The supply of used cars is expected to remain restricted in the short term, pushing up wholesale prices and limiting growth opportunities for dealers, according to Cox Automotive.

As car makers struggle to supply new models, the knock-on effect means that fleet, rental and leasing companies are delaying de-fleet activity and preventing the previously anticipated flood of used models onto the market.

Philip Nothard (pictured), Cox Automotive’s insight and strategy director, explained: “The news that manufacturers are struggling with the supply of new cars will be felt at dealers when it comes to obtaining stock. This means that the lease and contract hire sector can’t get new product and therefore can’t de-fleet many of those low mileage, nearly new cars that were hoped to enter the used car market in significant volume in the coming months.

“We had hoped that a regular and well-sized supply of de-fleeted vehicles would prove key to restoring a thriving, competitive used market. However, our latest warning does reflect the expectations of dealers, with 82% expecting supply to remain the same or decrease, and 33% predicting that wholesale prices would go up.”

Published in the new AutoFocus quarterly digital magazine, the most likely new car forecast for Q2 2021, is 520,835 registrations, representing a -5.9% drop compared to 2000 to 2019 pre-pandemic average. This scenario assumes some modest pent-up demand in April and May, with consumer nervousness holding back a full recovery

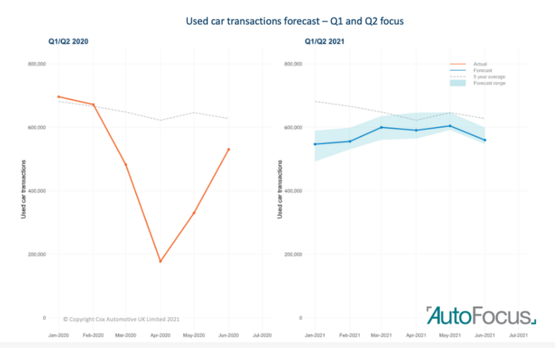

Cox Automotive believes, in the best-case scenario, that the used market will stay broadly in line with pre-pandemic levels of activity, in which case the UK market will end the year with 7.27 million car transactions.

Its latest dealer sentiment survey revealed that 54% of dealers were confident that used car transactions would increase in 2021 compared to 2020. This comes despite dealers feeling the effects of spending the first three months of the year in lockdown – signalling that they are feeling optimistic about the rest of 2021, now that in-person retail is once again possible.

The reopening of physical showrooms across the UK resulted in positive auction performance in the first half of the month. Compared to April 2019, Manheim’s wholesale activity showed CAP Clean performance (+4%) and first-time conversions (+2%) increase, indicating that buyers are returning to auctions to replenish stock sold since the reopening of their dealerships. The average wholesale car price for the first 16 days of April 2021 is at £6,448, an +£846 (+15.1%) increase compared to the same period in 2019.

However, not all dealers are experiencing pent-up demand following the latest iteration of lockdown easing. While used car supply has steadily increased since the start of 2021, volumes remain below expectation at this time of year, and crucially down compared to the period last summer between the first and second lockdowns. Used car supply constraints are anticipated to continue throughout the first part of the year.

“Pent-up demand is buoying the sector after the reopening of showrooms, but several factors remain unresolved,” added Nothard. “One is what happens as the government’s financial support for the automotive industry wanes – which will inevitably occur, though the furlough scheme has been extended until September. This ongoing support has enabled many businesses to stay afloat, but it may be masking a greater degree of financial exposure than we currently understand.

“Another factor is that we need to ascertain the UK economy’s overall economic recovery scenario. If it is weaker than expected, with higher debt and unemployment, then public demand for used cars will be slower to resurface.

“In spite of these uncertainties, we firmly believe that the future lies in dealers’ hands. They can put themselves in a position to succeed by remaining adaptable: maximising the potential of omnichannel retailing, sourcing and managing stock flexibly, spreading supply routes and aiming to sweat as much RoI as possible from every asset.”

Login to comment

Comments

No comments have been made yet.