The Society of Motor Manufacturers and Traders (SMMT) has revealed that used car dealers delivered four consecutive months of sales growth in 2020 – despite months of enforced showroom closures in COVID-19 lockdown.

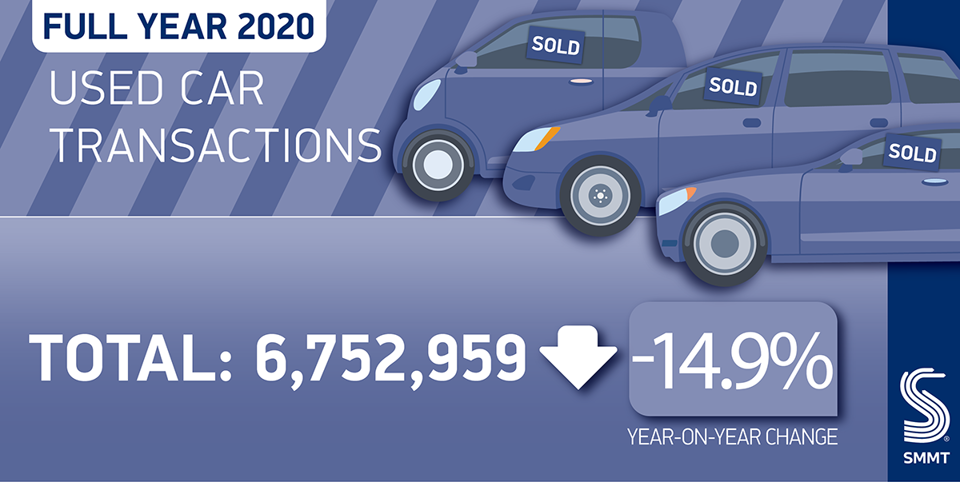

SMMT chief executive Mike Hawes said that the re-opening of showrooms must be “a priority”, however, as he revealed that COVID-19 lockdown closures contributed to a 14.9% decline in used car sales across the year.

But retailers who were quick to adapt to digital sales, backed by click and collect and click and deliver services, still managed to sell 6,752,959 as the pandemic dealt a blow to the wider economy.

In October, used car transactions increased by 3.7% as the sector achieved a fourth consecutive month of growth, the SMMT revealed.

However, the SMMT has joined with the National Franchised Dealers Association (NFDA) in calling for car showrooms to be re-opened as soon as any easing of lockdown restrictions allow after the results once again laid bare the impact of closures.

After its resurgent performance in Q3, the used car sector was hit by declines of 18.3% and 4.2% in November and December as lockdowns were re-imposed, leaving combined Q4 transactions down by 6.2% at 1,693,138.

The COVID-impacted 2020 used car sales results revealed today are the sector’s worst since 2012.

Hawes said: “These figures are yet more evidence of the significant damage coronavirus has caused the automotive sector.

Hawes said: “These figures are yet more evidence of the significant damage coronavirus has caused the automotive sector.

“Market growth at the start of the year was welcome but quickly stifled by the first lockdown as showrooms closed across the country, a picture that was repeated with the subsequent lockdowns in November and, indeed, into 2021.

“The priority now must be to allow car showrooms to re-open as soon as restrictions are eased.

“This will not only help the used market recover, supporting jobs and livelihoods and providing individuals with the personal mobility they need at a time when guidance is against using public or shared transport, but it will also enable the latest and cleanest vehicles to filter through to second owners and keep society moving.”

Following news of January’s 39.5% decline in new car registrations last week, NFDA chief executive, Sue Robinson, said that franchised car retailers remained optimistic about the year ahead “provided that dealerships will be allowed to reopen as soon as it is safe to do so”.

She said that there was “a proportion of consumers waiting for dealerships to reopen and holding off their vehicle purchases due to the current restrictions” and reiterated that the car retail sector had created a COVID-safe environment for consumers to visit.

She said that there was “a proportion of consumers waiting for dealerships to reopen and holding off their vehicle purchases due to the current restrictions” and reiterated that the car retail sector had created a COVID-safe environment for consumers to visit.

Robinson stated: “Showrooms have spacious areas and dealers can work by appointment ensuring the safety of customers and staff.”

Alternative fuel vehicles (AFVs) were the only used car segment to buck the trend of dexclining sales in 2020, according to the SMMT.

Volumes grew 5.2% to 144,225 of these models sold during the year, an increase of 5.2%, as their market share rose to 2.1%.

Battery electric vehicles (BEVs) saw their transactions increase by 29.7% to 19,184 units, but still only a fraction of all activity at 0.3%.

The market for hybrids (HEVs) also rose, by 4.7%, while demand for plug-in hybrids (PHEVs) fell by -5%.

Used diesel and petrol car transactions also fell, by 15.5% and 15.2% respectively, yet combined were still equivalent to some 6.6 million units finding new owners, the SMMT revealed

Responding to the used car sales data from the SMMT, Auto Trader chief executive, Nathan Coe, said: “The figures reveal the extent of the impact the lockdowns and restrictions imposed across the UK last year had on the used car market.

“However, they also highlight the resilience of the market, with very strong levels of consumer demand when forecourts were able to open.

“Whilst the decline was keenly felt last year, it’s reassuring to hear that many of our retailer partners were operating at 60 to 70% of normal trading volumes during January.

“This is more than we anticipated and testament to the speed at which retailers have adapted to digital retailing, as well as their sheer determination and hard work.”

Karen Hilton, heycar's chief commercial officer, also praised the used car retail sector's show of resilience. She said: “Although today’s figures show an overall decline in used car transactions, the market was showing signs of growth and positivity towards the end of the year - especially when compared with new car registrations. It’s impossible to overstate the importance of this to car dealers after the year all of us have just gone through."

Hilton also highlighted the resilience of used car values during the COVID crisis, something that contributed to the strong KPIs reported by ASE Global yesterday.

She said: “Data from heycar shows that the most popular styles of vehicle actually increased in value year on year, with the asking price of estate cars up 10 per cent on average, SUVs up nine per cent and even hatchbacks, the most popular style of all, increasing by one per cent on January 2020.

“This clearly demonstrates the strength of the used car market and is a tribute to the dealerships who kept going through the pandemic and lockdowns, ensuring stock was available to those who wanted a change of car.”

Login to comment

Comments

No comments have been made yet.