The Finance and Leasing Association (FLA) has predicted a “strong recovery” from the consumer car finance sector after volumes declined by 35% as COVID-19 ‘Lockdown 3’ stalled trading in January.

Geraldine Kilkelly, the FLA’s director of research and chief economist, said that the impact of the latest coronavirus restrictions on the car retail sector’s ability to trade had “not been as severe” as that experienced in H1 2020 she reported the latest finance data.

Kilkelly said: “The impact of the latest UK-wide lockdown restrictions has not been as severe as the first lockdown introduced last March with many dealerships able to offer click and collect or deliver services.

Kilkelly said: “The impact of the latest UK-wide lockdown restrictions has not been as severe as the first lockdown introduced last March with many dealerships able to offer click and collect or deliver services.

“The value of new business in the consumer car finance market is expected to fall by 16% in Q1 2021 as a whole.”

However, predicting a strong recovery for the sector, Kilkelly added: “Our latest research suggests that once showrooms re-open there will be a strong recovery in the consumer car finance market, with the value of new business expected to grow by 17% in 2021, and a further 12% growth forecast for 2022.”

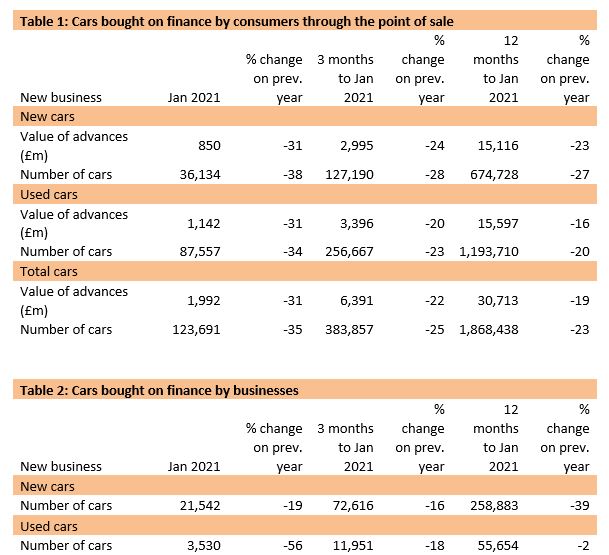

The FLA reported that the consumer new car finance market had seen a 38% fall in new business volumes in January (to 36,134) compared with the same month in 2020 as the consumer used car finance market reported a 34% fall (to 87,557).

The value of advances across both new and used declined by 31% during the month, it said, finishing the month’s trading at £1.99 billion.

Login to comment

Comments

No comments have been made yet.