Used car retailers rallied against three months of COVID-enforced dealership closures and vehicle supply shortages to deliver annual sales up 11.5% year-on-year in 2021.

The Society of Motor Manufacturers and Traders (SMMT) has reported that last year’s used car market was just 5.5% down on the pre-pandemic five-year average despite the issues.

An annual total of 7,530,956 transactions across the year meant that 777,997 more cars changed hands than in 2020, with retailers achieving high margins thanks to an imbalance of supply and demand.

Commenting on the performance of the car retail sector, SMMT chief executive, Mike Hawes, said: “It’s good to see the used car market return to growth, even if activity is still below where we were pre-pandemic.

Commenting on the performance of the car retail sector, SMMT chief executive, Mike Hawes, said: “It’s good to see the used car market return to growth, even if activity is still below where we were pre-pandemic.

“With the global shortage of semiconductors set to ease later this year, releasing the squeeze on new car supply, we expect more of the latest, cleanest and zero emission models to become available for second owners.

“The demand for personal mobility has undoubtedly increased during the pandemic, so it’s vital we have healthy new car sales to drive fleet renewal and the used car market if we are to improve air quality and address climate change.”

After an huge year for the used car retail sector the AM Awards 2022 is inviting entries to its Used Car Dealer of the Year and new-for-'22 Independent Dealer of the Year categories. Click here to find out more.

Yesterday, AM reported on Cox Automotive’s prediction that 2021’s trend of buoyant used car prices – caused by limited supply – would continue into 2023.

Yesterday, AM reported on Cox Automotive’s prediction that 2021’s trend of buoyant used car prices – caused by limited supply – would continue into 2023.

Auto Trader, meanwhile, said last week that lengthy new car lead times have continued to drive the price of nearly-new vehicles up, with more than one-in-five now more expensive than their brand new equivalents.

How the year panned-out

In its analysis of the 2021 used car market, the SMMT noted that the used car retailers delivered a record Q2, with 2.1 million transactions delivered as the UK emerged from COVID-19 lockdown.

May was the highpoint, with 769,782 cars finding new owners.

Stock shortages impacted as the year progressed, however, and Q4 brought a 3.1% year-on-year decline in activity to just over 1.6 million transactions.

The growth of the Omicron variant of COVID-19 in December was partially blamed for a 10.2% decline.

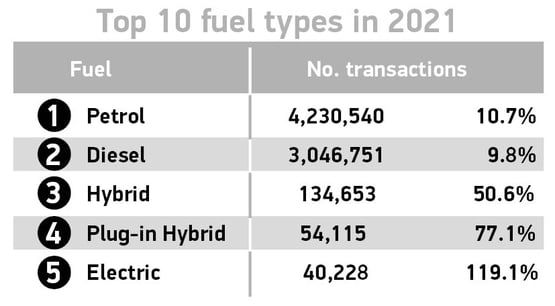

Sales of electric vehicles (EV) and plug-in hybrids (PHEVs) hit record levels in 2021, the SMMT reported, rising by 119.2% and 75.6% to 40,228 and 56,861.

Sales of electric vehicles (EV) and plug-in hybrids (PHEVs) hit record levels in 2021, the SMMT reported, rising by 119.2% and 75.6% to 40,228 and 56,861.

Hybrids also rose by 50.3% to a record 137,639.

Alternative fuel vehicles (AFVs) now represent 3.1% of the market, the SMMT said.

Petrol and diesel car transactions increased by 10.7% and 9.8% last year, with a combined 7,277,291 units changing hands. This accounts to 96.6% of all used car sales.

Superminis remained the most popular segment in 2021, taking a third of the market (32.7%), followed closely by lower medium (26.4%) and dual purpose (13.2%).

Sector commentary

Commenting on a turbulent year in the used car market, Auto Trader commercial director, Ian Plummer, said: “It’s easy to forget that physical forecourts were closed for over three months last year and just as the market returned to some semblance of normality, the world-wide supply shortage of semi-conductors hit new car supply very hard and with quick and deep knock-on effects on the used car market. Even with increased demand, such a strong performance is remarkable.

“I have no doubt 2021 will be remembered as a defining year for the used car market as we saw the steps it was forced to take to embrace digital solutions pay off in a big way. By the closing weeks of the lockdown, retailers were often hitting around 90% of normal sales volumes.

“I have no doubt 2021 will be remembered as a defining year for the used car market as we saw the steps it was forced to take to embrace digital solutions pay off in a big way. By the closing weeks of the lockdown, retailers were often hitting around 90% of normal sales volumes.

“The sharp hit to new car sales and chip shortages caused prices to rocket, with five years’ worth of growth squeezed into just seven months. With new car supply challenges set to last until at least the middle of the year, the effects will be felt for the next few years as younger vehicles become increasingly scarce.”

Chris Evans, head of Sales at heycar, said: “Used cars prices remain at a record high at the moment with little indication of this changing in the short to medium term.

“At heycar we’ve seen the average part exchange value shoot up by 55% in the past twelve months, while the value of leads we send to our dealer network is now 17% higher.”

National Franchised Dealers Association (NFDA) chief executive, Sue Robinson, said: “Over the past months, franchised dealers have adapted the profile of their stock to include older vehicles and a variety of brands to offer a wider choice of second-hand cars for the benefit of their customers.

National Franchised Dealers Association (NFDA) chief executive, Sue Robinson, said: “Over the past months, franchised dealers have adapted the profile of their stock to include older vehicles and a variety of brands to offer a wider choice of second-hand cars for the benefit of their customers.

“Although electrified vehicles currently represent a small proportion of the used car market, this transition will further accelerate as more EVs reach the second-hand market. This rapidly growing segment is being enabled by knowledgeable franchised dealers who are assisting customers with choosing the correct vehicle for their needs.

“In 2022 we expect the used car market will remain strong as franchised dealers continue to see buoyant demand from consumers. The undersupply of stock due to the global semi-conductor shortages has resulted in fewer vehicles being produced over the past two years and we expect this to gradually ease going forward”.

Login to comment

Comments

No comments have been made yet.