Cox Automotive’s Phillip Nothard has said it is “vital” that car showrooms are able to re-open as soon as possible despite signs that many retailers continue to perform well against the odds in COVID-19 ‘Lockdown 3’.

In a mid-month market review published today (February 18) Nothard, Cox’s insight and strategy director, said that 75% of car dealers who responded to the automotive retail services specialist’s latest survey indicated that new car orders for March were down between 10 and 50% year-on-year.

And in an echo of the calls made by the Society of Motor Manufacturers and Traders (SMMT) and National Franchised Dealers Association (NFDA) last week, he said: “Q1 is a critical period and it's vital that showrooms are able to re-open as soon as possible.”

In a series of recent interviews with AM, car retailers from across the UK voiced concerns that a failure to re-open car showrooms in-time for the March number plate change will impact jobs and the economy, claiming "politicians have no understanding of business”.

New car pressures

Nothard said that it was “encouraging to see many retailers have quickly adapted to the current conditions and perform well against the odds”, but added: “The new car market continues to struggle after a 39.5% drop in registrations last month and early signs point towards a similar decline in February.

Nothard said that it was “encouraging to see many retailers have quickly adapted to the current conditions and perform well against the odds”, but added: “The new car market continues to struggle after a 39.5% drop in registrations last month and early signs point towards a similar decline in February.

“As a result, the March new plate has become increasingly crucial for the sector.”

Supply issues resulting from issues at UK borders prompted by both Brexit and COVID-19 look set to combine with reduced consumer demand due to lockdown in stymying car retailers’ efforts to meet their Q1 sales targets.

Nothard claims that lockdown was masking new car supply problems caused by the EU exit, in particular.

He said: “The current lockdown has masked the issues on new car supply related to the EU exit deal, with border frictions continuing and many industry leaders indicating there is no easy fix.

“This has been compounded by a global microchip shortage which continues to hamper an increasing number of manufacturer production lines.

“The disruption will soon impact new vehicle supply in the global market.”

In her ‘Economic Outlook post-Brexit’ presentation at AM Live Virtual – online content from which remains free until February 19 – Deloitte director of automotive, Sarah Noble, suggested that uncertainty surrounding the ease of good movements may continue for some time.

In her ‘Economic Outlook post-Brexit’ presentation at AM Live Virtual – online content from which remains free until February 19 – Deloitte director of automotive, Sarah Noble, suggested that uncertainty surrounding the ease of good movements may continue for some time.

“We know that there have been some immediate changes at the border”, she said.

“Combined with COVID, we have already seen some pain points and we expect that to continue. In January I think there were only 20% of normal traffic, so that’s yet to be tested.”

Used car resilience

Cox Automotive’s used car market data indicated that the sector was continuing to prove its resilience compared to the new car market, according to Nothard.

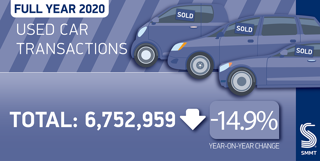

While used car sales fell 14.9% to 6,752,959 in 2020, the sector outperformed expectations with a partial recovery towards the end of the year, he said, and the Insight Report 2020, compiled in partnership with Grant Thornton, indicated that the market was forecast to hit 6.41m used car transactions in 2021.

Supply volumes in the wholesale market remain significantly behind 2020, however.

Nothard said this had been caused partly by a reduction in the number of part-exchanges entering the wholesale market.

Despite this, buyer demand is seeing marginal increases as retailers begin to lift buying bans surrounding optimism that the lifting of restrictions will soon be announced.

Aston Barclay recently reported that it had seen increased numbers of franchised retailers returning to its online sales to source stock.

But Nothard added: “As expected, trade values have eased as buyers become increasingly selective about what they buy, with accurately graded and retail-ready vehicles seeing the highest demand.

“In some cases, retailers are holding back from increasing their stock levels and are focused on only replenishing sold volumes.

“Market sentiment indicates that retailers are not anticipating the same sales activity level once the current lockdown eases.

“While we should see increases, it will not be to the levels observed in Q3 2020 that were bolstered by substantial pent-up demand.”

Login to comment

Comments

No comments have been made yet.