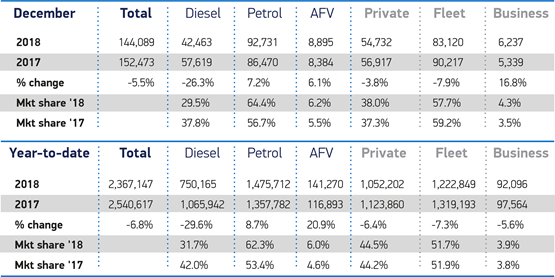

New car registrations were down 6.8% in 2018, as the new car market suffered its worst performance in five years.

Official figures from the Society of Motor Manufacturers and Traders show that a total of 2.36 million cars were registered last year – 12% below the peak in 2016.

Fleet sales were the hardest hit with a 7.3% decline, while private retail was down 6.4% overall with more than 71,000 fewer cars sold through dealers.

Mike Hawes, chief executive of the SMMT, said the decline was the result of a number of factors including Brexit, WLTP and the continued uncertainty over diesel.

“A second year of substantial decline is a major concern, as falling consumer confidence, confusing fiscal and policy messages and shortages due to regulatory changes have combined to create a highly turbulent market.

“The industry is facing ever-tougher environmental targets against a backdrop of political and economic uncertainty that is weakening demand so these figures should act as a wake-up call for policy makers,” added Hawes.

This year, the SMMT predicts a further decline of 2% in overall registrations – but the outcome of the Brexit deal is likely to big the biggest driver to market performance in 2019.

“The chancellor has spoken of a boost to the economy if a deal goes through. Without a deal it could be a different situation,” said Hawes.

The SMMT has a clear position that a “no deal” Brexit is not an option and it wants to ensure that there is a degree of continuity.

“Frictionless trade is what this industry depends on,” said Hawes. “Tariffs will push up the price of vehicles.”

The biggest volume decline in 2018 was seen in the diesel sector, down 29.6% in 2018, with the volume loss equivalent to some 180% of the overall market’s decline.

Diesels are, on average, 15-20% more efficient than petrol equivalents and so have a substantial role to play in addressing climate change, according to the SMMT.

Hawes said: “Supportive, not punitive measures are needed to grow sales, because replacing older cars with new technologies, whether diesel, petrol, hybrid or plug-in, is good for the environment, the consumer, the industry and the exchequer.”

He believes that diesel sales could see a resurgence as consumers look to switch back from less efficient petrol models and the introduction of RDE2 standards provides a fiscal incentive.

While last year was described as “highly turbulent”, Hawes said the performance was broadly in line with forecasts and “probably in line with the average for the past 10 years”.

Electric vehicle registrations could also be affected by the Brexit deal, as it is yet to be established how UK sales will contribute to manufacturer’s individual CO2 targets.

Hawes warned that manufacturers are unlikely to allocate large quantities of EV stock to the UK if those sales don’t count towards their targets.

Sue Robinson, director of the National Franchised Dealers Association (NFDA), said: “2018 was a very positive year for the used car market and we expect it to remain strong in 2019 continuing to provide franchised retailers with a key opportunity to boost profitability.

“We look forward to seeing what 2019 has in store as the effects of WLTP ease, stock supply improves, and the political environment becomes more stable."

Login to comment

Comments

No comments have been made yet.