Cap HPI’s live used vehicle valuations have recorded their first average value growth figures for 18 months.

The Leeds-based car valuations specialist said that the 0.4% increase at three-years and 60,000 miles signalled a “welcome end to the heavy price drops experienced over recent months” during September.

The wholesale market has experienced increased demand in September, it said, adding that there has also been a drop in the volume of vehicles available due to lower defleets, as is usually the case following August.

The outcome was healthy demand in the auction halls and for those buying directly from remarketers of used cars.

Derren Martin, Cap HPI’s head of UK valuations, said: "September saw used values, at least for the moment, return to a more stable footing.

“However, with Brexit looming and a seasonal slowdown, the coming months will likely see the current increases fade away. Any falls, however, are unlikely to be by as much as we witnessed in the April to July period this year.

In May Martin said that a “market correction” had wiped £500 to £1,000 off the price of the some used cars during the month.

He said that the pace of change in the market during the post plate-change month had been accelerated as part of “a realignment of values after some unprecedented strength in the market”.

While he believes that the market has now stabilised a little, he urged retailers to remain vigilant around the shifting market dynamics.

Martin said: “Whatever the overall market does, there will always be models and even engines and trims that react differently to their counterparts, depending on supply and demand.

“Attention to detail by the Cap HPI car valuations editors means that trade and retail prices are analysed at micro-level in real-time."

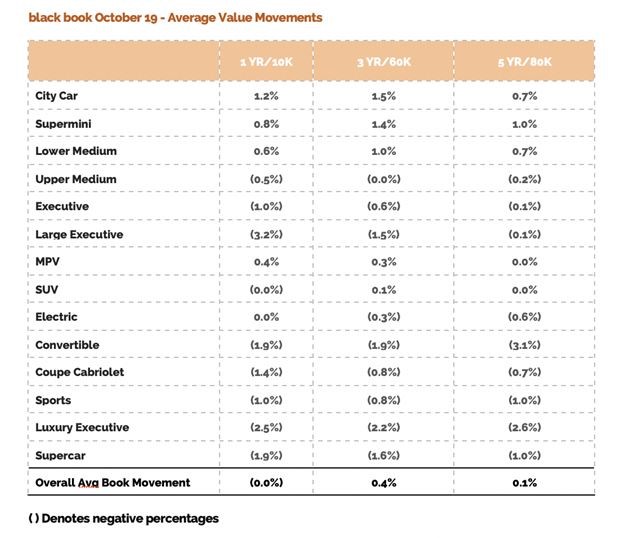

Cap HPI said that all of the mainstream used car segments had experienced average increases in values during September, with smaller city cars and superminis being the most heavily affected with increases of 1.5% and 1.4%, respectively. In monetary terms, this equates to an average of £65 to 100, it said.

Cap HPI said that all of the mainstream used car segments had experienced average increases in values during September, with smaller city cars and superminis being the most heavily affected with increases of 1.5% and 1.4%, respectively. In monetary terms, this equates to an average of £65 to 100, it said.

Small, petrol-engine cars remain the staple car of choice for retailers, meanwhile, and this demand, along with low supply and relatively heavy price drops earlier this year has meant buyers have been prepared to pay above previous prices for these models, particularly if in ready-to-retail, Cap clean condition.

Cap HPI reported that the Citroen C3, Toyota Aygo and Volkswagen Polo were among the models that have increased in value.

SUVs saw a negligible average movement in September.

“Vehicles in this sector were slightly slower to react than the others, partly due to volume, but values did then do a U-turn and have ended the period slightly up”, said Cap HPI, adding: “Newer models have been somewhat weaker than those at the three-year point.”

Average values drop in September were seen at the more expensive end of the used car pricing spectrum, with sports, supercars and luxury executive models all taking a hit.

Cap HPI said: “As is usual as we enter the autumn, convertibles struggled to sell, and the average drop in values for this sector was 1.9%, almost £400 at the 3-year 60,000-mile point.”

Average values of both petrol and diesel cars increased during the month, with petrol performing slightly stronger.

September saw a mixed performance in the electric sector.

According to Cap HPI, Nissan Leaf values slipped as supply of the latest derivative of the popular EV continued to be plentiful.

Values for the Renault Zoe with the fully owned battery also continued on an upward trend, while the values for some of the older models increased, with the Citroen C-Zero (11-19) and Chevrolet Volt (12-19), representing good value for money.

At the start of September members of the National Association of Motor Auctions (NAMA) predicted a rise in the value of used EVs during the month as consumers looking to buy a 69-plate car faced supply shortages.

NAMA found in the results of its latest market attitude survey that 30% of remarketers expected the average price of a used battery electric vehicle to rise during the key number plate-change month.

Login to comment

Comments

No comments have been made yet.