Used car retailers have been warned of an electric vehicle (EV) overpricing issue once again after diesel-powered vehicles sold fastest in January.

Last month Autorola blamed ongoing price increases among used EVs for leaving “cars left unsold on dealer forecourts” during 2020 and the online stock management specialist has reiterated its message after analysing data from the first month of COVID-19 ‘Lockdown 3’.

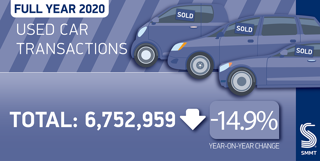

Autorola said that used car sales in the UK had declined 40.4% year-on-year last month in a report coming just a week after the Society of Motor Manufacturers and Traders (SMMT) suggested that showroom re-openings were ‘a priority’ after 2020's 14.9% used car sales decline

The fall was the single biggest January sales fall of any of the 13 European countries that feature in its monthly Indicata Market Watch insights report.

Autorola’s market insight tool showed that stock was turning at a slower level for all fuels but used diesels, at 6.4, were the fastest-selling powertrain as used hybrid sales fell 9% year-on-year and BEV sales only rose 15% – the lowest rate of growth since Indicata records began.

Autorola said in a statement issued this morning that it believed there are “distinct signs in the UK and across Europe of an oversupply of BEVs caused by over pricing which has also impacted stock turn.

Indicata group sales director, Jon Mitchell, said: “Looking at January in a positive way, 60% of used car volumes were achieved despite the market being locked down and relying on click and collect.

“The used market continues to trade digitally, and we have seen more buyers than ever sign up to our online Autofind portal to either buy or sell used car stock.

He added: “Already February sales have started to rise as franchised dealers come back into the market putting it into a good position ready for when lockdown 3.0 ends.”

Aston Barclay reported last week that it had seen evidence of http://am-online.com/news/market-insight/2021/02/12/car-retailers-return-to-auctions-in-february-after-price-sensitive-januarycar retailers returning to remarketing channels to re-stock their car forecourts at the start of February.

While many will be re-stocking after selling cars via click and collect or click and deliver services, some may be preparing for a return to showroom trading and the return of sales due to pent-up demand.

Auto Trader reported last week that it a 7.4% rise in used car values seen on its platform last month had given it “confidence we’ll see a quick return to health” as COVID-19 ‘Lockdown 3’ restrictions start to ease.

Autorola data indicated that overall dealer used car stock levels had declined by 10.2% during January.

It attributed this decline to “caution about overstocking”.

But Autorola added: “Despite the market stalling sales were still trending in January ahead of the levels recorded in lockdown 2.0 in October/November, while prices have risen by around 3% during January which reinforces demand is gradually coming back.”

Login to comment

Comments

No comments have been made yet.