new cars, but is now allowing generations of drivers to get their hands on the vehicles that they want without digging into their savings."

Mike Allen, Zeus Capital, said: "If the SMMT forecast of a full year performance of a 5-6% decline in the market is accurate this implies an improving outlook from here, albeit we remain cautious and believe we need to see March/April data together before forming a definitive view of the market.

"We also see potential for supply issues to come through in H2 as the new WLTP testing procedures begin to come into effect, so maintain an overall cautious view of the market at this stage."

Ian Plummer, manufacturing and agency director at Auto Trader, said: “New car sales were hit by a triple whammy in the first quarter of the year.

"First, Q1 of 2017 was always going to be a hard act to follow because sales were artificially inflated by consumers pulling forward purchases ahead of changes to Vehicle Excise Duty.

"Second, we had several days of Arctic weather and this impacted deliveries to dealers and deterred consumers from visiting showrooms.

"And third, the ongoing negative impact of Brexit. Not only has it severely dented consumer confidence but falling exchange rates has reduced the scope for manufacturers to entice consumers with strong offers due to the impact of a falling pound on the profitability of cars sold in the UK.

“On top of all that, there’s the continued uncertainty which has been created around diesel sales, which only adds to the list of reasons why consumers may be inclined to delay their next car purchase.

“We’ve been saying for a while that 2018 will be the year of the used car.

"For one, the decline in new car sales means manufacturers and their franchise retail networks will be working doubly hard to increase the profitability of their used car operations.

"It’s also because the used car market is getting younger.

"In the past five years the number of cars under four years old listed for sale on Auto Trader has increased by a third.

"That means people have more choice of high quality, relatively young vehicles to choose from. There is a huge opportunity for retailers to capitalise on this trend. As younger and more desirable, but more expensive cars enter the market, finance will play an increased role in the used car buying journey.

"The big winners this year will be the retailers that can offer more accessible finance solutions to consumers looking to upgrade their second-hand car.

“The new car market might be declining, but that doesn’t mean the opportunity for retailers lies solely within used. The introduction of the new lab test for cars, the Worldwide Harmonised Light Vehicle Test Procedure (WLTP), means all the cars currently in circulation that haven’t been registered need to be by the end of August. That forced pressure on adapting to this new regulation will mean manufacturers and retailers will no doubt offer strong incentives to encourage consumers back into the showrooms over the months to come.”

James Hind, chief executive of independent car buying site Carwow, said: “Perhaps unsurprisingly, March has seen the market downturn continue as consumers’ reluctance to change their cars persists and as confusion over the long-term future of diesel reigns supreme in the minds of would-be car buyers.

“As consumer confidence in diesel continues to plunge, the industry needs the government to inject consumer confidence by offering clarity on the future of diesel, and by comprehensively laying down their plans for the £400m promised for electric infrastructure in last year’s Budget. That way, the one in six drivers (18 per cent) we know are interested in buying an electric in the next two years, have the confidence - finally - to make the change, knowing that there are enough public charging points to support their choice.

“Manufacturers are investing hard to turn the trend but their efforts continue to be thwarted by continued government-led confusion. It’s time for change.

“For car buyers, however, it’s a great time to buy. As the market trades hard to re-engage with car buyers, there are strong discounts on offer, especially for diesel.

"Meaning that savvy motorists can make some very attractive savings. In the last quarter, we have seen the traditionally significant price difference between petrol and diesel models slashed by a third, and a plethora of generous deposit contributions.

“What’s also interesting - and made clearer this month - is that drivers want to be on the move no matter what the British weather throws at them. Demand for SUVs continued unabated and there’s no doubt that the Beast from the East, and its mini little brother, served to further encourage car buyers to choose these models .

“Of our 12 most searched for models in the past month, eight of them were SUVs of varying sizes and prices.

“These range from the compact Volkswagen Tiguan and SEAT Ateca, to the larger and pricier end of the SUV scale with models such as the Audi Q5 and Range Rover Evoque.

“There was also sustained high demand for the Skoda Kodiaq, Kia Sportage and Land Rover Discovery Sport.

“Clearly, news reports of stranded drivers up and down the country has preyed on the minds of those looking for a change of car. The weather is becoming so unpredictable that motorists are looking for the peace of mind that a four wheel drive can bring during bad weather.”

Login to comment

Comments

No comments have been made yet.