Europe’s new car registrations in April matched 2018’s record high for the month as petrol and electric vehicles (EVs) mitigated the effects of declining demand for diesel.

In its monthly report on new car registrations across 27 of the region’s new car markets, Jato Dynamics said that volumes during the month had remained flat year-on-year, with a total of 1.34 million new vehicles finding owners.

The figure repeated last year’s strong performance, which saw the month record its best performance for a decade, it said, but the region’s performance remains 2.5% down year-to-date, with 5.47 million registrations recorded so far in 2019.

The UK's 4.1% decline in new car registrations during April was the ninth largest among 12 nations which experienced a decline in registrations as 14 delivered growth, as France's total remained flat.

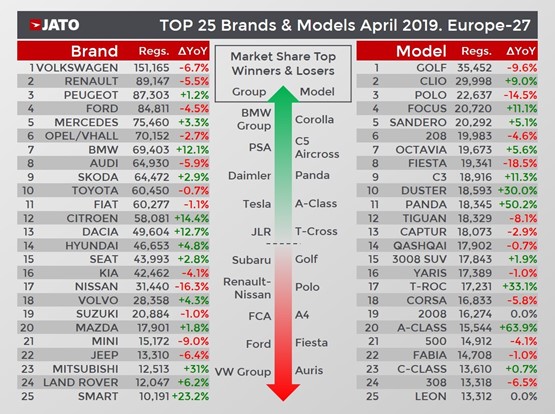

Jato said that registrations declines were posted by the Volkswagen Group, Renault-Nissan, FCA Group and Ford were offset by growth at PSA Group, Daimler and BMW Group

Jato said that registrations declines were posted by the Volkswagen Group, Renault-Nissan, FCA Group and Ford were offset by growth at PSA Group, Daimler and BMW Group

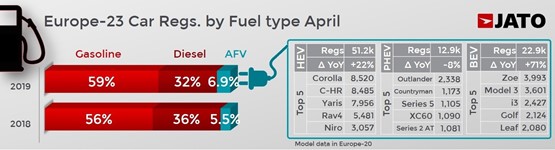

Electrified vehicles counted for 6.9% of the total market, meanwhile, generating 91,200 registrations.

This was largely due to an increase in demand for pure electric cars, Jato said, which resulted in a 71% registrations increase to 22,900 units.

Tesla’s overall volume returned to a normal level following March’s 15,755 Model 3 registrations, with 3,700 of the saloons sold during April.

However, Jato’s global analyst, Felipe Munoz, said: “We should expect to see another boost of the Model 3 once it hits British dealers.”

The growth of EVs and what Jato now describes as the “commanding position of gasoline cars” mitigated the effects of a 12% drop in diesel registrations across Europe during April.

Jato reported that, with the exception of Germany and Croatia, diesel registrations fell in every European country.

Jato reported that, with the exception of Germany and Croatia, diesel registrations fell in every European country.

Year to date figures show diesel’s volume has dropped by 15% during the first four months of 2019, counting for 32.5% of the total market.

SUVs continued to grow during the month, as the segment recorded 495,000 registrations – up by 11% on April 2018.

Year-to-date figures show there has been 2.02 million SUV registrations since the start of 2019 – up by 8% on the same period last year.

In April, the segment’s growth was driven by BMW Group (+29%), VW Group (+23%), PSA (+14%) and Hyundai-Kia (+14%).

Demand for the Dacia Duster grew by a huge 30% in April, as the vehicle led the SUV rankings for the first time since its launch.

Meanwhile, the Toyota C-HR, Rav4 and Niro were the top-selling electric SUVs, and the Audi Q3, BMW X1 and Audi Q2 led the premium SUV rankings.

Elsewhere, demand for MPVs fell by 21%, with only 65,200 registrations recorded during April.

It was closely followed by the LCV-derived van segment, which recorded 54,600 registrations as demand increased by 3%.

Jato’s insights expect the van segment to overtake the MPV segment, given it offers consumers vehicles with the same amount of interior space but with cheaper prices.

VW continued to lead the market in April despite a 7% decline caused by the reduced sales performance of its Golf, Polo and Tiguan models.

VW continued to lead the market in April despite a 7% decline caused by the reduced sales performance of its Golf, Polo and Tiguan models.

Ford’s volume was negatively affected by the Fiesta, Kuga and Ka+, meanwhile, as Opel/Vauxhall lost ground despite the double-digit growth posted by the Crossland X and Grandland X, as the Corsa, Astra and Mokka slipped down the rankings.

Audi also recorded a drop due to the results of the A3 and A4, while it sold 963 units of the new fully electric E-Tron premium SUV.

BMW’s strong performance with its X1 crossover, 1-Series and the new 3-Series saloon delivered a strong overall performance

The new 3 Series alone recorded 10,000 registrations as demand increased by 19%, Jato said.

Similarly, Peugeot saw a volume increase due the strong results of the 3008 and 108 – and it recorded 2,384 registrations of the newly introduced 508.

Skoda also grew, with volume up by 3% due to the Octavia and Karoq, while it recorded 704 registrations of the Scala.

Among the market’s latest launches, the following totals were registered: Toyota Corolla 11,381 units; Toyota Rav4 7,016; Citroen C5 Aircross 6,799; Mercedes B-Class 6,431; Peugeot Rifter 4,457; Mercedes CLA 3,666; DS 7 Crossback 2,509; Volkswagen Touareg 2,104; BMW X4 2,070; and Seat Tarraco with 1,963 units.

Login to comment

Comments

No comments have been made yet.