Car brands have managed to improve their customer satisfaction ratings despite a decline in vehicle availability triggering record customer complaints.

The UK Customer Satisfaction Index (UKCSI) found that, despite average customer satisfaction in the automotive sector rising to 80.7 points – its biggest ever year on year increase – 14.1% of customers have experienced problems with a brand’s service in the past six months.

It attributed rising complaints to vehicle supply shortages arising as a result of COVID-19 and the limited availability of semiconductor microchips and other components.

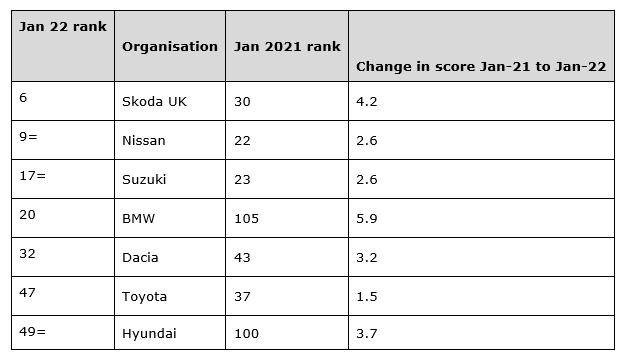

Skoda (ranked 6th) and Nissan (joint 9th) climbed into the top 10 performaning organisations in a top 50 ranking of brands offering the best customer satisfaction across 13 market sectors, however.

Suzuki (joint 17th), BMW (20th) Dacia (32nd), Toyota (47) and Hyundai (joint 49th) also delivered top 50 rankings after rising up this year’s table.

Jo Causon, the chief executive of The Institute of Customer Service, said: “The latest UKCSI results demonstrate the complexities of the current environment the automotive sector continues to face.

Jo Causon, the chief executive of The Institute of Customer Service, said: “The latest UKCSI results demonstrate the complexities of the current environment the automotive sector continues to face.

“The number of customers experiencing a problem with an organisation is at its highest ever level, although satisfaction with complaint handling and overall satisfaction has improved.

“This suggests many organisations have got better at service recovery and adapted to new ways of working.

“However, wider service chain issues continue to plague the automotive sector. This is something we need to tackle if we are to improve organisational performance and productivity.

“Those organisations in the top 10 make it easy to contact the right person, show they care about their customers, and build trust by making them feel reassured.”

Yesterday, the results of research from JudgeService revealed that car retailers with a higher proportion of ‘satisfied’ customers are selling cars more quickly.

It identified a correlation between customer satisfaction and dealer stock turn, despite the shortage of new and used cars and the impact of the pandemic.

UKCSI’s twice-annual survey polls 10,000 consumers to track the effects of customer service on business performance.

It found that supply chain and resource challenges, in a volatile financial environment, were largely to blame across the sectors, with fewer problems with staff (attitude and competence) and more problems with availability, suitability, and quality/reliability of the good and services they’re buying, compared to 12 months ago.

Its findings contrast those of Driver Power's Shopper Survey - drawn from the reports of up to 60,000 participants a year - which recently found that dealer staff appeared to be "the weakest link in an otherwise almost universally satisfying process".

As customer frustrations grew, the proportion of customers willing to pay more for better service has risen from 37.8% to a record 43.5%.

Causon said that the trend suggests there is a business opportunity to invest in delivering the real value that customers expect and deserve.

“Against the backdrop of a challenging economy, a strong service offering is an increasingly important battleground for brands to differentiate themselves and drive stronger financial performance,” she said.

Login to comment

Comments

No comments have been made yet.