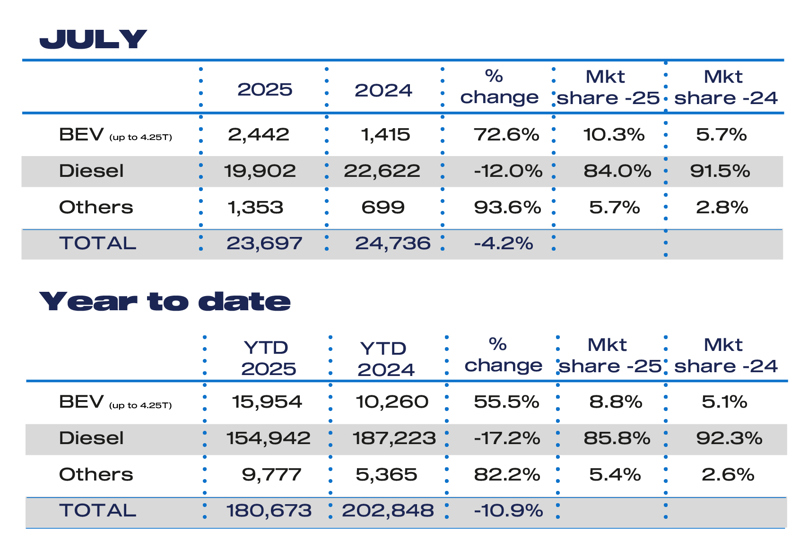

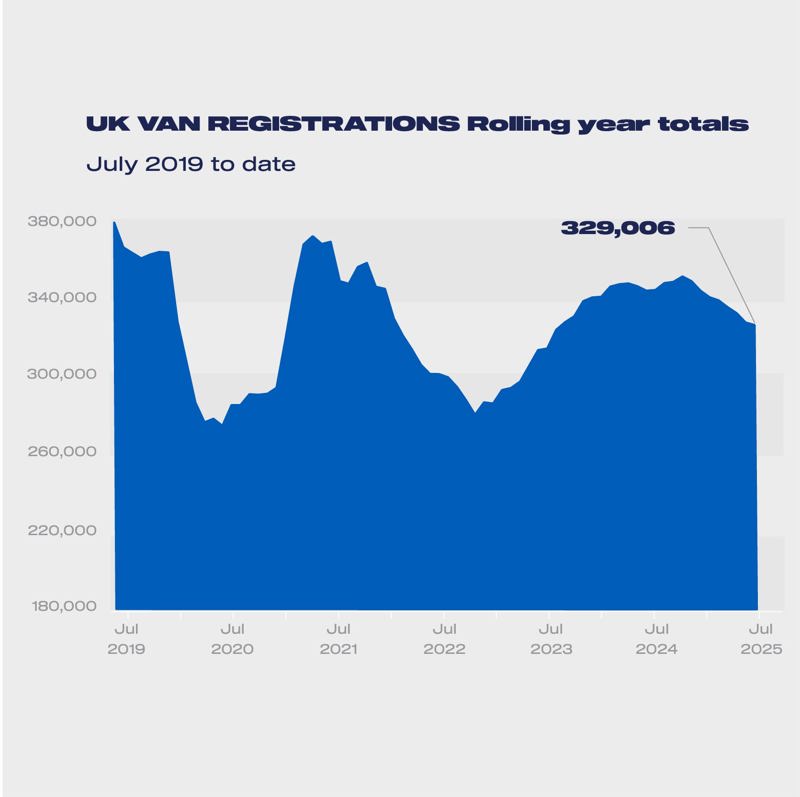

The new light commercial vehicle (LCV) market shrank by 5.1% in July, with 24,433 vans, pickups, 4x4s and taxis registered – marking the sector’s eighth consecutive month of decline, according to the Society of Motor Manufacturers and Traders (SMMT).

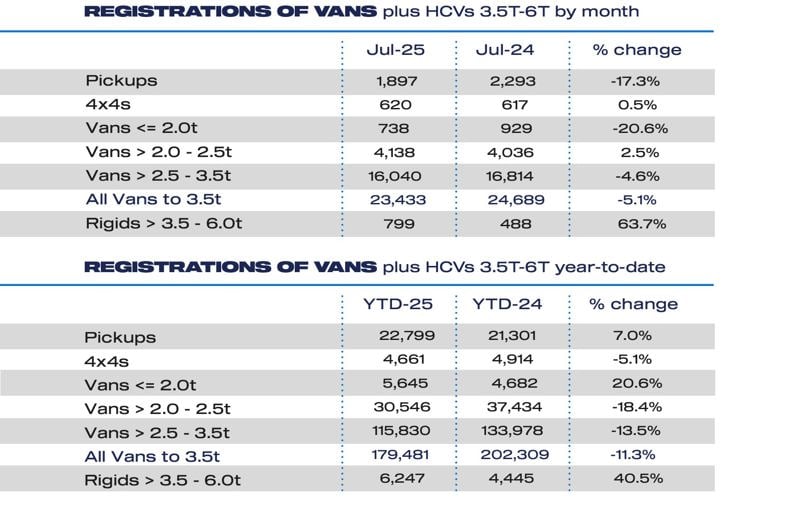

Data indicates last month was the weakest July performance since 2022, as persistent economic uncertainty and low business confidence continue to suppress fleet investment. Most vehicle segments recorded a drop in registrations, with the sharpest fall seen in the smallest vans (under 2 tonnes), down 20.6% to just 738 units.

Deliveries of large vans (2.5–3.5 tonnes), the backbone of many commercial fleets, also dipped by 4.6%, totalling 16,040 registrations. Pickups fell for the third consecutive month - down 17.3% to 1,897 units – following tax rule changes in April that reclassified double-cabs for benefit-in-kind and capital allowance purposes.

There were small bright spots with mid-sized vans (2.0–2.5 tonnes) growing 2.5% to 4,138 units and 4x4 registrations up by 0.5% to 620 units

Despite the wider market decline, battery electric vans (BEVs) posted another strong month, with registrations up 72.6% to 2,442 units, extending a streak of eight consecutive months of growth. However, BEVs still represent just 8.8% of the LCV market so far in 2025 – well short of the 16% zero-emission vehicle (ZEV) mandate target set by the government for this year.

Even so, manufacturers are responding to demand with more than 40 BEV models now on the market, offering a variety of payloads and price points. But industry leaders warn that infrastructure and policy lag behind.

Mike Hawes, SMMT chief executive, said: “Eight months of LCV market decline underlines the ongoing economic pressures facing businesses, yet the sector remains steadfast in its commitment to decarbonise.

“Manufacturers continue to invest in delivering a diverse range of zero-emission vans to suit every use case, and it’s encouraging to see uptake growing – but to meet mandated targets, it must grow faster. Accelerating infrastructure rollout, streamlining planning processes and providing targeted support for fleet operators are essential to drive progress and keep the UK at the forefront of road transport decarbonisation.”

The SMMT has revised its full-year 2025 forecast, now predicting the market will contract by more than 30,000 units - an 8.7% drop to 321,000 registrations. The BEV market share forecast has also been downgraded from 9.4% to 8.6% for 2025, with only a marginal rise to 13.7% expected in 2026 - still far below the 24% ZEV mandate for that year.

“July’s figures have seen the new light commercial vehicle market decline for the eighth consecutive month, reflecting ongoing pressure on demand and economic uncertainty” said Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK.

“Although this decline is not the worst seen this year, it is still of major concern that the light commercial vehicle sales is seen as a barometer of the strength of the economy and year to date LCV registrations have decline at -11.3%.”

Login to comment

Comments

No comments have been made yet.