The Finance and Leasing Association (FLA) still expects a H2 rise in car buying activity, despite expectations that spending will slow amid rising inflation, interest rates, and taxes.

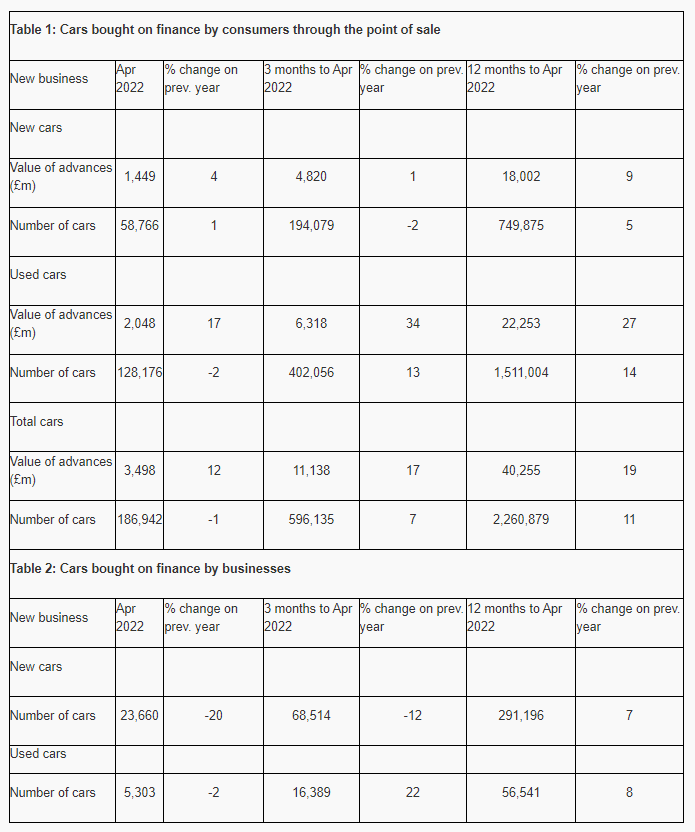

The FLA revealed that consumer car finance new business volumes fell by 1% year-on-year in April (to 596,135 units) as the value of new business grew 12% (to £11.14bn) over the same period.

As a result, total new business volumes were 15% higher during the first four months of 2022 than in the same period of 2021, which included COVID-19 lockdown car showroom closures.

Geraldine Kilkelly, the FLA’s director of research and chief economist, said: “The consumer car finance market continues to be impacted by the global disruption to the supply of vehicles.

“The market reported further double-digit growth in the value of new business reflecting upward pressure on car prices, particularly in the used car market.”

Despite the growing market pressures – and car retailers’ freedom from COVID-19 restrictions in H2 2021 – Kilkelly still anticipates year-on-year growth from the car finance sector in the second half of 2022, however.

Despite the growing market pressures – and car retailers’ freedom from COVID-19 restrictions in H2 2021 – Kilkelly still anticipates year-on-year growth from the car finance sector in the second half of 2022, however.

She said: “Consumer spending is expected to slow as pressure builds on household incomes from higher inflation, interest rates, and taxes.

“Our latest research suggests that consumer car finance new business by value will grow by 11% in the first half of 2022 and by 5% in the second half of the year.

“As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”

Kilkelly's comments come a month after the FLA stated that the squeeze on household incomes and continued new car supply constraints would mean that the UK’s car finance sector is likely to be restricted to ‘single-digit growth’ in 2022.

The FLA’s April market data showed that consumer new car finance delivered a 4% rise in new business by value and 1% by volume compared with the same month in 2021.

In the first four months of 2022, new business volumes in this market were 5% higher than in the same period in 2021.

The consumer used car finance market reported new business up 17% by value, but 2% lower by volume in April compared with the same month in 2021.

Last week Cap HPI director of valuations Derren Martin told AM that restricted supplies – and sales volumes – were keeping used car margins strong, preventing what could otherwise be a “bloodbath” for the sector.

Last month's AM magazine gave an insight into trends in the car finance market and sought to offer advice on how retailers can remain competitive in a trading environment hampered by rising interest rates.

Login to comment

Comments

No comments have been made yet.