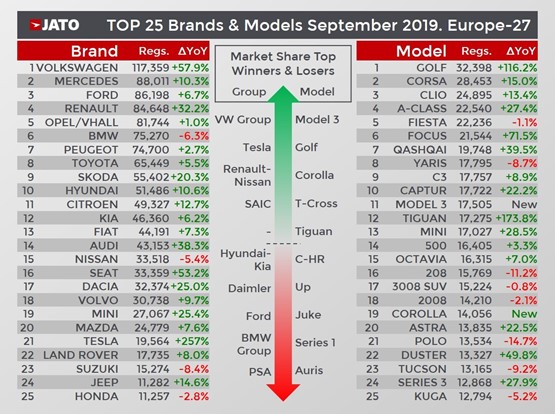

Volkswagen and Tesla were among the European new car market’s biggest market share winners as registrations in the region rose by 14% during September, Jato Dynamics has reported.

The latest data from the 27 European nations analysed by Jato on a monthly basis showed that Tesla recorded 19,500 registrations and controlled almost half of the BEV market, as it its Model 3 electric vehicle (EV) missed out on the top ten best –selling cars by just 217 units – recording 17,500 registrations for the Californian brand.

The Volkswagen Group, meanwhile, benefitted from the continued success of SUVs, selling 102,400 units into a segment which now accounts for 40% of the group’s overall volume.

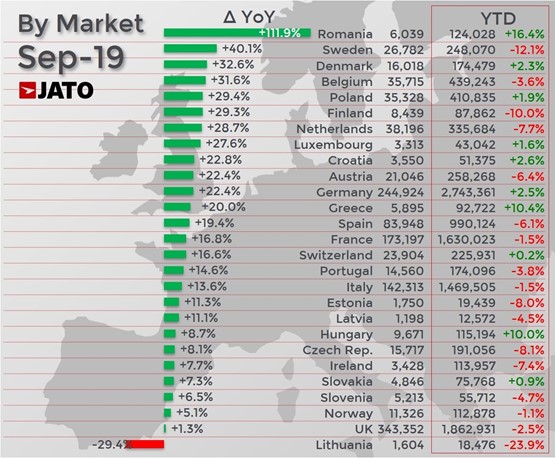

Overall, Jato reported that September’s 1.28 million new car registrations across Europe last month could be partially attributed to the market-shrinking impact of the roll-out of WLTP in 2018.

Despite last month’s volume boost, the region’s new car registrations remained 1.6% down year-to-date, with 12.08m registrations (2018: 12.27m).

However, Felipe Munoz, Jato’s global analyst, said: “The overall growth posted in August-September indicates that, despite the market’s new challenges, consumer demand continues to be strong in Europe.

However, Felipe Munoz, Jato’s global analyst, said: “The overall growth posted in August-September indicates that, despite the market’s new challenges, consumer demand continues to be strong in Europe.

“This is a good sign for the coming months, when the looming CO2 targets become even more pressing for the industry.”

The UK was among 14 European markets to post volume growth during August and September, rising by 0.7% as Germany and Italy growing by 9.1% and 6.5%, respectively.

Spain’s 19% September growth was not enough to offset its 30% decline in August.

“Despite the negative views about the state of the industry, the data shows that we still have a healthy European car market – although there are many challenges heading its way, of course,” said Munoz.

“Despite the negative views about the state of the industry, the data shows that we still have a healthy European car market – although there are many challenges heading its way, of course,” said Munoz.

This is especially true when looking at demand for SUVs, according to Jato’s market data.

In September 2019 they counted for 39% of total registrations, as their volume increased by 23% after posting a timid decline of 3% in August.

In fact, September 2019’s result marked a 10% increase on September 2017 – confirming that SUVs have been a long-term source of growth for the European market.

While the Volkswagen Group was the carmaker to benefit most from the continuous demand for SUVs, PSA Group, Renault-Nissan, Hyundai-Kia and BMW Group all posted double-digit growth.

The model ranking was led by the Nissan Qashqai, and Volkswagen placed three of its models in the top 10.

September 2019 was also a significant month for Electric Vehicles (BEV), as registrations increased by 119% to 40,700 units – boosted by the performance of Tesla, BMW and Volkswagen.

September 2019 was also a significant month for Electric Vehicles (BEV), as registrations increased by 119% to 40,700 units – boosted by the performance of Tesla, BMW and Volkswagen.

Tesla recorded 19,500 registrations and controlled almost half of the BEV market, as it was boosted by the Model 3, which was the best-selling electric vehicle and the 11th best-selling vehicle overall during September.

“It was the first time in history that an electric car has come so close to entering Europe’s top 10 model rankings”, Jato reported.

Meanwhile, Hybrids (HEVs) and plug- in hybrids (PHEV) also posted strong growth, as they were up by 26% and 27%, respectively.

Jato noted that there were also some notable results among the new entries to the market, including: the Toyota Corolla (19th best-selling model); the Volkswagen T-Cross (5th best-selling B-SUV); the Citroen C5 Aircross (sold 7,111 units and outperformed the Grandland and Ateca); the Skoda Scala (sold 4,318 units and entered the top 15 in the B segment); the Seat Tarraco (5th best-selling mainstream midsize SUV and outperformed the Tiguan Allspace); the Lexus UX (sold 2,187 units); and the Mazda CX-30 (sold 2,143 units).

Login to comment

Comments

No comments have been made yet.