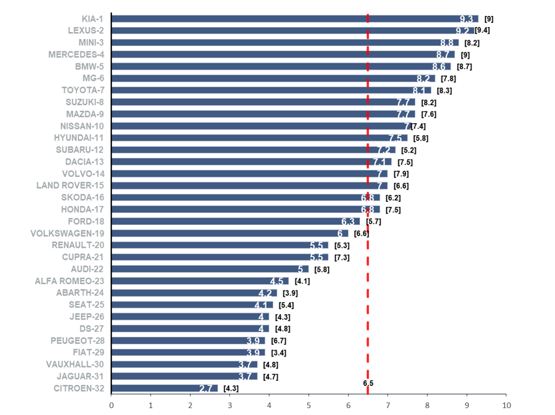

Kia UK toppled premium Japanese brand Lexus’ seven-survey stint at the top of the National Franchised Dealers Association’s (NFDA) Dealer Attitude Survey Winter 2022/2023.

The Korean brand, which delivered a record 100,000 registrations and launched a new corporate identity for its showrooms in 2022, scored 9.3-out-of-10 in the bi-annual survey’s crucial ‘how would you rate your manufacturer overall?’ question.

Lexus scored 9.2 as Mini, which is expected to roll-out direct-to-consumer agency model retail in 2024, jumped four places in the rankings to finish third with a score up 0.6pts at 8.8.

Lexus scored 9.2 as Mini, which is expected to roll-out direct-to-consumer agency model retail in 2024, jumped four places in the rankings to finish third with a score up 0.6pts at 8.8.

Kia UK toppled premium Japanese brand Lexus’ seven-survey stint at the top of the National Franchised Dealers Association’s (NFDA) Dealer Attitude Survey Winter 2022/2023.

The Korean brand, which delivered a record 100,000 registrations and launched a new corporate identity for its showrooms in 2022, scored 9.3-out-of-10 in the bi-annual survey’s crucial ‘how would you rate your manufacturer overall?’ question.

Lexus scored 9.2 as Mini, which is expected to roll-out direct-to-consumer agency model retail in 2024, jumped four places in the rankings to finish third with a score up 0.6pts at 8.8.

Lexus scored 9.2 as Mini, which is expected to roll-out direct-to-consumer agency model retail in 2024, jumped four places in the rankings to finish third with a score up 0.6pts at 8.8.

Mercedes-Benz slipped out of the top three, with a score down 0.3pts, in a period in which it finalised preparations for the launch of its own agency model strategy from January 1.

Stellantis brands continued to populate the NFDA survey’s bottom rankings as it too makes preparations to introduce agency model retail after a six-month delay to implementation.

Abarth (4.5), Jeep (4.3), and Citroen (3.6) sat at the bottom of the overall rankings in the Winter 2022/2023 results.

Celebrating its survey-topping score, Kia UK president and chief executive Paul Philpott said: “Seeing our dealers’ views represented in the NFDA survey is such a valuable asset and one that helps us plan further improvements to our products and services.

Celebrating its survey-topping score, Kia UK president and chief executive Paul Philpott said: “Seeing our dealers’ views represented in the NFDA survey is such a valuable asset and one that helps us plan further improvements to our products and services.

“It is rewarding to see our efforts result in Kia being positioned as the number one brand in the UK.”

Philpott added: “While 2022 was a challenging year, we and our dealer partners achieved our long-term goal of selling over 100,000 vehicles in the UK.

“These survey results prove that this record achievement was delivered with true partnership and to our mutual benefit.”

NFDA chief executive Sue Robinson said that the results of the latest Dealer Attitude Survey revealed “a positive outlook” for the car retail sector that, on average, demonstrated that “relationships have improved over the last six months”.

Improving attitudes

The survey returned a record response rate 70% with a total of 2,647 responses, the highest response rate in 76 editions, from 32 participating manufacturer networks.

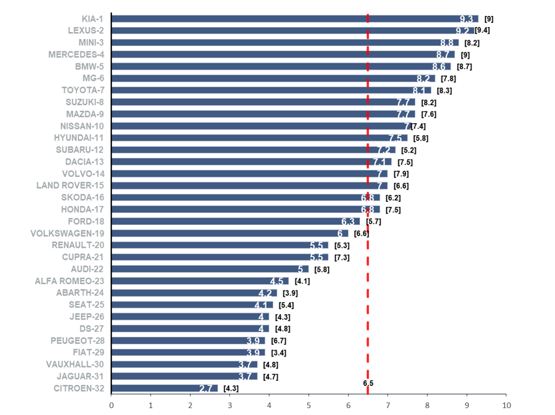

The results indicated that dealers were more satisfied with their profit return from representing their manufacturer than six months ago, returning an average score of 6.7 out of 10 – an increase of 0.3.

The results indicated that dealers were more satisfied with their profit return from representing their manufacturer than six months ago, returning an average score of 6.7 out of 10 – an increase of 0.3.

Kia and BMW led the highest scores returning nine points each out of 10, followed by Mercedes with 8.7.

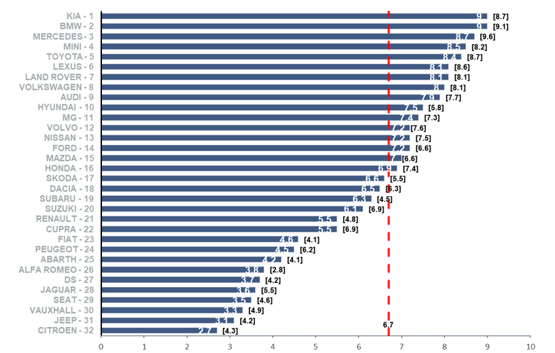

Dealers’ satisfaction with used car margins delivered the survey’s highest average score of 7.4 out of 10.

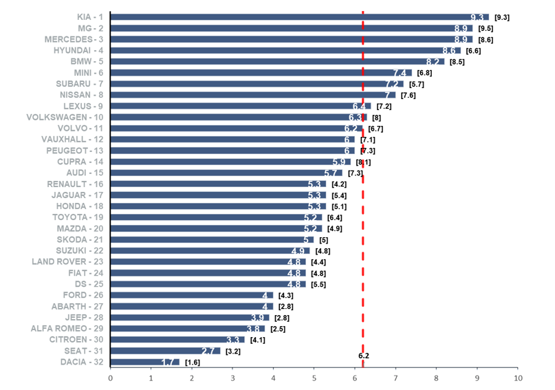

Responses to questions about electric vehicle (EV) questions indicated a more positive approach to zero-emissions models in comparison to six months ago.

Attitudes towards OEM partners EV model offering rose 0.4pts, from 5.8 to 6.2, with Kia dealers – fresh from the launch of the new Niro and updated Soul – the most satisfied at 9.3 out of 10.

Kia was followed by MG - fresh from its UK Car of the Year 2023 win with the MG4 hatchback - and Mercedes-Benz.

OEM scores for questions answered across the scope of the Dealer Attitude Survey Winter 2022/2023’s 53 questions showed Hyundai had made the biggest improvement, with a score up by 106.6 points.

OEM scores for questions answered across the scope of the Dealer Attitude Survey Winter 2022/2023’s 53 questions showed Hyundai had made the biggest improvement, with a score up by 106.6 points.

Elsewhere Subaru delivered an 84 point rise as Fiat’s retailers furnished it with 44.6 additional points across all questions.

At the other end of the scale Citroen’s overall tally dipped by 62.2 points, Cupra by 71 and Peugeot 76.9.

Robinson said it was “extremely encouraging” to see a record response rate of 70% in the latest survey, adding that this highlighted “the importance that the UK dealer network still places on the survey, particularly entering times of turbulence and uncertainty”.

She added: “The DAS remains a crucial barometer for the UK automotive industry. Manufacturers and dealers must work in a mutually beneficial way that adheres to consumers' needs and explores how they can improve business areas which have received below average scores.”

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.