Soaring wholesale used car prices are “not recoverable” through retail price rises, creating an environment of ever-shrinking margins.

In his latest market report, Cazana director of insight, Rupert Pontin, spelled out the impact of supply issues which have resulted in “some quite extraordinary pricing for some used car stock”.

Cap HPI head of valuations, Derren Martin, said that the average used car rose 6.7% in value during May alone, with expectations of a similar rise in June.

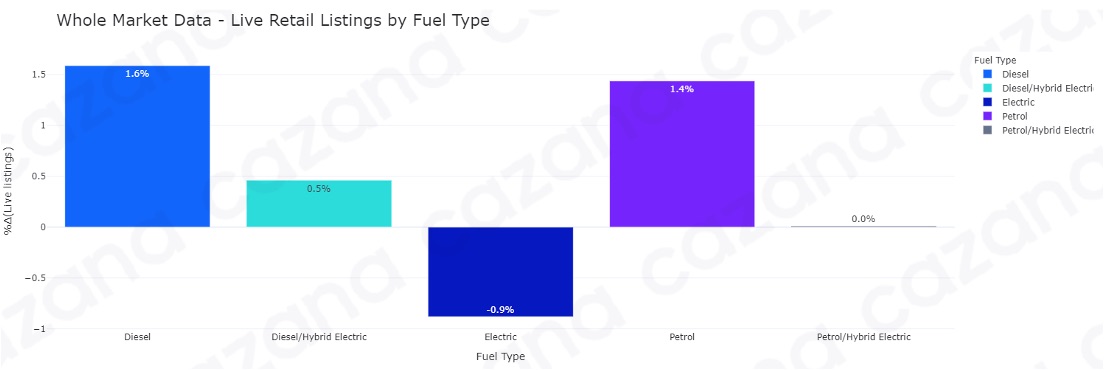

The trend comes as social distancing measures hamper the rate of remarketing operations and the global semiconductor shortage hampers new car production, limiting sales and the resulting flow of part-exchange vehicles into the market.

Pontin said: “The resulting sometimes erratic supply of used cars in the wholesale market has seen some quite extraordinary pricing for some used car stock, but the concern is that this enhanced wholesale price is not recoverable by the corresponding increase in the retail price of the car."

He warned: “The concern over used car stock availability and the resulting high auction pricing is cause for concern as this perceived widespread uplift is not translating to the retail pricing.

“Buying with care and being fully aware of today’s retail pricing is essential for commercial success.”

One independent trader told AM that, while stock is in short supply, he was managing to profit purely from sales of the vehicles he was able to source into franchised car retail sites.

One independent trader told AM that, while stock is in short supply, he was managing to profit purely from sales of the vehicles he was able to source into franchised car retail sites.

He said: “Cap prices are going off the scale and the prices that dealers seem willing to pay to get their hands on cars is incredible.”

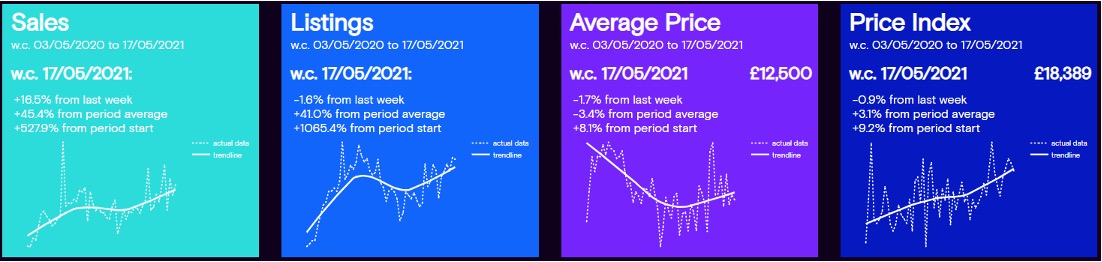

Pontin suggested that Cazana’s Retail Price Index had actually shown a 9.2% rise since the start of May.

Emerging online used car retail disruptors are also paying the price, with Webuyanycar said to be paying a premium to source cars for its own cinch operation.

“Webuyanycar are paying massively over the odds,” said AM’s source. “There is no profit left in the car.

“I don’t know how long the market can sustain it.”

In his market analysis, Pontin claimed that the highest prices being paid for used cars by retailers were often seen in situations where businesses found themselves “exceedingly short of stock”, or “where a car is being bought for a sold order”.

He said: “Both circumstances carry a high level of risk, especially when the retail price can move so much from day to day, and realistically, real-time pricing data is the only way to minimise loss and maximise return.”

Rising used car prices also come at a price when many car retail groups are looking to ramp-up their exposure to the used car market, with Peter Vardy’s Carz operation on a growth trajectory and both JCT600 and Inchcape UK launching their own new standalone car retail operations.

Inchcape chief executive James Brearley told AM that his business had been able to maintain stocking levels, but conceded that it had “paid the price” to keep forecourts full.

Cazana’s data suggests that retail used car sales are on the increase, despite low stock levels.

Pontin said the week commencing May 17 recorded an uplift of 16.5% in used car sales, but added that it was also worth noting that the number of newly listed vehicles for the week dropped by 1.6%.

He said this was “perhaps a reflection of the difficulty in getting hold of replacement used cars”.

He said this was “perhaps a reflection of the difficulty in getting hold of replacement used cars”.

Since the beginning of January, Cazana’s data has shown a 10-day improvement in the average days to sale, from 42 days to 32 days.

He said that the speed of sale meant that a 50 car used car sales pitch would be on track to sell 435 cars over the course of the year, adding: “It is not difficult to understand why so many retail groups and independent retailers have seen such an increase in financial performance over recent months and weeks.”

Login to comment

Comments

No comments have been made yet.