Motorists’ continued appetite for car buying has delivered another 5.1% increase in the value of the average used vehicle advertised for sale on Auto Trader.

Month-to-date to November 17 the average price of a used car rose around £300 to £17,863 on the same period in October as ongoing stock shortages continue to play out in a market that seems robust, despite the cost-of-living crisis’ impact on household finances.

On a month-on-month basis, used car prices have now been neutral or risen for five consecutive months on Auto Trader.

Data used to compile its Retail Price Index Report showed that car retailers were turning stock in an average of just 27 days month-to-date, which is one day faster than last year (28), and four days fewer than 2019 (31).

Auto Trader also claimed that the volume of advert views on its marketplace increasing 1% on November 2021, and a significant 14% on pre-pandemic November 2019.

Richard Walker, Auto Trader’s data and insights director, said: “The exceptional market dynamics we’ve seen over the course of the pandemic has shifted average prices up dramatically – around 47% on 2019 levels.

Richard Walker, Auto Trader’s data and insights director, said: “The exceptional market dynamics we’ve seen over the course of the pandemic has shifted average prices up dramatically – around 47% on 2019 levels.

“But whilst we continue to hear reference to a figurative cliff edge, or prices set to collapse, we still see no evidence of it. Based on what we’re tracking across the whole retail market, as well as forward views of supply chains, there’s nothing to suggest anything other than a return to relative normality now that those dynamics have been absorbed and new equilibrium seems to be stabilising.”

The latest findings from Auto Trader’s consumer sentiment survey, conducted in October, suggested 42% of 2,000 respondents intend to purchase a car within the next two weeks, which is up from 40% in September, whilst nearly a quarter (24%) intend to purchase within the next three months.

Auto Trader said it continues to see at least 80% of surveyed consumers visiting its marketplace stating they’re as confident they can afford their next car today as they were last year, if not more.

In his mid-month market update with AM, Cap HPI director of valuations Derren Martin described the sector’s current high used car values to remain, describing the outlook as “very stable”.

In his mid-month market update with AM, Cap HPI director of valuations Derren Martin described the sector’s current high used car values to remain, describing the outlook as “very stable”.

He revealed that electric vehicles (EV) were becoming prone to depreciation, however, as carmakers prioritised their production and used car buyers shied away from their high prices.

Tesla’s Model 3 has lost around £5,000 in value (at three years, 60,000 miles) since the start of October, he suggested.

Auto Trader’s data communicated a similar trend.

The average price of a used EV having declined from £39,166 in October to £38,021 in November – a fall of £1,145.

It said that a “significant increase in the levels of supply” were a contributor, with the volume of EV adverts on Auto Trader grew 200% YoY.

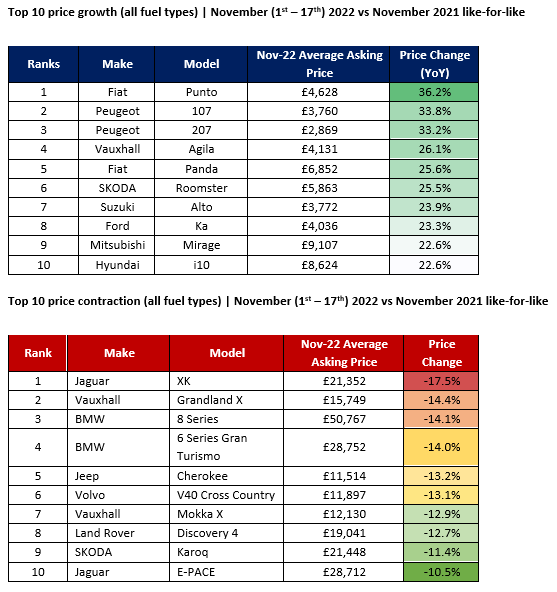

Auto Trader’s monthly ranking of November’s least and most depreciating used cars included just one EV, but did show an increasing demand for budget-oriented city cars, with the Fiat Punto (up 36.2%), Peugeot 107 (up 33.8%) and Peugeot 207 (up 33.2%) the most appreciating vehicles.

At the other end of the spectrum the Jaguar XK (down 17.5%), Vauxhall Grandland X (down 14.4%) and BMW 8 Series (down 14.1%) had lost the most value.

Login to comment

Comments

No comments have been made yet.