In his latest in-depth analysis of the UK's car registrations landscape for AM Magazine, David Francis finds the global supply woes and cost-of-living crisis might be favouring affordable car brands.

The September market was up 4.6% at 225,269 units. To put that into perspective, pre-2017 the speculation was how far past 450,000 the market would go.

In the past two years, we have not even been able to get to 250,000. The one growth area, of course, is in battery electric vehicles (BEVs), with the Society of Motor Manufacturers and Traders (SMMT) celebrating the registration of the one millionth example last month.

However, the more significant statistic may be that, in September, BEV (16.5%) nearly matched full hybrids and plug-in hybrids combined (18.4%).

Five years ago, BEVs took only one-ninth of all electric vehicle (EV) sales, and they are now the dominant EV type.

Plug-in hybrids are fading away as they now cost a similar amount to a BEV. Also, the charging anxiety related to BEVs is reducing. PHEVs were always seen as a bridge technology to BEVs, but the bridge is turning out to be shorter than expected.

FORD STRENGTHENS AS VW FALTERS

At a manufacturer level, Ford is actually looking quite perky for a change. A very good September (9.2%) share has led to a small increase for the year (7.8% year-to-date – YTD – 2022 vs 7.5% YTD 2021).

Both the Puma (up 5.9%) and the Kuga (up 20.2%) MG and Dacia’s growth in September reflects product quality, not just frugality are doing well, although the unlikeliest rise has come from the dated Ecosport (up 76.2%).

However, the Fiesta and the Focus continue to struggle and are down approximately 20% and 40% respectively.

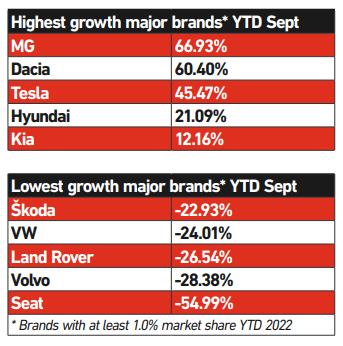

In second place, VW is down a whopping 24.0%.

The only conventional model that increased sales at all was the Arteon, but that is a fringe player at best. Even the ID3, supposedly VW’s most important model since the Golf Mark 1 in 1974, had a sales fall.

The only conventional model that increased sales at all was the Arteon, but that is a fringe player at best. Even the ID3, supposedly VW’s most important model since the Golf Mark 1 in 1974, had a sales fall.

The only comfort for VW is that nearly all its models fell by a similar amount, strongly suggesting that the decline is due to VW Group microchips going to more expensive models, rather than because of a decline in the appeal of VW products.

In third place was Kia (that phrase still takes some getting used to).

Surprisingly for a brand increasingly known for crossovers and EVs, its fastest growing model was its most conservative. The Ceed grew by 42%, and is now the fifth best-selling C-segment hatchback, just ahead of the Ford Focus.

Behind Kia, Audi and BMW are, as usual, in lockstep with fewer than 500 units between them.

However, just behind the German duo is Toyota, which has been increasing its share for most of this year.

Dependent on availability, it is not impossible that Toyota could overtake the German premium brands and finish the year in fourth place, which would be its highest-ever position in the UK.

Vauxhall is steady in sixth place on 5.5% share. That is not a bad result, but the Astra is a potential cause for concern.

Vauxhall is steady in sixth place on 5.5% share. That is not a bad result, but the Astra is a potential cause for concern.

First deliveries of the new model were in April, but it is not yet even in the Top 20 C-segment hatchbacks, having been overtaken by Cupra’s Born.

Cars are traditionally at their most profitable in their first couple of years when retail customers are most keen to buy high-spec versions, so the Astra really needs to shift through the gears.

Outside the Top 10, the two stellar performers have been MG (up 66.9%) and Dacia (up 60.4%).

This is partly a reflection of economic conditions that encourage frugality, but it also reflects the strengths of the vehicles themselves.

To take the example of the Dacia Sandero, which now outsells its Clio sibling by 2:1, what exactly are customers missing out on in return for more space and a lower price? Apart from slightly harder cabin plastics, which most people probably either never notice, or stop noticing after the first five minutes, there are few downsides.

LAND ROVER MOVES TO BACK OF THE QUEUE

Among the significant brands to have lost share has been Land Rover (-26.5%). Clearly SUVs are not going out of fashion, but Land Rover appears to have been hit harder than most by the chip shortage.

When faced with a choice of keeping the big boys, such as Stellantis (or even BMW) happy, or keeping Land Rover well supplied, JLR seems to be towards the back of the queue.

The major brand that has fallen the furthest is Seat, down by 55.0%, but that seems to be little to do with the models it is selling. After all, three years ago, Seat was steadily increasing market share and seemed to be heading towards 3%.

The problem appears to be fratricide: Cupra, once Seat’s performance sub-brand, is now a fully-fledged brand in its own right, and seems to be gobbling up both Seat’s production slots and its buyers. Spain is not a low-cost country anymore, so it makes more sense for parent VW to concentrate resources on higher-margin Cupras.

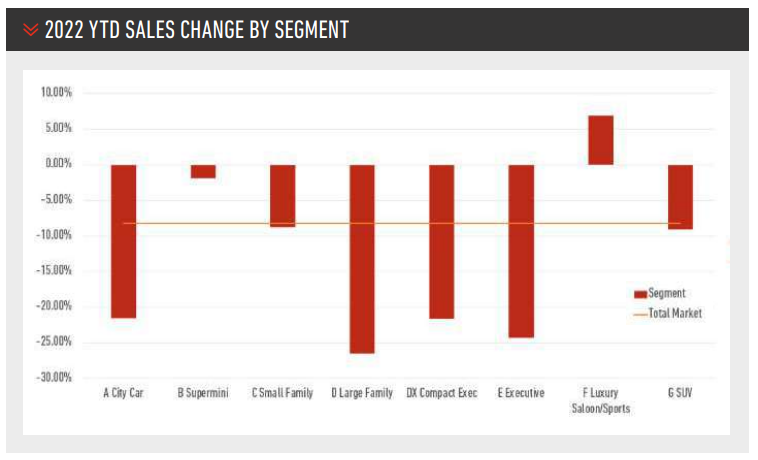

At a segment level, city cars continued their slide (down 21.6%), with more competitors leaving the segment.

There are effectively only five models left (Fiat 500/500E, Toyota Aygo X, Kia Picanto and Hyundai i10), but that, at least, means each one can sell in respectable numbers.

There are effectively only five models left (Fiat 500/500E, Toyota Aygo X, Kia Picanto and Hyundai i10), but that, at least, means each one can sell in respectable numbers.

As has been the case for the past two years, the supermini segment (down 1.9%) has fallen by less than the overall market, as more families have decided that a B-segment crossover is big enough for their needs.

Two of the segments that have declined most sharply are compact executive (down 21.6%) and executive models (down 24.3%), both suffering as buyers move to premium crossovers – more BMW X3 and fewer BMW 3 Series sales.

Large family saloons have also declined, but this has been a given for most of the past 20 years.

For the full year, the SMMT is forecasting 1.6 million registrations, followed by 1.9 million in 2023.

If forecasting is usually hard, it is near-impossible at present.

The chip shortage should ease off during 2023, boosting the market. However, interest rates are rising, and it is possible that house prices will fall – consumers with falling house values are traditionally less likely to buy a new car.

Hence you could make a good case for any number between 1.75 million and 1.95 million for 2023.

Login to comment

Comments

No comments have been made yet.