A dip in UK new car registrations in July has been partly blamed on buyer hesitation over which models will qualify for the Government’s new electric car grant.

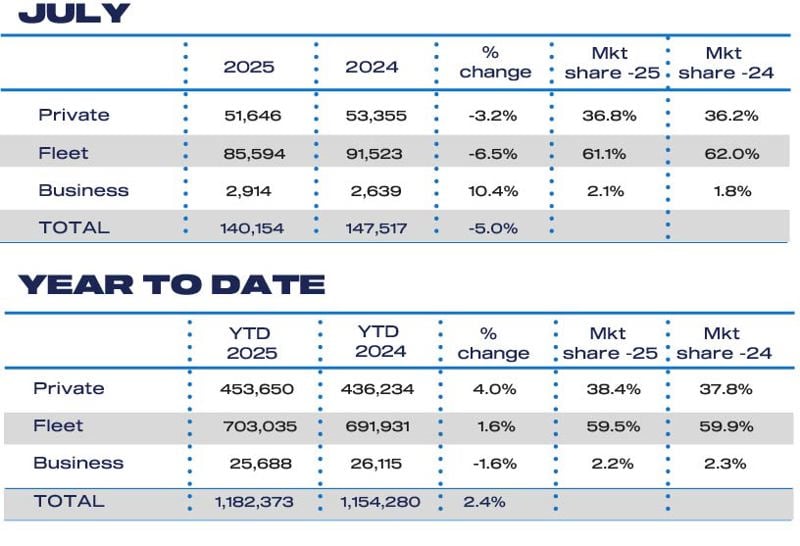

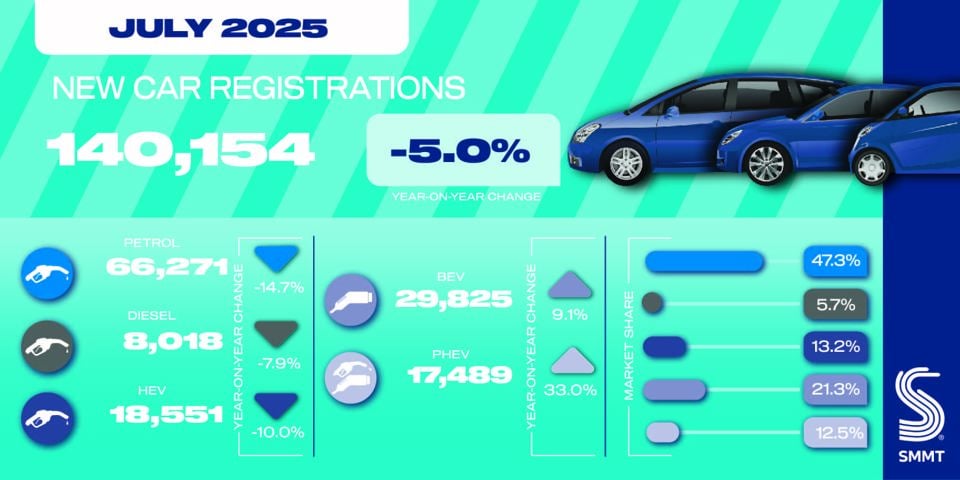

According to the latest figures from the Society of Motor Manufacturers and Traders (SMMT), registrations fell by 5% year-on-year to 140,154 units – the weakest July performance since 2022 and 10.8% down on pre-pandemic 2019 levels.

The drop was most pronounced in the fleet and business sector, where registrations declined by 6.3% to 88,508 units, accounting for 63.2% of the market. Private demand also slipped, falling 3.2% to 51,646 units. Registrations fell across most segments, with only dual purpose, mini, and luxury saloon models seeing growth.

The Government launched its long-anticipated Electric Car Grant (ECG) in July, offering discounts of up to £3,750 on eligible battery electric vehicles (BEVs). However, with only a handful of models currently confirmed – four Citroën models eligible for the lower £1,500 grant – buyers appear to be holding back in anticipation of further announcements.

The SMMT warned that the lack of clarity is creating hesitation in the market. “Confirming which models qualify for the new EV grant... should send a strong signal to buyers that now is the time to switch,” said chief executive Mike Hawes.

While plug-in hybrid (PHEV) registrations rose by 33% and BEVs by 9.1% in July, the pace of electric growth has slowed. July marked the second-weakest month for BEV growth in 2025, making up 21.3% of the market, up from 18.5% last year, but still short of the 28% ZEV mandate target.

Hybrid electric vehicle (HEV) registrations declined by 10% to 18,551 units, while petrol and diesel registrations combined dropped 14% to 74,289 units, still representing over half the market (53%).

Despite July’s dip, the year-to-date market remains up 2.4% at 1.18 million units – including more than 250,000 BEVs. The SMMT has revised its 2025 forecast up to 1.9 million units, with BEVs expected to reach a 23.8% share.

Industry figures responded with a mix of concern and cautious optimism.

Sue Robinson, NFDA chief executive, expressed disappointment over July’s decline, stating: “We are disappointed to see a reversal of the gains made in June. Looking ahead, we are likely to see continued pressure on the new vehicle market, due to weak economic growth.”

She added that while EV sales are expected to rise with the Government’s Electric Car Grant (ECG), they still fall short of 2025 ZEV Mandate targets.

“Once the consumer has a clear understanding of the ECG and manufacturers have applied the grant discount of £3,750, an uptake in registrations should increase.”

Ian Plummer, Auto Trader chief commercial officer, noted that the ECG has boosted interest in EVs but may have delayed actual purchases: “It also explains slow July sales as buyers wait to see just which models will get what level of grant.”

He said more than a dozen brands are now offering their own grants, attracting increased consumer attention: “With some experiencing three digit increases in the number of buyers looking at their models on Auto Trader, we can expect this to trickle through to EV sales in the coming months.”

MORE: new car registration data

Philipp Sayler von Amende, CCO at Get Your Car, highlighted strong online demand for electrified vehicles which have consistently outpaced petrol and diesel on Carwow's platform throughout 2025 with BEV enquiries increasing 88% year-on-year in July.

He singled out Chinese brands as growth drivers with BYD seeing a 608% year-on-year increase in enquiries last month

but urged faster implementation: “The sooner the full list is published, the sooner this demand can be turned into real sales.”

John Cassidy, director of sales, Close Brothers Motor Finance, said he remained upbeat despite the headline decline: “A far broader range of choice - at more affordable price points - is likely to accelerate the move away from traditional combustion-engined powered cars.”

Commenting on the July figures, Philip Nothard, insight director, Cox Automotive, was also optimistic: "Car registrations fell 5% year-on-year in July, marking the weakest month since 2022, although year-to-date volumes remain 2.4% above 2024. While the impact of the Electric Car Grant (ECG) remains unclear, early price activity among manufacturers suggests it may help re-engage parts of the market and potentially trigger a 'price war'."

Login to comment

Comments

No comments have been made yet.