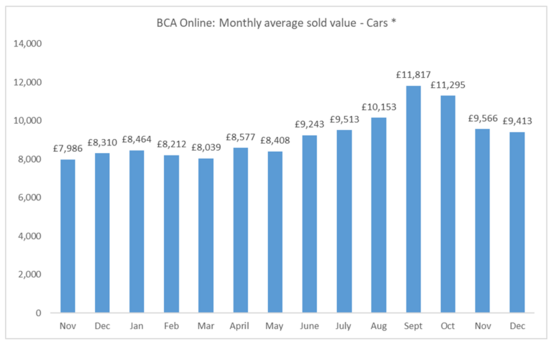

Used car values were up 13.2% year-on-year in December as BCA’s programme of festive auctions delivered a near-25% sales boost during the last week of 2021.

The remarketing giant said that values rose by the equivalent of £1,103 over December 2020 – to £9,413 – as it maintained an extensive sales programme throughout the festive season, staging sales every day from December 27 to New Year’s Eve.

BCA said that its sales programme of online sales had attracted over 2,500 buyers and sold nearly 25% more than the same week a year earlier.

BCA said that its sales programme of online sales had attracted over 2,500 buyers and sold nearly 25% more than the same week a year earlier.

Chief operating officer, Stuart Pearson, said: “Used values remained stable despite buyers becoming a little more selective in early December, with the anticipation of more significant lock-down measures being announced.

“Perhaps surprisingly, more significant restrictions didn’t follow post-Christmas and we saw improved levels of activity throughout the festive period, with year-on-year sold volumes rising significantly between Christmas and the New Year.”

Pearson said that BCA expected used vehicle values to remain resilient in the coming weeks and the early days of 2022 having seen bidding confidence return and demand accelerating.

In this month’s AM News Insight feature car retailers shared an uncertain outlook for 2022 as continued vehicle supply shortages look set to define the year ahead.

Cap HPI head of valuations Derren Martin, Cox Automotive insight and strategy director Phillip Nothard, and Auto Trader commercial director Ian Plummer said there is little prospect of any sizeable influx of new cars or used car stock any time soon.

The effect is likely to be a continuation of buoyant used car pricing.

Last week Pendragon chief executive, Bill Berman, told AM that it could take the sector eight years to recover from the supply shortages resulting from COVID-19 lockdowns and shortages of semiconductor microchips and other components to OEMs.

Pearson said: “Looking back at 2021, the dynamics seen in the used vehicle sector were driven by often exceptional levels of demand and amplified by the challenges around new car supply.

“It’s questionable whether we’ll ever see such a consistent run of rising average values again, however as the industry continues to go through such significant change, nothing should be ruled out.”

Login to comment

Comments

No comments have been made yet.