Motor retailers should be prepared to review how they advertise their finance offers for new and used vehicles on social media due to the Financial Conduct Authority’s (FCA) latest crackdown.

The FCA is already several weeks into a new consultation that could lead to including warning labels with more information on the risks associated with taking out finance on adverts placed on social media platforms like Instagram, TikTok, Facebook, YouTube, Threads, Discord and more.

The current FCA guidance on social media hasn’t been updated since 2015 and it said that while “many of its key principles still hold”, it is heavily based around character-limited media like Twitter. This consultation will lead to an update on its rules around social media.

This spotlight on social media is almost like an extension of the FCA’s Consumer Duty regulations and has been prompted initially by bad practices from cryptocurrency advertising and “finfluencers” (finance influencers) in particular.

It means all finance deals promoted on social media are now under the microscope, including for new and used car finance.

The finance and insurance regulator said that social media is being used by many consumers as a go-to source of information, and this is reflected in advertising trends.

The AA/Warc expenditure report found that the UK social media advertising market was worth £6.4 billion in 2021, representing nearly a third of all internet advertising spend.

In Q4 of 2022, the FCA said 69% of financial promotions communicated or approved by authorised firms which were amended or withdrawn following our intervention involved website or social media promotions.

It said this data shows consumers using social media to inform their financial decision-making will likely have seen promotions that are “unfair, unclear, or misleading in some way, demonstrating the potential for widespread harm in this space”.

The requirement to be fair, clear and not misleading means there should be balance in how financial products and services are promoted, so that consumers are informed not only of the potential benefits but also of the relevant risks.

Lucy Castledine, director, consumer investments at the FCA, said: "We’ve seen a growing number of ads falling short of the guidance we have in place to stop consumer harm.

"We want people to stay on the right side of our rules, so we’re updating our guidance to clarify what we expect of firms when marketing financial products online.

"And for those touting products illegally, we will be taking action against you."

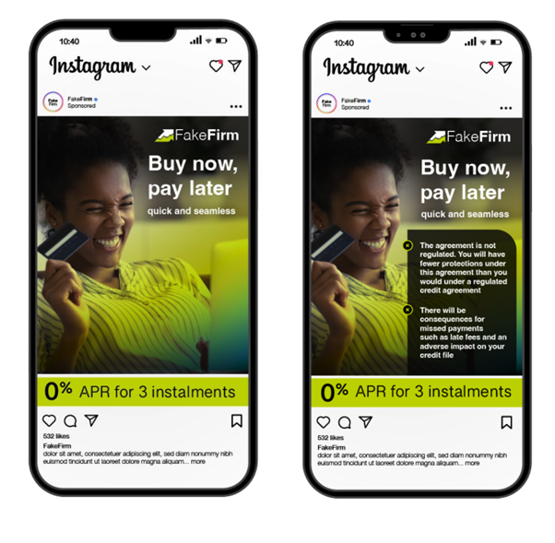

While the consultation is running until September 11, the FCA’s document already includes examples of what the FCA sees as bad practice, compared with good practice.

Risk warnings

This involves including a lot more information on each social media advert, including more detail on the risks of taking on finance.

In an FCA example Instagram advert for a 0% APR finance offer, information on whether the credit agreement is regulated or not, as well as information about the consequences of missing payments is included in the design of the advert.

Think of it as a little bit like the warning labels on cigarette packets.

The FCA expects risk warnings on social media to be “clear, prominent and without a design feature that reduces their visibility or prominence”.

The regulator’s own research shows that risk warnings are more effective when viewed at the time of or just before the communication of the promotion, as well as when they are prominent and stand out from their surroundings.

It said: “For this reason, evidence suggests that it may limit consumer understanding to display a risk warning which is less prominent than the headline, or which is presented at a later stage.”

The FCA’s consultation is specifically asking for feedback from the industry around whether the prominence of information around risks on social media advertising is agreeable.

Consistency with websites and social media

Neil Smith, former Imperial Cars operations director and Cazoo’s retail operations director, is founder and chief executive at Motorvait, the digital marketing consultancy.

He described social media as “the last wild west” when it comes to finance advertising.

S mith said: “The FCA has regulated dealers’ websites and the way adverts are presented on classified websites like Auto Trader, so now social media is like the last piece of the wild west.

mith said: “The FCA has regulated dealers’ websites and the way adverts are presented on classified websites like Auto Trader, so now social media is like the last piece of the wild west.

“It’s where some unreputable retailers are using Facebook and other channels to bend the rules.”

Smith said any quick search on a social platform like Facebook will show adverts that are in breach with even the current FCA regulations around social media, let alone the closer scrutiny that can be expected in the coming months.

He said: “Most dealers are doing what they should be doing on their websites by showing APR examples and the representative examples on the advert.

“Once the FCA makes these new social media rules mandatory, the one thing retailers will likely have to do is put in more elements around risks, what protections consumers can expect and the consequences to missed payments.”

Smith (pictured) also made it clear that until the FCA updates these new social media regulations, there’s currently nothing forcing motor retailers to include more detail about risk in their social media advertising.

However, it’s still prudent to think about what may be coming in the future and whether finance offers and the marketing teams are approaching promotions with the spirit the FCA has in mind.

Smith said: “I have noticed that some social media advertising doesn’t reflect the same way finance offers have been advertised on dealers’ own websites or on Auto Trader.

Smith said: “I have noticed that some social media advertising doesn’t reflect the same way finance offers have been advertised on dealers’ own websites or on Auto Trader.

“I have seen dealer websites that are advertising finance offers within the current regulations correctly on their websites, but this approach isn’t reflected when it comes to social media.

“There has to be a consistent approach between the care that’s been taken to be compliant on dealers’ websites and anything that goes out on social media.

“Social media is perhaps seen as not having as much focus from the FCA as its has been so consumed by Consumer Duty so that’s obviously what its now trying to tighten things up.”

Tanesha Austen, founder of Armchair Marketing, told AM that modern dealerships are well versed in producing transparent financial advertisements as part of their business.

She said: “This experience over the years puts the automotive retail industry in a favourable position compared to newer sectors like crypto, where change is more imminent.

“Car dealerships and marketing agencies within our industry are already skilled at crafting ads that are both clear and captivating for customers.

“Therefore, focusing on eliminating misleading content is just another facet of our ongoing commitment to responsible advertising.”

Design of the adverts and click through rates

Some dealers may argue that the level of additional information on risks on the social media advert itself, it’s going to affect the design and readability.

The risks included within the P2P Facebook advert example text reads: “...”Don’t invest unless you are prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong…”

The risks included within the P2P Facebook advert example text reads: “...”Don’t invest unless you are prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong…”

Is this the sort of advert a company would put forward to try and boost interaction with an audience through Facebook?

The FCA’s consultation document says: “It may be possible to signpost a product or service with a link to more comprehensive information, provided that the promotion remains standalone compliant.”

Smith agreed that the FCA’s guidelines in the past have been quite “grey”, but isn’t as concerned about the potential impact to click through rates and interaction if there was to be increased warning labels on finance advertising.

He said: “I don’t see these potential new social media rules as a major problem for the industry.

“It’s more around understanding exactly what the FCA means and getting the approach right and compliant.

“Ultimately whatever the guidelines are, the FCA is trying to protect vulnerable consumers and to make them aware of the risks, which is ultimately a good thing.”

The FCA’s consultation on advertising finance on social media is running until the second week of September and feedback can be sent to gc23-2@fca.org.uk

Login to comment

Comments

No comments have been made yet.