Finance companies may be required to fully disclose the commissioned paid to dealers and brokers following the FCA’s review of motor finance.

James Tew, CEO at iVendi, said that the results of the study were “harder hitting” than many in the industry expected and a “clear sign that business-as-usual was not an option.”

“Our reading of the review is that the FCA has actually developed a much better understanding of the industry than previously and that what it is saying about introducers, whether they be motor dealers or specialist credit brokers is in many respects probably correct,” Tew said.

The FCA’s criticism centred around individual introducer’s ability to dictate interest rates, with the lack of any discernable link between the rates being set and the customer’s credit score coming in for special criticism. Instead, it is suggested that rates are being dictated in many cases by the introducer’s desire to earn commission.

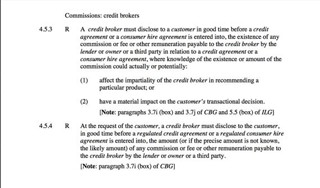

Concerns were also raised about the introducer’s disclosure of commission under current rules and whether motor finance companies were doing enough to ensure introducers were complying with FCA regulation. It concludes that, “…change is needed across the market, to address the potential harm we have identified."

Tew added: “This is very much a clear shot across the bows for motor finance companies and their approach to operational oversight of introducers. Better solutions and processes will need to be put in place.

“The ultimate sanction is probably if full disclosure of commission at the point of sale is made mandatory, something that introducers will be very keen to avoid.

“It may already be too late to avoid this but the industry could certainly attempt to pre-empt any FCA action by ending the practice of introducers controlling sell-out rates.”

Login to comment

Comments

No comments have been made yet.