As the UK’s automotive retail sector digests the new car registrations data from H1 2022, AM’s David Francis takes an in-depth look at the trends in the first five months of the year.

And fears there are not many signs of optimism on the horizon…

May was another terrible month – second only to May 2020, when consumers could not go out to buy a car. This time it was more a case of consumers not being able to find a car, thanks to supply chain problems. Nor is there much sign of optimism on the horizon.

Supply chain issues may ease over the next six-12 months, but the UK economy is facing the appalling combination of 10% inflation and zero growth in 2023, according to the latest forecasts.

The consumer may go from not being allowed a new car, through not being able to find a new one, to not being able to afford one – all in the space of three years.

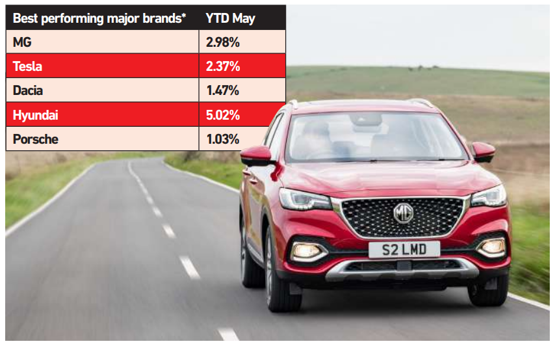

Back in the here and now, manufacturer market shares are still subject to some wild gyrations, but definite patterns are emerging.

Ford is maintaining its recent position as market leader, despite a market share figure of only 7.7%.

Pre-pandemic, market leadership with less than 10% market share would have been unthinkable.

On the plus side, the Puma is now in a solid No.2 spot in the sales charts, and is within shouting distance of the Corsa.

The Puma is effectively the new Fiesta in terms of its positioning, a statement underlined by the recent announcement that the Fiesta three-door is being dropped this summer.

Anyone with a current Fiesta ST three-door is thus left owning a minor piece of history – the last-ever three-door Ford hot hatch.

Kia is still breathing down Ford’s neck in second place, while Audi is currently third. Audi’s position is significant, as it points to the new priorities in the VW Group.

Kia is still breathing down Ford’s neck in second place, while Audi is currently third. Audi’s position is significant, as it points to the new priorities in the VW Group.

The group is prioritising its most profitable brands, so Audi is performing much better than VW.

Traditionally, VW has been as keen as anyone on sales volume, not least to keep its unsackable Wolfsburg workers occupied, so it will be interesting to see how its new focus on profit margins plays out.

VW workers at HQ are probably feeling safe, but workers in other plants may not be feeling so sanguine.

The other big news in the VW Group is the rise of Cupra.

Within two years, it has reached 0.6%, but its plans are to go way beyond that. Cupra has just announced that it aims to reach a production level of 500,000 cars per year by 2025. That would be almost the same number as Seat made pre-pandemic (592,000 in 2019), which raises the question of Seat’s future.

In the early 2000s, the idea was that Seat would become an accessible performance brand – like Alfa Romeo, only viable. Cupra was launched as a performance sub-brand of Seat, but will Seat end up as the economy sub-brand of Cupra?

Of the top 10 brands, it is significant that the only three that have grown year-to-date (YTD) are Asian ones: Kia (up 33.6%), Hyundai (up 40.6% and still recovering from a couple of bad years), plus Toyota (up 2.5%). The rise of the Korean brands has, rightly, got a lot of attention, but Toyota’s increase is just as noteworthy.

After years in the doldrums, with market share of around 4%, Toyota is now on the march.

The new Aygo X, Yaris Cross, C-HR and Corolla are all doing well (the latter being good news for the UK Burnaston factory).

However, Toyota still has a bizarrely long tail of seven models that barely sell at all.

The Prius was the future once, but it has registered only 250 so far this year, while the fuel-cell Mirai, which is still available on Toyota’s website, has only found a handful of buyers over the past year.

Hydrogen makes a lot of sense for 44-tonne trucks, but it is harder to see the point for a family car.

Hydrogen makes a lot of sense for 44-tonne trucks, but it is harder to see the point for a family car.

Outside the top 10, one of the brands to watch is Dacia (up 67.2%). The Sandero is up to No. 8 in superminis, and is now outselling such long established models as the Citroën C3, Renault Clio and Škoda Fabia.

The Dacia Jogger has only just been launched and its combination of a starting price of £15,000 and seven seats should make it a hit with families on a budget.

The forthcoming Bigster (a large crossover, as its name suggests) will further boost sales, although there is still no confirmation whether Dacia’s small EV, the Spring, will come to the UK – its price in France is just £16,500 before incentives.

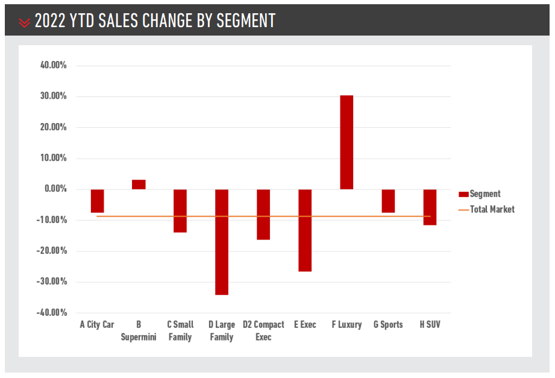

At a segment level, we should pause for a short requiem for what used to be called the large family car and could now be termed the large minicab segment.

Even combining traditional large family cars (e.g. Vauxhall Insignia) and large MPVs (e.g. Ford Galaxy), total market share is now just 1.2%.

Even combining traditional large family cars (e.g. Vauxhall Insignia) and large MPVs (e.g. Ford Galaxy), total market share is now just 1.2%.

Only three models have sold more than 500 units YTD (the related VW Passat, VW Arteon and Škoda Superb), while only Ford still makes actual MPVs – although not for much longer. All other large people carriers are converted vans, such as the Mercedes Vito.

Nevertheless, new models are occasionally driven into the quicksands of the segment: quite how the new Peugeot 508 justifies its existence with registrations of 50 units per month is an open question.

Going up-market from large family cars to executive and luxury saloons, the message seems to be “go large (and electric), or go home”.

The executive segment (e.g. BMW 5 Series) has dropped to its lowest-ever market share of 1.44% but, somewhat paradoxically, the luxury saloon segment has risen to its highest-ever penetration of 0.74%.

Five years ago, executive saloons outsold luxury ones by 6:1, whereas today the margin is only 2:1. The main reason for the growth of the luxury saloon segment has been the Porsche Taycan, which is now easily Porsche’s best-selling model.

A decade ago, we all wondered how sports car brands would adapt to a world without petrol engines.

Porsche’s answer has confounded all of us: by creating the world’s most desirable luxury sports saloon.

Login to comment

Comments

No comments have been made yet.