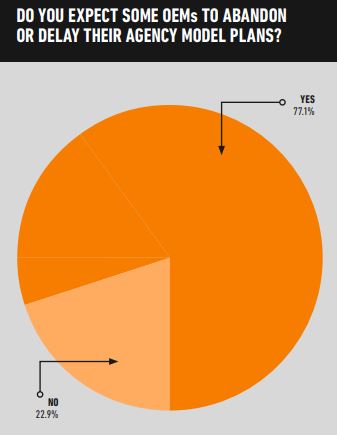

Carmakers aiming to switch to direct-to-consumer new car sales through agency agreements with their dealers are expected to defer or even abandon their plans by three-in four AM-online poll respondents.

Carmakers aiming to switch to direct-to-consumer new car sales through agency agreements with their dealers are expected to defer or even abandon their plans by three-in four AM-online poll respondents.

AM posed the question recently after Stellantis UK declared that it would delay its roll-out of agency contracts to its DS Automobiles, Alfa Romeo and commercial vehicle dealers until the start of 2024, six months later than it had planned.

Volvo Car UK has since delayed its start from April to June.

Dealers are watching Mercedes-Benz with interest. Its agency contracts started on January 1 and dealer sources told AM in early February that it had an impact on sales volume.

“Without proven success from the likes of Mercedes-Benz retailers, who are already doubting the feasibility of the model, some will only hesitate for longer or retain current practices,” says one premium brand dealer in their response to the AM-online poll.

Another says OEMs will “learn from the early adopters that there are fundamental issues with the model that need adapting” and “the execution capabilities may delay it, but, on the whole, it won’t be abandoned.”

A third claims: “Most OEMs have under-estimated the management of retail offers and the cashflow impact of not wholesaling vehicles.”

In February National Franchised Dealers Association (NFDA) retained legal advisor, TLT partner Miles Trower, said he believes further delays are likely with OEMs planning an agency switch.

“I think it’s fair to say that some of the operational and process considerations that have so far been considered by OEMs in the abstract are becoming more complicated as they drive into the detail,” he said.

Login to comment

Comments

No comments have been made yet.