Registrations of Chinese-built electric vehicles (EV) soared 78% across Europe during August as overall vehicle registrations rose for the first time in 2022.

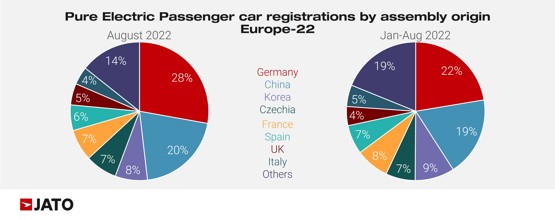

In the latest market data report published by Jato Dynamics global analyst Felipe Munoz described Chinese OEMs’ market share growth to 20% – making it the second-biggest EV producer, behind Germany’s 28% share – as an early indicator of how “sooner or later, they will play a key role in the global market”.

Earlier this week AM reported that Peter Vardy was set to be the first franchised partner of incoming Chinese EV brand Ora when it reaches the UK this November – imported by IM Group.

BYD is among a number of other high-profile market entrants poised to enter the UK market.

Currently most of the cars made in China were not produced by Chinese OEMs, however.

Currently most of the cars made in China were not produced by Chinese OEMs, however.

Almost half were manufactured by Tesla, while the Dacia Spring and several MG models also contributed to the total.

In August, only 18% of EVs made in China and registered in Europe were sold under a Chinese brand.

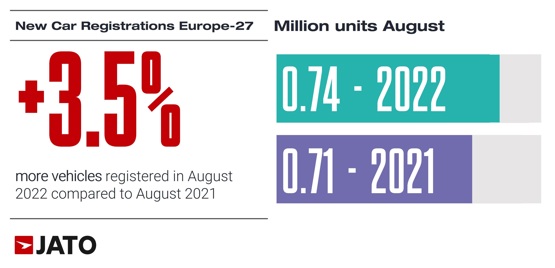

Last month, overall market volumes grew by 3.5% to 739,037 units across the 27 European new car markets analysed by Jato.

Last month, overall market volumes grew by 3.5% to 739,037 units across the 27 European new car markets analysed by Jato.

Germany, France, Spain, Italy and the UK all delivered growth during the month, with just six countries experiencing declines.

Year-to-date volumes remain down on a challenging 2021, however, remaining 12% down at 7.14 million units.

Munoz said: “The situation is still quite complex. Although the industry is slowly learning how to deal with the shortage of components and parts, consumers still face long waiting lists for new vehicles with many being forced to shift to the second-hand market”.

T-Roc reigns

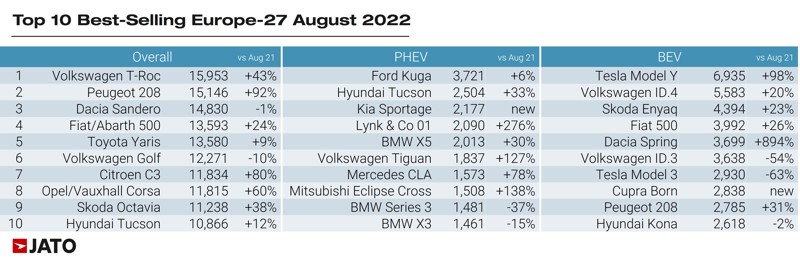

Volkswagen’s T-Roc crossover was Europe’s biggest-selling car for the second consecutive month, after registrations rose 43% to almost 16,000 units in August.

The T-Roc is now outselling the VW Golf year-to-date.

Other strong performers in August include the Peugeot 208, Citroen C3, and Vauxhall Corsa.

Meanwhile, registrations of the new Kia Sportage and Ford Kuga increased by 63% and 59% as Tesla doubled registrations of its Model Y – making it August’s best-selling EV.

Meanwhile, registrations of the new Kia Sportage and Ford Kuga increased by 63% and 59% as Tesla doubled registrations of its Model Y – making it August’s best-selling EV.

In the competitive C-SUV and B-SUV segments which dominate sales with 18.9% and 18.3% market share, respectively, the Volkswagen Group led the market with a 28% market share.

The T-Roc’s strong showing was supported by strong performances by the Tiguan, ID.4, and the new Taigo.

Stellantis followed Volkswagen Group in the SUV segment but lost traction with a 9% drop in volume.

Registrations fell for the Peugeot 3008 (-39%), Opel/Vauxhall Grandland (-29%), Citroen C5 Aircross (-16%), and the Jeep Renegade and Compass (-42% and -53% respectively).

Despite this, the positive performances of the Peugeot 2008 (+27%), Opel/Vauxhall Mokka (+25%) and Opel/Vauxhall Crossland (+21%) secured Stellantis’ second place position in the SUV market.

Login to comment

Comments

No comments have been made yet.