Car buyers boosted the consumer motor finance sector’s volumes by 12% in June – a year on from the 2020’s easing of the UK’s first coronavirus lockdown.

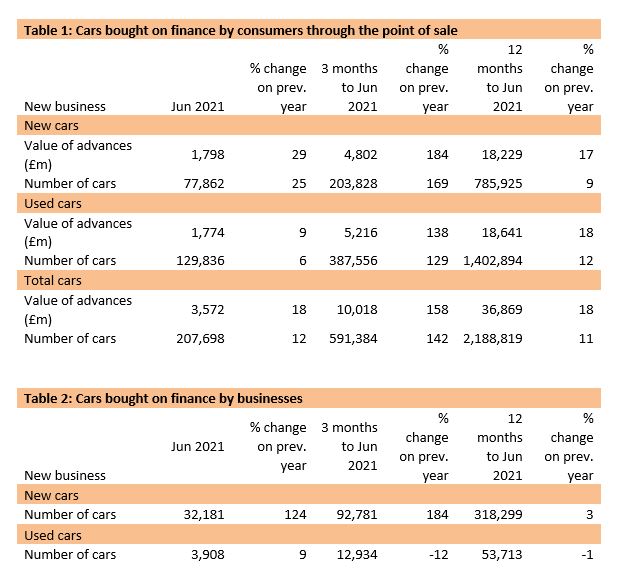

Data from the Finance and Leasing Association (FLA) has shown that new business volumes rose by 25% from new car sales (to 88,862) as used car sales generated a 6% rise in volumes (to 129,836) last month.

The value of the new business rose 29%, to £1.80 billion, in new cars and 9% to £1.77bn in used cars, it said.

Overall, the market’s new finance volumes were up by 12%, to 207,698, with the value of advances up 18% to £3.57bn.

The rise came against the backdrop of a car retail sector which is managing limited new car supply, resulting from the global shortage of semiconductor microchips, and a corresponding uptick in used car values.

The rise came against the backdrop of a car retail sector which is managing limited new car supply, resulting from the global shortage of semiconductor microchips, and a corresponding uptick in used car values.

The UK’s motor finance recovery might be about to slow, according to Geraldine Kilkelly, the FLA’s director of research and chief economist, however.

Kilkelly said: “The consumer car finance market continued to report solid growth in June, but as expected growth rates are beginning to moderate.

“The H1 2021 results show that new business levels have recovered strongly as restrictions to deal with the pandemic have been gradually eased.

“The value of consumer car finance new business in H1 2021 was only 8% lower than in H1 2019.

“Our latest research suggests that the industry has maintained its optimism about the opportunities for growth despite the risks to the economic recovery from further waves of COVID-19.

“The FLA’s Q3 2021 industry outlook survey shows that 91% of motor finance providers expected new business growth over the next twelve months.”

Last week Cox Automotive reduced its used car sales forecast for 2021 just a week after cutting its new car registrations predictions for the remainder of the year.

Cox’s full-year 2021 forecast now stands at 6,766,250 used car sales, down 0.6% (40,414 units) on its April forecast and 8.3% down on the 2000-2019 average.

Its full-year registrations forecast is now 1,823,426, up 11.8% on last year’s COVID-19 impacted performance but down 2.48% (46,349 units) against Cox's April forecast and 21.1% compared to the 2000 to 2019 average.

Cox’s insight and strategy director, Phillip Nothard, believes new car supply issues and buoyant used car values are likely to remain in play until 2022.

Login to comment

Comments

No comments have been made yet.