Car dealers’ part-exchange vehicles reached record values at BCA’s auctions during January as the sector continues to compete for a wide range of vehicle stock to fill their forecourts.

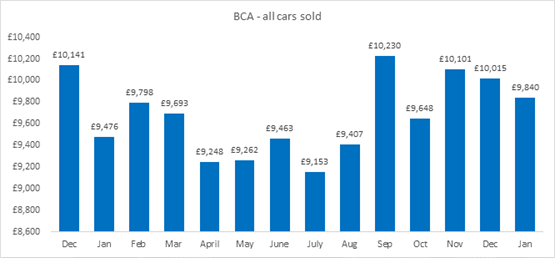

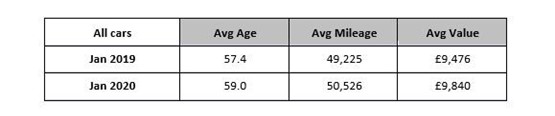

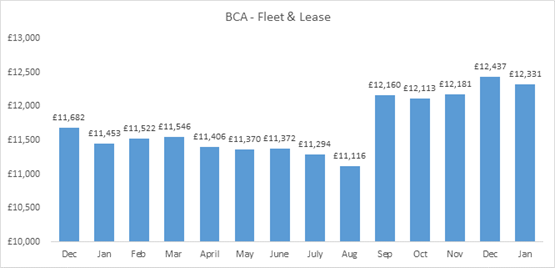

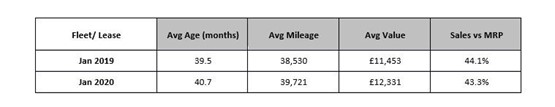

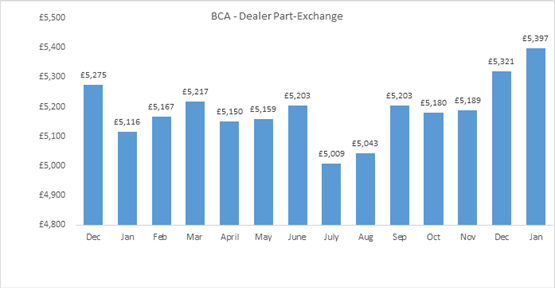

While the average price of a used car sold through BCA’s network of UK remarketing centres and its online channels rose by 3.8% (£364) year-on-year to £9,480 last month, former fleet and lease vehicles delivered a 7.1% (£878) rise to £12,331 to maintain their strong performance as older, higher mileage part-exchanges rose by 5.5% (£281) to £5,397.

Despite the year-on-year rises, BCA’s Pulse Report stated only that average used car values had “returned to more typical levels in January, following on from the seasonally affected values recorded during December 2019”.

Despite the year-on-year rises, BCA’s Pulse Report stated only that average used car values had “returned to more typical levels in January, following on from the seasonally affected values recorded during December 2019”.

As AM reported late last month, trading started strongly for BCA in 2020 as it sold record volumes of vehicles in January, with digital sales increasing by 23% year-on-year.

Stuart Pearson, BCA’s chief operating officer of UK Remarketing, said: “January was a strong month across BCA’s network with record volumes sold and strong buyer engagement across the network for both physical and digital sales.

“Dealer customers are reporting positive levels of retail activity and this is driving demand in the wholesale sector.”

Fleet and lease values averaged £12,331 at BCA in January 2020, the second highest value ever recorded at BCA, following December’s record result.

Demand has seen values rise consistently since September of last year, with the last five months representing the five highest monthly values recorded.

Dealer part-exchange values at BCA rose to record levels for the second month running during January 2020, increasing by £76 (2.5%) over the month to reach £5,321.

Dealer part-exchange values at BCA rose to record levels for the second month running during January 2020, increasing by £76 (2.5%) over the month to reach £5,321.

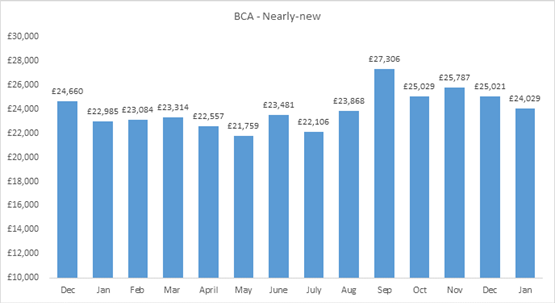

Values for nearly-new vehicles at BCA averaged £24,029 in January 2020, with year-on-year values up by £1,044 (4.5%), despite a dip in values since November last year.

Values for nearly-new vehicles at BCA averaged £24,029 in January 2020, with year-on-year values up by £1,044 (4.5%), despite a dip in values since November last year.

BCA said that model mix has a significant effect in this sector, with brand specific winners and losers.

Login to comment

Comments

No comments have been made yet.