July 2019 brought with it much discussion around the decline in used car performance despite a level of decline which will remain a moot point.

There has also been a plethora of comments on the performance of dealer groups nationwide and the City and markets have watched carefully as the half-year financial results of the large dealer groups have been announced.

Despite the negative comments the outlook has not been all doom and gloom.

Some of the larger dealer groups have posted a reasonable performance which is something the industry should do well to focus on.

Whilst enquiry levels continue to be lower than desired, tenacity and speed of response has still resulted in sales and, interestingly, despite continued comment on the collapse of used values by some market data providers, used car pricing has not been in the freefall some might have you believe.

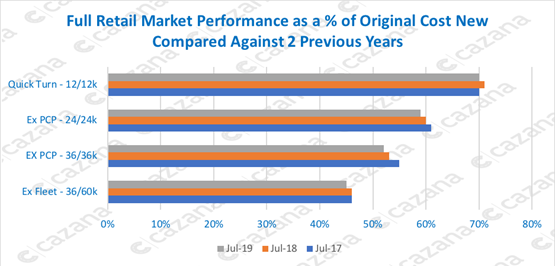

The following chart shows the comparison at key age and mileage profiles against the same period over the last two years:

By highlighting the performance of pricing as a percentage of original cost new, using retail pricing as this is the largest data source available to the industry, this chart confirms the fact that retail pricing is not on a steep downward trajectory.

By highlighting the performance of pricing as a percentage of original cost new, using retail pricing as this is the largest data source available to the industry, this chart confirms the fact that retail pricing is not on a steep downward trajectory.

In comparison to the same period last year, all age and mileage profiles have shown a one percentage point decrease which is more in line with a healthy market movement the industry might expect. For the time being the days of static retail pricing have passed.

What is of more interest is the movement of pricing for the Ex-PCP profile cars at two and three years of age over the last two years.

The largest downward movement has been for three-year-old cars that have seen pricing drop 3ppts.

It is possible that this is because of the type of car coming back to the market and an increase in the number of volume brand cars in the market might produce a poorer residual performance.

However, there has been a 5.4ppt increase in average cost new over this time which is broadly in-line with the increase in cost new over the time period thus inferring that it is a mix of volume and demand that has been the cause of the decline.

However, this is not the same for cars in the two-year-old age profile as the average price of cars advertised for retail sale has increased by 12% over the two-year period.

This would suggest that there has been an increase in the higher priced premium brands coming to the used market.

A more detailed analysis of the data would corroborate the link between new car registrations of key premium brands two years ago and the supply of those cars coming back to the used car market.

The other consideration here must be what is happening with propulsion types as there is much consternation over the immediate future of diesel.

The question is what has happened with used car retail prices, as anecdotal market discussion and other valuation providers will have the market believe that pricing has dropped considerably.

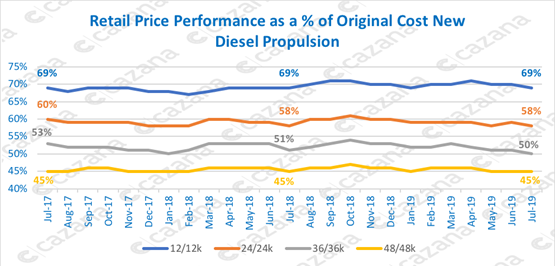

The following chart looks at performance of used diesel cars at key age and mileage profiles:

This chart is of particular interest as it immediately shows that used diesel-fuelled vehicles are not in major pricing difficulty.

This chart is of particular interest as it immediately shows that used diesel-fuelled vehicles are not in major pricing difficulty.

Wholesale anecdotal comment that nobody wants these cars is just not supported by the Cazana retail data and this rhetoric is more likely a pricing negotiation tactic on behalf of the buyers.

Retail consumer demand broadly remains good with stability evident at both one year old and four years old.

The retail pricing movement at two and three years old is clear although the key is the stability over the two-year period.

There has not been any significant drop in values.

These age and mileage profiles would expect to see a drop-in pricing due to the increase in volume as a result of new car sales activity using PCP finance products but what this chart really highlights is the continued consumer demand for diesel cars.

In conclusion, it is acknowledged that July 2019 has been a more difficult month for used car sales.

Retail pricing confirms that despite some claims, the market whilst tougher is still in fair shape.

Author: Cazana's head of valuations, Rupert Pontin

Login to comment

Comments

No comments have been made yet.