The Financial Conduct Authority will set new rules for regulated financial services including motor finance by mid-2022 as it aims to “fundamentally shift the mindset of firms”.

Currently financial services do not always work well for consumers, the regulator said, and despite the current regime it has seen some practices that cause harm.

Such practices include presenting information in a way that exploits consumers’ behavioural biases, providing poor customer support or selling products the FCA deems not fit for purpose.

Introduction of the new Consumer Duty by the Financial Conduct Authority will be backed by “assertive supervision” and a “data-led approach” for intervention when it spots practices which do not deliver for consumers.

Its new ‘Consumer Principle’ is that “a firm must act to deliver good outcomes for the retail consumers of its products”.

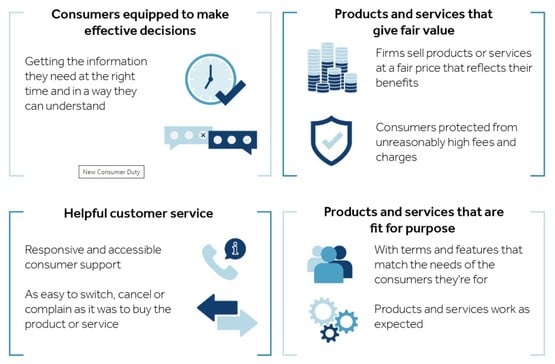

The new rules will require firms to focus on supporting and empowering their customers to make good financial decisions and avoiding foreseeable harm at every stage of the customer relationship.

Firms will have to provide consumers with information they can understand, offer products and service that are fit for purpose and provide helpful customer service.

A second consultation is now under way until February 15, with the final rules being confirmed in July 2022.

Sheldon Mills (pictured), executive director of consumers and competition at the FCA, said: “Making good financial decisions is vital to financial well-being and trust, but too often consumers are not given the information they need to make good decisions and are sold products or services that do not offer the benefits they might expect.

“We want to change that. We’ve been working to set a higher standard for firms, to put more of the onus on them to act in their customers’ interests and get their products and services right.

“We want to change that. We’ve been working to set a higher standard for firms, to put more of the onus on them to act in their customers’ interests and get their products and services right.

“The new duty will drive a change in culture at firms. We expect firms to step up and put consumers at the heart of what they do and we’ll be holding senior managers accountable if they do not.

“The duty will also help create an environment for healthy competition between firms, encouraging them to be innovative in developing products and services that meet consumer's needs.”

In its consultation paper the FCA states that although all firms that have an impact on consumer outcomes will need to consider their obligations under the Consumer Duty regime, there is more onus on dealers and customer-facing businesses.

"We would generally expect firms with a direct relationship with the end user to have greatest responsibility under the Consumer Duty," the FCA said.

However firms will only be liable for their own activities.

Following the implementation period the FCA will expect existing contracts to be included in firms's compliance with the Consumer Duty on a forward-looking basis.

In January the FCA introduced revisions to its consumer credit rules which require dealers to be more open about the fact that they earn commission from selling finance, and which stamped out broker reward models which could be unfair to consumers.

Login to comment

Comments

No comments have been made yet.