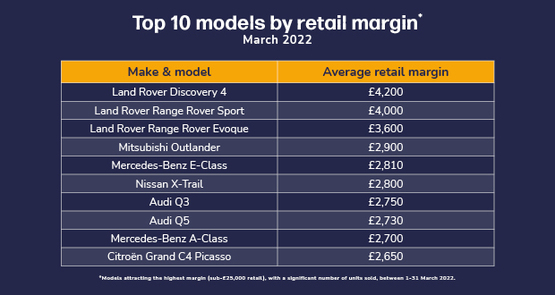

Three Land Rover models took the top three places for used car retail margin in March, according to data analysed by Dealer Auction's Retail Margin Monitor.

Most profitable was the Land Rover Discovery 4, with an average retail margin of £4,200, which is the highest average profit margin that Dealer Auction has recorded so far in 2922.

It was followed by the Range Rover Sport at £4,000 and the Range Rover Evoque at £3,600.

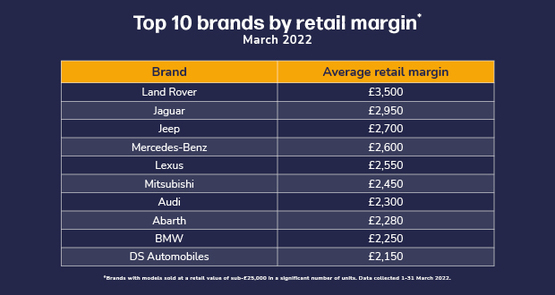

Although Jaguar models didn't feature in the top 10, the British brand ranked second behind Land Rover in the top 10 brands by retail margin analysis, with a £2,950 average.

Although Jaguar models didn't feature in the top 10, the British brand ranked second behind Land Rover in the top 10 brands by retail margin analysis, with a £2,950 average.

Dealer Auction’s sales and marketing director Sarah Marley said: “The data emphatically shows that preowned ‘Landies’ are the ones to watch for dealers seeking out opportunities for extra profit.

"Despite the current pressures on consumers’ pockets, the profit performance of these premium vehicles indicate that buyers are far from put off. ”

Used premium marques in general attracted the biggest retail margins for March – making up seven of the total top 10 models and seven of the top 10 brands. Land Rover was the top performing brand with an average retail margin of £3,500, with Jeep also performing well – showing preowned SUVs continue to be big earner for dealers, as drivers seek practical lifestyle-inspired vehicles.

Richard Walker, data and insights director at Auto Trader, which jointly owns Dealer Auction with Cox Automotive, added: “Again, the RMM offers a fascinating look at the many opportunities available in the market. Although there are signs the exceptional levels of demand we saw in 2021 are softening slightly, consumer appetite for new and used cars remains comfortably above pre-pandemic levels.

Richard Walker, data and insights director at Auto Trader, which jointly owns Dealer Auction with Cox Automotive, added: “Again, the RMM offers a fascinating look at the many opportunities available in the market. Although there are signs the exceptional levels of demand we saw in 2021 are softening slightly, consumer appetite for new and used cars remains comfortably above pre-pandemic levels.

"And despite the potential economic headwinds, our research shows consumer confidence among car buyers is robust.

"Combined with the ongoing supply constraints, these market dynamics will ensure used car prices remain strong for the foreseeable future, and in turn, continue to offer positive trade margins.”

Recent news that fleets are keeping their vehicles for longer, impacting on supply of used stock for dealers, is likely to keep margins strong for some time as consumer demand outstrips supply.

Login to comment

Comments

No comments have been made yet.