New car retail demand took an 8% hit in April as tax changes started to bite, but the private market is still up 6.3% year-to-date.

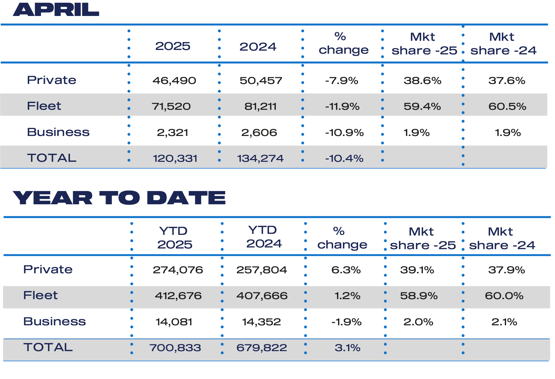

The latest data from the Society of Motor Manufacturers and Traders (SMMT) shows that the overall market was down by 10.4% or 13,943 units to 120,331 units in total, but the biggest drag on registrations was the fleet sector.

Fleet and business demand dropped by 11.9% and 10.9% respectively in April.

> New car sales registration data

It was the sixth fall in the last seven months, which the SMMT said reflects “a fragile economic backdrop and weakened consumer confidence, with 13,943 fewer cars registered in the month compared with the year before and 25.3% behind pre-pandemic April 2019”.

In what is traditionally a quieter month following the March plate change, volumes were also impacted by the late timing of Easter, resulting in fewer working days.

In addition, the implementation of VED changes affecting all new cars, including the Expensive Car Supplement which became applicable to many new EVs from April 1 , pushed transactions into March as shrewd buyers got ahead of the tax increases.

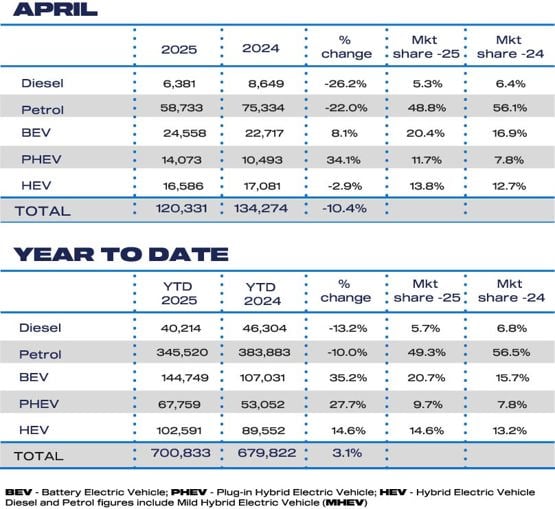

Plug-in vehicles take a fifth of UK new car market

In terms of powertrain performance, demand for hybrid electric vehicles (HEVs) fell 2.9%, with petrol and diesel registrations down 22.0% and 26.2% respectively.

Conversely, registrations of vehicles with a plug rose: plug-in hybrids (PHEV) up 34.1% and battery electric vehicles (BEV) increasing 8.1% to 24,558 units, taking more than a fifth (20.4%) of the market.

Mike Hawes, SMMT chief executive, said: “April’s performance is disappointing but expected after March’s surge.

“Another month of growth for electric vehicle registrations is good news, however, even if demand remains well below ambition.

“Recent Government adjustments to flexibilities and compliance within the ZEV Mandate are welcome and an important first step in relieving some of the pressure on the market and manufacturers.

“However, EV uptake is still being heavily and unsustainably subsidised by the industry which is why a compelling package of measures from Government is essential if consumers are going to make the switch.”

The latest market outlook revises up full year 2025 new car registrations to 1.964 million units but keeps 2026 expectations below the two million mark for what would be the seventh successive year.

Market share expectations for new BEV registrations, meanwhile, remain fairly constant with only a marginal revision downward from the January view, by 0.2 percentage points to 23.5% for this year, and down by 0.3 percentage points to 28% next year, compared with the ZEV Mandate targets of 28% and 33% respectively.

Kia and Ford top the volume charts

Government should offer clear and long-term support to UK automotive retailers

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), said BEVs have continued on an upward trajectory after a positive start to the year.

However, both fleet and private demand have seen downturns, reflecting ongoing challenges in the market.

She said: "The start of the new fiscal year has brought further pressures, with increases to employers’ National Insurance contributions and the extension of Vehicle Excise Duty and the Expensive Car Supplement to EVs.

“The Government’s recent changes to the ZEV Mandate reflect several key recommendations from NFDA’s consultation response, including the recognition of hybrids as a transitional solution beyond 2030.

"This is welcome but we reiterate that more could be done to align the UK with the rest of the world.

“Amidst ongoing economic uncertainty and the potential impact of US tariffs, it is more important than ever that the Government offers clear support and long-term certainty to UK automotive retailers."

Ian Plummer, commercial director at Auto Trader, said: "Short term turbulence is most likely to blame for April’s softening new car sales, but we’re seeing new car visits on Auto Trader up 8% on 2024 and we’re confident this will convert to sales in the coming months.

"While any growth in electric sales is welcome, we are still lagging behind the ZEV mandate target this year.

"New and more affordable models are turning heads and should help get us closer to the target, with the new EVs that launched last year accounting for a quarter of all new electric advert views."

Consumer perception on EVs still needs to shift

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said April was always set to be a low volume month, but noted that it is still disappointing to see sales stall at a time when the industry is on the lookout for signs of positivity in the market.

He said: "Although sales of battery electric vehicles continue to grow across the sector, it is clear that consumer perception on EVs still needs to shift.

"With ongoing concerns over price and charging infrastructure still commonplace, more needs to be done to support private buyers thinking about switching to electric."

As tariffs on cars being sold to the US are implemented, Hamilton said the consensus view from industry analysts is that demand for new cars in the US is set to fall this year.

This is likely to have a material impact on UK car production, with the US a key market for UK automotive companies.

On top of this, Deloitte’s recent Q1 CFO survey highlighted that businesses were becoming more defensive, with a greater focus on cost control in light of geopolitics being rated as the top risk to businesses.

With fleet sales continuing to drive growth in the sector, any pull back on investment could slow down the ability of fleet managers to replenish their stock of vehicles.

He added: "From a private buyer’s perspective, there will be concerns that a flattening of consumer confidence could mean some consumers think twice before making a large purchase.

"However, there are positive signs in the UK economy, including real wage growth, which may prove encouraging for consumers considering car purchases."

Login to comment

Comments

No comments have been made yet.