Car retailers improved their profitability by 4.4% year-on-year to an average of £118,000 during March, according to the latest data published by ASE.

Last March’s snowy start to the crucial numberplate change month gave the sector scope to improve in 2019, but ASE chairman, Mike Jones, hailed retailers’ result last month as “a creditable performance” in light of wider economic uncertainty, nonetheless.

Jones added: “This is a very creditable performance underlying the resilience of both UK motor retailers and the motor retail model. To improve profits whilst consumers and businesses were faced with the massive Brexit uncertainty we saw during March is a strong result.”

Jones added: “This is a very creditable performance underlying the resilience of both UK motor retailers and the motor retail model. To improve profits whilst consumers and businesses were faced with the massive Brexit uncertainty we saw during March is a strong result.”

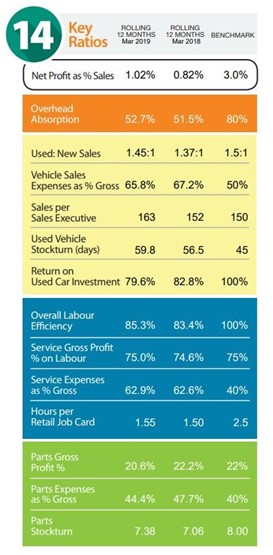

ASE reported that car retailers across the UK had managed to improve the average overhead absorption provided by their aftersales operation from 51.5% to 52.7% in the rolling twelve months to March.

At the same time overall labour efficiency improved from 83.4% to 85.3% with the average hours per retail job card having risen slightly from 1.50 to 1.55.

Jones said: “The slow and steady improvement in the overall level of profit generated by the aftersales departments continued during March.

“We have been benefiting from the increased vehicle parc over recent years and this is improving labour efficiency and driving profit.

“The one area of concern is the high level of warranty content, particularly amongst some brands, depressing retail.”

Elsewhere the picture was less positive, as ASE reported that used car return on investment had declined from 82.8% to 79.6% during the same period as the ratio of used to new vehicle sales rose still further from 1.37:1 to 1.45:1.

It is the first time that used car return on investment had slipped below 80% since the end of 2016, according to ASE.

Jones said: “Used car profitability has remained constant over recent months, however we have seen an increase in average stock holding which is driving the return ratio down and slowing stockturn.”

Looking forward to the year ahead, Jones noted that “as we move through the remainder of the year we come up against some weaker comparatives, particularly within the brands heavily impacted by WLTP delays”.

He said: “This should leave retailers well placed to outperform their prior year results.”

Login to comment

Comments

No comments have been made yet.