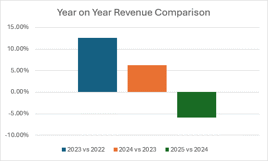

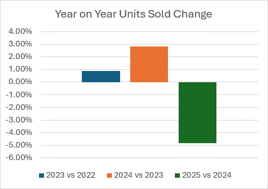

The automotive aftermarket has continued to struggle through the first half of 2025, with both sales and revenue falling year-on-year, according to new data from market intelligence firm Factor Sales.

Figures covering the first 22 weeks of the year reveal a 4.83% drop in unit sales and a 5.82% fall in revenue compared to the same period in 2024.

The downturn follows an already sluggish start to the year, which saw a 3.1% dip in volume and a 3% revenue decline across the opening nine weeks.

However, the picture looks more stable when benchmarked against 2023. Compared to the same timeframe two years ago, unit sales are down just 2.16%, while overall revenue is virtually flat, showing a marginal 0.03% increase.

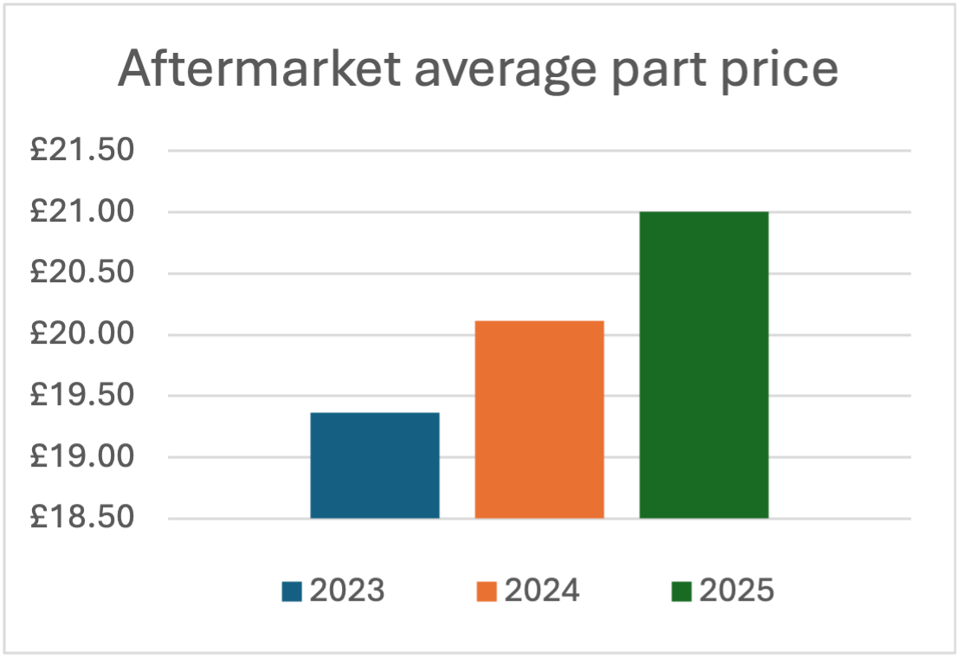

The divergence between volume and value figures is largely due to price increases, Factor Sales said. The average unit price has risen to £21.01 - up from £20.12 in 2024 and £19.36 in 2023 - thanks in part to growth in higher-value segments such as bodywork and exhaust components. Meanwhile, demand for lower-value items has softened.

The divergence between volume and value figures is largely due to price increases, Factor Sales said. The average unit price has risen to £21.01 - up from £20.12 in 2024 and £19.36 in 2023 - thanks in part to growth in higher-value segments such as bodywork and exhaust components. Meanwhile, demand for lower-value items has softened.

Factor Sales said these shifts are helping to offset wider pricing pressures caused by competitive discounting and intensified promotional activity among major distributors.

Despite the overall market slowdown, several product categories are showing signs of resilience.

The cooling and heating segment continues to perform strongly, while engine and service part revenues are now down just 1.5% and 1.3% respectively, having recovered from early-year lows.

Notably, engine components have seen a 2% rise in unit sales.

In contrast, braking remains the sector’s weakest performer, with revenue down 9.5% and unit sales falling by 11%.

Factor Sales’ business development manager Alex Jenner said: “This latest data is concerning and while it is difficult to pinpoint exactly why, looking back to 2023 when the market was broadly flat in terms of value, the recent price increases would indicate that they are now playing a significant role.

Factor Sales’ business development manager Alex Jenner said: “This latest data is concerning and while it is difficult to pinpoint exactly why, looking back to 2023 when the market was broadly flat in terms of value, the recent price increases would indicate that they are now playing a significant role.

“Despite the broader decline, some areas are showing resilience, and I hope that other component categories will do the same as we move into the second part of 2025. We will continue to monitor the trends and provide our latest report in Q3.”

Login to comment

Comments

No comments have been made yet.