Consumer motor finance defied September’s 4.4% new car registrations dip to record a 7% year-on-year rise in volumes and 11% growth by value, according to the Finance and Leasing Association (FLA).

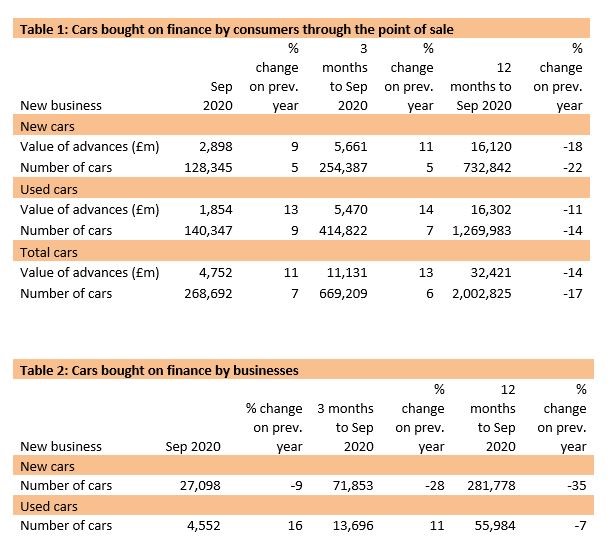

New data published by the FLA today (November 4) showed that the consumer car finance market helped to deliver 268,692 new and used car sales in the UK motor trade’s key number plate change month, with advances worth a total of £4.75 billion.

The result came despite a Society of Motor Manufacturers and Traders (SMMT) reported 4.4% year-on-year decline in new car registrations, which compared to modest 1.3% growth a year earlier.

However, in the first nine months of 2020, new business volumes remain 22% lower than in the same period in 2019 – largely as a result of the COVID-19 crisis.

Geraldine Kilkelly, head of research and chief economist at the FLA, said: “The FLA’s latest figures show that the consumer car finance market has played a significant role in the UK’s economic recovery following the easing of the first lockdown restrictions in June.”

Repeating the FLA’s recent calls for fiscal help to support motorists during the coronavirus pandemic, Kilkelly added: “As we enter a new phase of national lockdowns across the UK, it is vital that that the Government and Bank of England support all lenders, including non-banks, by providing direct access to funding.

“This will enable the motor finance industry to meet the ongoing demand for forbearance and new credit.”

The consumer new car finance market reported new business volumes up by 5% in September 2020 (to 128,345) compared with the same month in 2019 as the value of advances rose 9% to £2.9bn.

The consumer new car finance market reported new business volumes up by 5% in September 2020 (to 128,345) compared with the same month in 2019 as the value of advances rose 9% to £2.9bn.

In the nine months to September 2020, new business volumes in this market remains 27% down on the previous year, however.

The consumer used car finance market reported growth in new business volumes of 9% in September 2020 (to 140,347) compared with the same month in 2019 as the value of advances rose by 11% to £4.75bn.

In the nine months to September 2020, new business volumes in this market fell by 19% compared with the same period in the previous year.

Sales to businesses using FLA members’ finance products declined 9% in the new sector (to 27,098), but rose 16% in used, albeit rising to a more modest 4,552.

Login to comment

Comments

No comments have been made yet.