The automotive sector has been accused of “kicking the can down the road” rather than facing up to the long-term implications of new car specification changes.

The automotive sector has been accused of “kicking the can down the road” rather than facing up to the long-term implications of new car specification changes.

Retailers currently attempting to placate car buyers missing thousands of pounds’ worth of technology from their vehicles due to component shortages could become the victims of costly stocking headaches when underequipped vehicles re-enter the sector as used cars, it has been claimed.

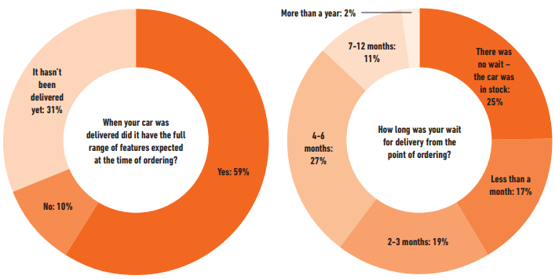

And the confusion and potential conflict with clued-up car buyers could be felt for years to come. A poll conducted by Parkers, on behalf of AM, found that 14.2% of new vehicles delivered in 2022 had items of their expected specification missing.

Among the absent items were: wireless phone chargers; infotainment screens; head-up displays; satnavs; mood lighting and electric seat adjustment.

But Autorola sales director Jon Mitchell (pictured) suggested that the true scale of the issue of missing spec could be far greater. “I suspect a lot of issues are flying under the radar,” he said.

“One of the major issues is that vehicles are coming through and the missing parts aren’t even being discussed.

“In some instances, customers are being told there have been omissions from their vehicle, but if they don’t want the car there’s another customer waiting… it’s your choice, take it or leave it.

“These vehicles’ quirks will be very difficult to detect when they re-enter the market. It is a huge problem that won’t fully rear its ugly head until 2024 or beyond.

"For now, it feels like an issue that is being kicked down the road.”

Phillip Nothard, insight and strategy director at Cox Automotive, echoed Mitchell’s concerns and stories of new car customers being issued ultimatums upon the delivery of underequipped vehicles after a potentially lengthy wait. With global production likely to be down 40 million units in the three years to the end of 2022 – as a result of COVID-19 and supply issues – many franchised car retailers have entered H2 with a 12-month order bank for certain brands and eager customers waiting to pick up unwanted orders, he said.

AM’s Parkers poll found 13% of new car buyers had waited seven months or more for their vehicle, with delivery taking more than a year for 2%. The largest portion of respondents (27%) received their car in four-to-six months, while 19% said it took twoto-three months and 17% had their order honoured in less than a month.

The results also laid bare the market advantage being leveraged by retailers and OEMs still able to offer a ready stock, with 25% of respondents stating they were able to take immediate delivery.

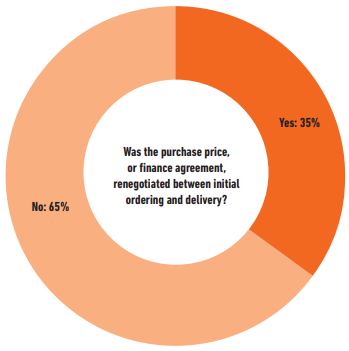

More than a third (35%) revealed they had renegotiated the purchase price of their vehicle, or terms of their finance agreement, between order and delivery.

Nothard said he knew of one car buyer who agreed to delivery of a vehicle missing more than £3,000- worth of technology to avoid a further lengthy wait.

“It’s an issue for car retailers who need to communicate extremely well and placate their customers today, but there are potentially even bigger problems being stored up for the future,” said Nothard.

“Franchised retailers able to plug into OEMs’ systems will likely be able to see the exact specification of a car when it’s time for remarketing, but independents tend to rely on DVLA data, inspections and industry knowledge to be sure of what they are buying.

“Growing numbers of dealers will be caught out in future as a result of the volume of spec changes we’re currently seeing and it could cost them significantly.”

Tom Marley, the chief executive of the Aston Barclay Group, told AM: “It promises to bring real headaches and challenges when it comes to valuations in future. Currently, we are asking our leasing company vendors to document the specification of the vehicles. They have to create their own record when they come to remarket.

Tom Marley, the chief executive of the Aston Barclay Group, told AM: “It promises to bring real headaches and challenges when it comes to valuations in future. Currently, we are asking our leasing company vendors to document the specification of the vehicles. They have to create their own record when they come to remarket.

“As a sector, we’re more reliant on data than ever before. Does that mean we’re geared-up to detect those data variances in the future? I suspect not.”

In a report into the automotive sector’s component shortages, however, Cap HPI said: “We can see from our live data feeds that there are variations, with some manufacturers were amending their offerings considerably more than others as they change the specification available across their range.”

It added: “Our new vehicle data shows EVs across all manufacturers are less impacted than ICEs (internal combustion engines). Given the uptick in interest in EVs and the recent fuel shortage crisis brought about by panic buying, the consumer’s positive view of EVs has certainly been accelerated and cemented manufacturer opinion that this remains the correct course of action.”

Mitchell said he suspected many OEMs were also prioritising technology for privately-bought vehicles over those destined for fleet users at a time when higher margin sales were being sought.

Senior vehicle data editor Christopher Wingate said some OEMs had amended their model line-ups and changed Cap IDs to account for spec changes prompted by component shortages, but conceded that “many haven’t”.

Senior vehicle data editor Christopher Wingate said some OEMs had amended their model line-ups and changed Cap IDs to account for spec changes prompted by component shortages, but conceded that “many haven’t”.

He played down the impact of this on residual values and the used sector, however, stating: “If you ask the average punter off the street what a 2020 Focus Zetec spec is compared withthe 2021 model, they’re not going to know.”

Nothard (pictured) said wrongly-described used vehicles threaten the “trust” and “transparency” now prized by car retailers increasingly operating online. “Customers do their research online and will expect certain things on a vehicle when they take delivery,” he said. “If the first time they identify missing spec is after taking delivery remotely, at home, that presents real issues for used car retailers in future.”

Nothard (pictured) said wrongly-described used vehicles threaten the “trust” and “transparency” now prized by car retailers increasingly operating online. “Customers do their research online and will expect certain things on a vehicle when they take delivery,” he said. “If the first time they identify missing spec is after taking delivery remotely, at home, that presents real issues for used car retailers in future.”

Mazda UK sales director Peter Allibon told AM about the actions it had taken to protect its customers, and residual values, as it was impacted by component shortages. “We’ve decontented a couple of aspects, but I think the key with that is communication,” he said.

“We want to ensure that residual values are reflected in it and that prices are reflected where they can be. In fact, we have generated completely new derivatives just so, in the short term, we are able to keep supply coming.”

Allibon said issues with Bose amplifiers on CX-5 Sport had led to the creation of a Sport Edition without Bose, adding: “That gives the customer a choice as to whether they take a car with some certainty over delivery without a particular element or choose the original spec car with a little less certainty as to when they actually get that.

“We’ve seen the former in most cases because they want that certainty and it’s not been fundamental things about the way the car drives.”

Luke Broad, brand director at Dacia UK, said wireless Apple CarPlay had been missing from its cars in recent months, describing the issue as “really quite painful”.

He said: “You don’t want it to be a traumatic experience when it comes to handover. If we have had to remove something, we will always give the customer something to recognise that we’ve taken some value from a car.”

Arbury Motor Group managing director Ben Archer said his staff had been working hard to help customers caught out by specification changes.

He said: “We are aware of cars coming through with Cap IDs that don’t match the specification of the vehicle and we do have manufacturers who are sending cars through now that are on order for a customer and they’re changing the specification before it lands.

“That can be a huge problem. If you think about a Motability customer that has ordered an automatic tailgate because they’ve got a wheelchair (a genuine scenario we’ve encountered) and it’s coming through without, that’s a huge issue from a customer experience point of view but also from a Cap ID and future values point of view. It’s not hugely prolific, but it’s more prolific than it was six months ago.”

Archer added: “I’m not so sure what happens two or three years down the road. It’s going to be a problem.”

IMDA founder and Specialist Cars owner Umesh Samani suggested car traders will have to be eagle-eyed when stocking their forecourts in two or three years’ time.

“The problem is this is a constant thing. It’s going on now but it’s only going to get worse,” he said. “Some dealers aren’t trained, they rely on data these days, but they are going to have to go back to basics.”

Login to comment

Comments

No comments have been made yet.