In the second of our series of updates on the taxation of electric vehicles (EV) from MHA MacIntyre Hudson, leading advisers to the UK Motor Sector, Nigel Morris, employment tax director considers how wider regulation impacts tax policy and further influences the aim to increase the use of low emission vehicles.

As part of the drive to tackle climate change full electric vehicles (EV’s) and ultra-low emission vehicles will be key.

The ‘real’ impact our cars are having on the planet is under the spotlight and, under conditions defined by EU law, the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) laboratory test is now required to measure fuel consumption and CO2 emissions from passenger cars, as well as their pollutant emissions.

Cars registered from April 2020 will be taxed based solely on WLTP, which aims to be more representative of real world driving conditions, compared to the previous test, the New European Driving Cycle (NEDC).

NEDC tests were not conducted on every model, but on a ‘family’ of models, whereas WLTP values depend, in part, on a consumer’s decisions to purchase additional accessories.

On specific models, there is a range of values impacted by different trim levels and accessories.

The difference between a models CO2 rating under WLTP can be as much as 20g/km.

The vehicle tax system plays an important role in supporting the government’s ambition for all new cars sold to be effectively zero emission by 2040 and to help achieve their legally binding climate change objectives.

WLTP represents a significant change to the vehicle tax system and the government aims to support the automotive sector – and protect consumers – during the transition.

The Government has sought views from the sector on how they should balance environmental, economic and other factors when considering what taxation changes are required and how these could be delivered.

As part of their consultation the government has stated that it recognises the importance of incentivising users to choose cars with zero and low CO2 emissions and generating a competitive second-hand market in these vehicles.

The government’s analysis suggests that company cars do have lower CO2 emissions compared to other new registrations.

WLTP provides an opportunity to strengthen the link between the vehicle tax system and the true environmental impact of car purchasing decisions.

Allowing consumers to make more informed decisions between model variations and this should be reflected in the amount of tax paid.

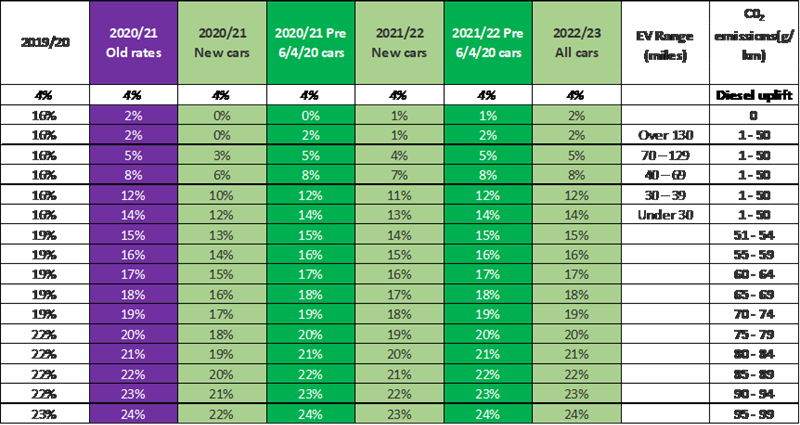

We now have draft legislation that shows the proposed company car taxation up to 2023.

This extract shows the original and revised plans for electric and low emission vehicles, whether registered before or after 6 April 2020 for tax purposes:

Example 1 – Full electric car

List price £80,000 BIK

2019/20 £12,800

2020/21 Nil

2021/22 £ 800

2022/23 £ 1,600

Total £15,200

Example 2 – Diesel 78g/km CO2

List price £32,000 BIK

2019/20 £ 8,320

2020/21 £ 7,680

2021/22 £ 7,680

2022/23 £ 7,680

Total £31,360

Tax savings, or at least reductions in tax increases is very welcome and users need to look very carefully at vehicle choice, options and whole life costs. Whilst the revised reduction in rates by c.2% are helpful, reports from the market suggest that they may not be enough.

Making clear the future direction by government

Well, there is some clarity, but still some mixed messages from Government, who need more full electric and ULEV new and company cars to help with their environmental targets, surveys show company cars on average pollute less than other new cars and much less than older cars that users procure personally.

Clarity on future taxation is very welcome, but has been awaited for too long. The proposals included some welcome surprises, which are hopefully not too little too late for decision makers and users.

So, the government still needs to do more to, perhaps committing to more like five years of tax benefit projections, which will help the market and decision makers to support the adoption of new all electric and ULEV vehicles sooner.

Login to comment

Comments

No comments have been made yet.