Lexus UK has cemented its position as UK car retailers' favourite franchise in the National Franchised Dealers Association’s (NFDA) latest dealer attitude survey.

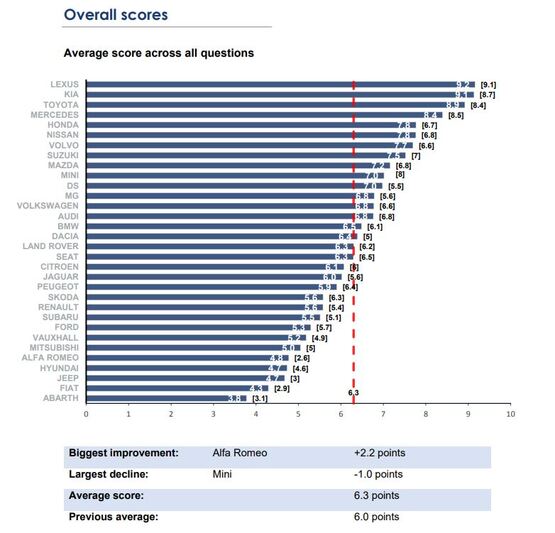

The Japanese premium brand scored a 9.2-out-of-10 average score across all the NFDA Dealer Attitude Survey summer 2021’s questions to make top spot its own for a third consecutive survey as Kia finished second with 9.1 and Toyota third with 8.9.

Stellantis brands Jeep (4.7), Fiat (4.3) and Abarth (3.8) finished bottom of the average score rankings, but their fellow former FCA Group stablemate Alfa Romeo gained 2.2 points to be the survey’s most improved performer, albeit finishing fifth from bottom – above Hyundai (4.7) with a score of 4.8.

Stellantis brands Jeep (4.7), Fiat (4.3) and Abarth (3.8) finished bottom of the average score rankings, but their fellow former FCA Group stablemate Alfa Romeo gained 2.2 points to be the survey’s most improved performer, albeit finishing fifth from bottom – above Hyundai (4.7) with a score of 4.8.

In a period that saw OEMs called upon to show support for their franchised operators in a market hampered by the ongoing impacts of COVID-19 and new car supply shortages, NFDA chief executive Sue Robinson said she was encouraged by a general improvement in relationships across the board.

Average levels of dealer satisfaction with the support received through the pandemic by respective manufacturers rose from 6.4 in the winter 2020/2021 issue of the survey to 6.8 this time around, with Toyota (9.6), Lexus (9.5) and Kia (9.4) topping the ranking.

The average score from car retailers asked to rate their OEM partner overall rose 0.2 points to 6.5 as the average overall score across all questions was 6.3, up from 6.0.

Robinson said: “It is positive to see that dealers’ satisfaction levels with their manufacturers have improved across most business areas; as consumer confidence returns and the economic environment continues to recover, there are reasons to be optimistic about the months ahead.”

Robinson said: “It is positive to see that dealers’ satisfaction levels with their manufacturers have improved across most business areas; as consumer confidence returns and the economic environment continues to recover, there are reasons to be optimistic about the months ahead.”

A total of 2,468 car retailers responded to the NFDA’s bi-annual survey, from 32 participating dealer networks, resulting in a response rate of 56.8%.

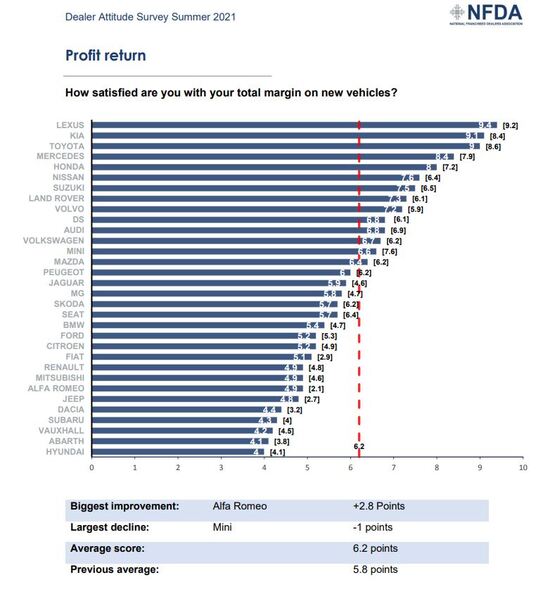

In the key questions over margin on new vehicles, Lexus (9.4), Kia (9.1), Toyota (9) and Mercedes (8.4) topped the scoring.

And in a period dogged by manufacturing issues which hampered vehicle supplies to car showrooms, and uncertainty about the strength of consumer demand, Mercedes topped the rankings in a period which saw it remove retailers’ volume targets.

Mercedes-Benz scored 9.2-out-of-10 on volume aspirations, followed by the familiar table-topping brands of Lexus (9.1), Kia (8.9) and Toyota (8.4).

Mercedes-Benz scored 9.2-out-of-10 on volume aspirations, followed by the familiar table-topping brands of Lexus (9.1), Kia (8.9) and Toyota (8.4).

Robinson said: “The NFDA Dealer Attitude Survey represents a key indicator of the health of the business relationship between franchised dealers and their respective manufacturers, and it is encouraging to see that every six months it attracts an extremely high response rate from dealers as well significant recognition from manufacturers.

“The overall average score across all questions of the survey continued to improve. Unsurprisingly, dealers’ satisfaction levels were particularly high with respect to total margins on used car sales; most dealers gave high ratings also to their manufacturers’ alternative fuel vehicle offering and the quality of their OEMs’ training.

“A number of networks were concerned with their brand’s new car targeting process, although there was an improvement in score.

“It is vital that dealers and manufacturers continue to work closely together as we emerge from the pandemic and related challenges. NFDA will continue to engage with manufacturers on behalf of our members.”

To read the NFDA Dealer Attitude Survey summer 2021 summary report, click here.

Login to comment

Comments

No comments have been made yet.