SMMT chief executive Mike Hawes has said that OEMs were doing “all they can” to deliver new cars to customers after the UK suffered its worst August sales performance since 2013.

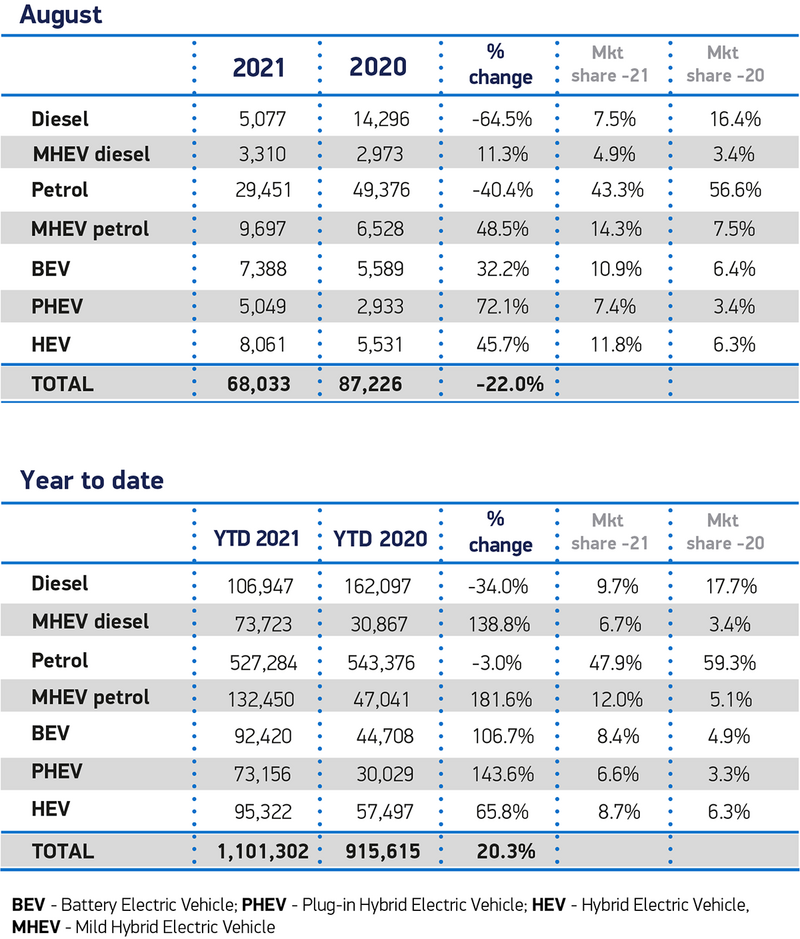

Data published by the Society of Motor Manufacturers and Traders (SMMT) this morning (September 6) showed that sales had declined by 22%, to 68,033, last month as the global shortage of semiconductor microchips continued to stall the car manufacturing sector.

As car retailers begun to realise the effect of the crisis on the crucial September numberplate change month, What Car? editorial director, Jim Holder, warned that the microchip shortage “has the potential to surpass COVID with its impact on the industry”.

So far this year, UK new car registrations remain up 20.3%, to 1,101,302 registrations, an increase of 185,687 units with electric vehicles (EV) and plug-in hybrids (PHEV) at 8.4% and 6.6% market share respectively.

So far this year, UK new car registrations remain up 20.3%, to 1,101,302 registrations, an increase of 185,687 units with electric vehicles (EV) and plug-in hybrids (PHEV) at 8.4% and 6.6% market share respectively.

This performance is measured against the COVID-hit 2020 market, when showrooms were closed for much of the year, however.

The SMMT said that total registrations in 2021 are 25.3% below the 10-year average for January to August.

Commenting on August’s new car sales dip, Hawes said: “While August is normally one of the quietest months for UK new car registrations these figures are still disappointing, albeit not wholly surprising.

Commenting on August’s new car sales dip, Hawes said: “While August is normally one of the quietest months for UK new car registrations these figures are still disappointing, albeit not wholly surprising.

“The global shortage of semiconductors has affected UK, and indeed global, car production volumes so new car registrations will inevitably be undermined.

“Government can help by continuing the supportive COVID measures in place currently, especially the furlough scheme which has proven invaluable to so many businesses.”

Hawes added: “As we enter the important September plate-change month with an ever-increasing range of electrified models and attractive deals, buyers in the market for the new 71-plate can be reassured manufacturers are doing all they can to ensure prompt deliveries.”

Demand for EVs, PHEV and hybrid cars surged last month, according to the SMMT’s data, up 32.2%, 45.7% and 72.1% respectively.

The SMMT reported demand for PHEVs has outpaced EVs in five of the last six months since changes to Government’s Plug-in Car Grant (PiCG) in March.

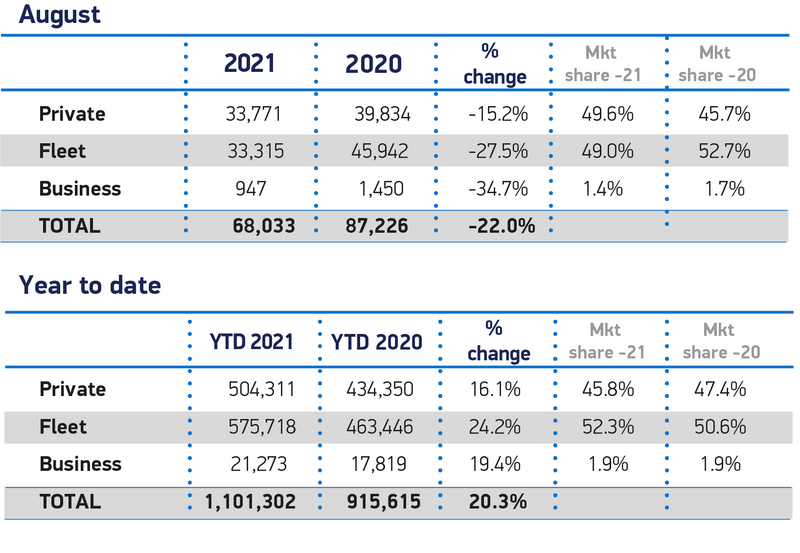

Registrations by private, business and fleet buyers all fell by double digits in the month with fleet purchases down 27.5%, a loss of 12,627 units.

Registrations by private, business and fleet buyers all fell by double digits in the month with fleet purchases down 27.5%, a loss of 12,627 units.

Private activity held up better, registrations dropping 15.2% to 33,771 units, meaning that just shy of half (49.6%) of all sales in August were driven by private consumers.

Last month AM reported that shortages of key components including semiconductor microchips had prompted Jaguar Land Rover (JLR) and Mercedes-Benz to warn fleet customers of lengthy lead times and vehicle specification changes.

It came as AM learned of at least one car maker importing ‘incomplete’ new cars into the UK in a bid to maintain a flow of vehicles to its dealer network and customers.

Commenting on August’s new car registrations data today, heycar chief commercial officer, Karen Hilton, said: “Our own industry research indicates that manufacturers fear it could take until 2024 for global supply to fully meet demand - which is prompting them to take unprecedented action in a bid to reduce spiralling lead times, of up to six months for some of the UK’s most popular models.

Commenting on August’s new car registrations data today, heycar chief commercial officer, Karen Hilton, said: “Our own industry research indicates that manufacturers fear it could take until 2024 for global supply to fully meet demand - which is prompting them to take unprecedented action in a bid to reduce spiralling lead times, of up to six months for some of the UK’s most popular models.

“The result is the biggest wholesale transformation in car production in decades - inspired by the tech giants of Silicon Valley.

“To streamline manufacturing - they long ago abandoned offering customers the ability to customise products in anything other than the most minor way.

“And so will it be with cars. Gone will be the ability to endlessly modify a vehicle down to the tiniest bespoke detail. In its place will be models and trims with specs that are fixed and a reduced number of options to add on top.”

“Ultimately car-buyers will still get a product that delights them - but one, crucially that can be produced much more quickly.”

Holder said: “The microchip shortage has the potential to surpass COVID with its impact on the industry.

“With production delays and limitations, the immediate impact for buyers has been delays to new car lead times and a smaller pool of vehicles and trims to choose from.

“Estimates suggest it won’t be until early 2022 before the supply constraints ease and production levels start to recover.”

He added: “The positive news is that customer demand remains strong, despite all the difficulties.

“As part of our latest industry research of 1,619 in-market buyers, 38% told us they are looking to purchase a car in the next four weeks, while 27% are planning to purchase within the next one to three months. The problem is whether that demand can be met and managed.”

Login to comment

Comments

No comments have been made yet.