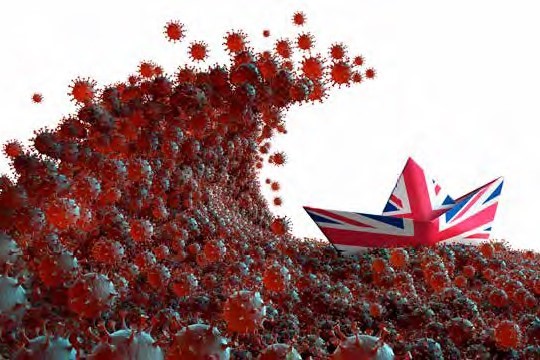

Rising cases of the Omicron variant of COVID-19 are exposing anti-vaxxers as one of the car retail sector’s biggest business disruptors, it has been claimed.

As AM today (December 21) questioned car retailers on the impact of soaring coronavirus cases across the UK, the prospect of future dealership closures and fiscal support from Government, the impact on staffing and employee wellbeing emerged as a major concern for the sector.

Government data showed there were 91,743 new cases in the UK yesterday, taking the total confirmed cases of the new variant in the UK to 45,145.

And Peter Smyth, director at Swansway Group, said that employees who refuse to be immunised are creating major problems for employers as the numbers rise.

“The main issue is our anti vaxxers,” Smyth told AM. “They are coming in saying they have a cold and it immediately sets other employees on edge.

“The main issue is our anti vaxxers,” Smyth told AM. “They are coming in saying they have a cold and it immediately sets other employees on edge.

“It’s a very sensitive issue, but we had someone who we had to insist took a test, turned out to be positive, and we sent them home immediately.

“It’s my opinion that everyone should be vaccinated. By not having the jab you’re becoming one of the biggest potential disruptors to the business and putting others at risk.”

Vaccines a ‘difficult subject’

CarShop chief executive Nigel Hurley said that the Sytner-owned car supermarket group were encouraging all its staff to take every precaution possible to mitigate against the impact of COVID-19.

He said: “Mask wearing, social distancing, limited numbers in working spaces combined with the vaccinations and recent booster jabs appear to be providing a higher level of confidence and protection to all.

He said: “Mask wearing, social distancing, limited numbers in working spaces combined with the vaccinations and recent booster jabs appear to be providing a higher level of confidence and protection to all.

“We have been encouraging our team to have their booster jabs at all possible opportunities.”

Robin Luscombe, managing director of Luscombe Motors, said that, while he hoped the majority of his workforce had been vaccinated against COVID-19, broaching the subject was a “difficult issue”.

“It’s still people’s choice whether they have the jab or not, so it’s a difficult thing to ask about,” he said.

“It’s still people’s choice whether they have the jab or not, so it’s a difficult thing to ask about,” he said.

“Thankfully we’ve not had a lot of COVID-related absences, so it’s not been an issue so far and – at this time of year – the reduced level of trade means we could absorb issues that bit more easily.”

TrustFord chairman and chief executive, Stuart Foulds, Perrys managing director Darren Ardron and Devonshire Motors owner Nathan Tomlinson all echoed Luscombe’s view.

Many have experienced staff absence to some degree, but have so far been able to absorb their impact.

Foulds said: “COVID absences are a real issue in varying parts of our group, for example in our Parts Plus business in Warrington it had almost been epidemic like with a large percentage of the team off with COVID, whereas in some other businesses there has been little impact at all.

Foulds said: “COVID absences are a real issue in varying parts of our group, for example in our Parts Plus business in Warrington it had almost been epidemic like with a large percentage of the team off with COVID, whereas in some other businesses there has been little impact at all.

“The worry is the spread seems to be accelerating rapidly and so who knows what’s in store over the festive period.”

Tomlinson said the emotional impact of COVID-19 on his workforce had been felt as much as any illness or absenteeism resulting from the pandemic.

He added: “The big impact on business has been from the constant fear, uncertainty and doubt which is being fed into our daily newsfeeds.

He added: “The big impact on business has been from the constant fear, uncertainty and doubt which is being fed into our daily newsfeeds.

“This, along with the chain reaction of a family member, school, carer, or business partner dealing with the effects of the pandemic have created a completely new and unpredictable pattern which disrupts most.”

All the retailers approached by AM stated that their business had reinstated stringent COVID safety measures from earlier in the pandemic in light of the rise in cases.

Hurley suggested that “Our working environments probably safer than at home”.

Government’s fiscal support

All retailers are hoping that retail closures are not enforced by Government in a bid to tackle the pandemic in the New Year, with Foulds, Ardron and Hurley all stating that preparations should be made to provide further fiscal support to businesses in such an eventuality.

Foulds said: “I think the UK and devolved governments absolutely need plans for fiscal support in some industries as we go into 2022.

“This pandemic has a pretty long shelf life and so it is probably going to get worse before it gets better.

“When you see what actions other countries are doing in terms of lockdowns and major restrictions, the Government simply cannot ignore the facts as they emerge.”

Luscombe and Smyth pointed out that Government would eye what proved to be a buoyant car retail sector warily when it came to plans for COVID-19 support, however.

“The packages issued last year look a bit generous now that you look at the results from many in the car retail sector,” said Luscombe. “I think Government would see that and think twice about a similar course of action.”

Smyth said: “I’d be surprised if our sector gets any help. I think Government would think hard about separating us from their decisions on the rest of the retail sector after the recent record financial results of so many groups.”

Tomlinson said suggested that any Government support should be issued in a more nuanced way than when it was first announced in 2020, stating that the impact beyond profit and loss was on “the ability to recruit, retain and support those that remain at work and working through all the challenges of reduced resource, disrupted supply and process failure”.

He added: “The big cost pressure we face is in developing a business model that can support the present and possibly a future of ongoing change.”

Login to comment

Comments

No comments have been made yet.